Economics

SVB 101: Here’s What You Need to Know

The headlines this week have been alarming, to say the least. If your portfolio is tied up in bank stocks, then you may be panicking about the implications…

The headlines this week have been alarming, to say the least. If your portfolio is tied up in bank stocks, then you may be panicking about the implications of Silicon Valley Bank’s spectacular fall.

But here’s our advice in a nutshell… don’t panic.

First and foremost, what happened may raise the specter of the 2008 financial collapse… but it does not mirror it in any way.

The problems with SVB are idiosyncratic… not systemic, and here’s why.

The Wealth Shift You’d Least Expect

Right now, one of the poorest areas in America is reemerging as a new breeding ground for incredible wealth. Investors are flocking to this 300-square mile spot with plans to join the “one-percent.” Eric Fry has the full story… plus 5 key stock recommendations that could unlock 1,000% gains…

SVB Broke All the Rules

What happened to SVB could have been avoided if the bank had operated as a traditional financial institution. Instead, it made several critical mistakes:

- It was financed basically entirely of deposits without much diversity in investments, which is not best practice for any bank.

- It was essentially dependent on tech startup and venture capital startup clients, whose businesses don’t initially produce revenue. These companies were flush with cash in 2020-2021, but as those income sources dried up, they depended more on cash reserves and withdrew more money.

- Other investments were in long-term bonds, which lose value as interest rates increase.

- Management and board members were heavily incentivized by stocks and stock price.

Federal bank regulators have stepped in to ensure that depositors recoup their money, so small businesses who banked with SVB will be made whole.

Moreover, the Fed deployed a new program this week called the Bank Term Funding Program (BTFP) that should put the brakes on potential bank runs in the near-term. This program enables banks to borrow against their assets, like Treasuries and mortgage-backed securities, at face value – even if the assets are currently trading at much lower values.

If SVB would have had access to a program like this, their doors would probably still be open today.

The Fed and Market Respond

The market predictably was in turmoil Friday and into Monday on the heels of the news, but now it is responding pretty well. The federal safeguards and bailouts put in place have stabilized the financial market and stemmed any contagion to other entities.

The next step we’re taking is to watch the Fed’s announcement next week – will it raise interest rates as high as predicted?

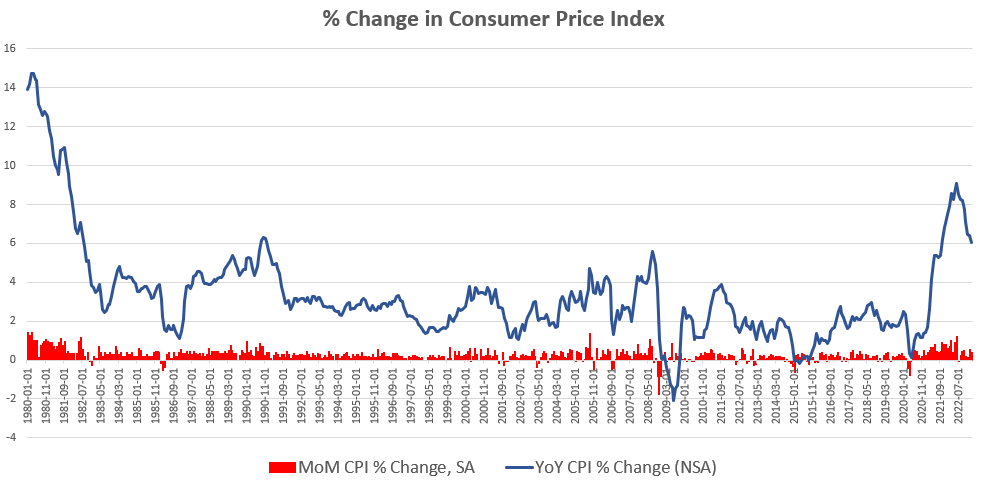

Speculation has changed as the labor market softens and inflation continues to decrease, albeit incrementally. Paired with the panic of the last few days, we could see the Fed increase interest rates by just 25 basis points (instead of the predicted 50 basis points) at this month’s meeting and in the next few meetings. It’s even possible the increases will stop soon.

Keep an eye on the markets – and this space – this time next week. The Fed announcement might just create some great buying opportunities. We’ll keep you posted.

The post SVB 101: Here’s What You Need to Know appeared first on InvestorPlace.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…