Economics

Long Treasuries Top Bond Market Returns This Year

Last year’s famine has turned to feast in the bond market in 2023 as the riskiest slice of fixed income tops year-to-date results through yesterday’s…

Last year’s famine has turned to feast in the bond market in 2023 as the riskiest slice of fixed income tops year-to-date results through yesterday’s close (May 17), based on a set of proxy ETFs.

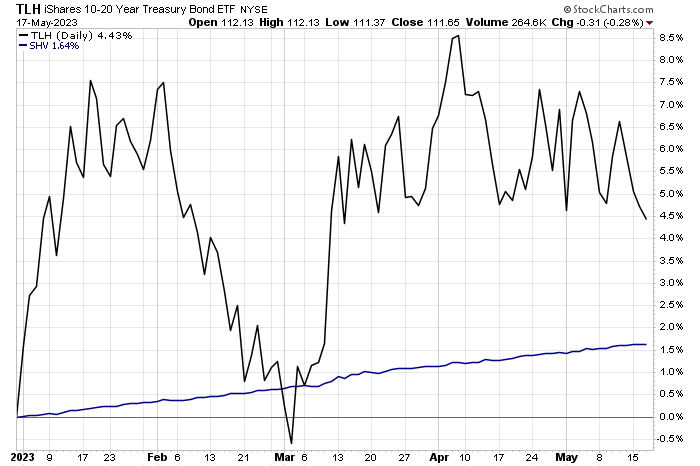

The iShares 10-20 Year Treasury Bond ETF (TLH) is the lead horse in this year’s performance race with a 4.4% gain. A close second-place performer: iShares 20+ Year Treasury Bond ETF (TLT), which is up 4.1%.

The ride to reach the top has been volatile. As the chart below shows, TLH’s year-to-date run has been erratic. As recently as early March, TLT was posting a slight year-to-date loss. By comparison, the cash proxy (SHV), the weakest performer year to date, has delivered a smooth ride and is currently higher by 1.6% in 2023.

One factor supporting long Treasuries is the expectation that the Federal Reserve will pause its interest-rate hikes at the upcoming FOMC meeting on June 14. The Fed funds futures market this morning is pricing in 68% probability that the central bank will leave its target rate unchanged at a 5.0%-to-5.25% range. If correct, the decision will mark the first time the Fed hasn’t lifted rates in more than a year.

The assumption that tighter monetary policy is ending has been a boost for the bond market overall this year. All the ETFs in CapitalSpectator.com’s bond-fund opportunity set are posting gains in 2023, including the broad investment-grade proxy (BND), which is up 2.8% year to date.

The main uncertainty for bonds – Treasuries in particular — at this point is how and when the US debt-ceiling impasse is resolved. Although President Biden is “confident” the US won’t default on its debt, there’s still no news of a deal between the White House and House Republicans after several rounds of talks. Meanwhile, Treasury Secretary Yellen warns that the government will run out of money to pay its bills as early as June 1 if Congress doesn’t act.

There are, however, several political hurdles to overcome, including anxious Senate Democrats, who are “warning the president not to agree to anything that would hurt low-income Americans or undermine the battle against climate change,” The Hill reports.

Nonetheless, House Speaker McCarthy offered an optimistic view yesterday, telling CNBC: “I think at the end of the day we do not have a debt default.”

The bond market seems to agree, or so it appears, based on a momentum profile of all the ETFs listed above. Using a set of moving averages to quantify the overall bias in prices indicates a strong degree of bullish momentum in recent days. The crowd, in short, is assuming a favorable outcome. The caveat: there’s little room for disappointment in the market if reality falls short of expectations.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…