Economics

Key Events This Week: All Eyes On CPI And Retail Sales; Fed Speakers Galore

Key Events This Week: All Eyes On CPI And Retail Sales; Fed Speakers Galore

While some will be secretly asking chat GPT to write a poem for…

Key Events This Week: All Eyes On CPI And Retail Sales; Fed Speakers Galore

While some will be secretly asking chat GPT to write a poem for their loved ones tomorrow (“Violets are blue, roses are red, humans are stupid and will soon all be dead”), those following markets will only care about one thing: the January CPI report (especially after the BLS just revised its seasonal adjustments and weight factors). As DB’s Jim Reid writes this morning, “it only feels like yesterday that US inflation prints were seen as last year’s news given the recent falls. In addition, forecasts and breakevens suggested we were on a glide path to normality over the next few months and quarters.”

However, as Reid warns, that view has received a bit of a jolt in the last 10 days:

- First we had payrolls print which raised the prospect that core services ex-shelter could stay stronger for longer.

- Then we had lots of hawkish central bank speak that the market had previously ignored but was now slowly waking up to.

- Then Manheim suggested US used cars (+2.5% mom in January) climbed at their fastest rate for 14-months, and…

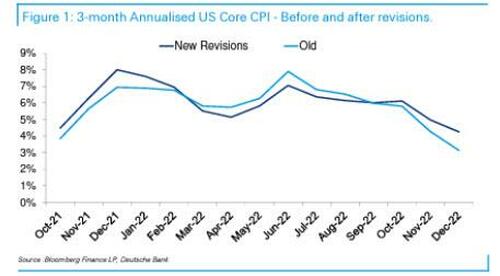

- Finally, we had US CPI revisions on Friday that have rewritten the last year of history and in turn reduced core inflation by around a tenth each month leading up to June and have increased it by an average of around a tenth in each month since August. As such the trend in core CPI hasn’t fallen as much as expected and we now haven’t seen any month less than +0.3% MoM. In addition 3m annualised core CPI ran at 4.3% in December rather than the 3.1% reported at the January 12th release. So although year on year hasn’t changed the momentum is notably different.

For tomorrow’s reading, higher gas prices should boost headline MoM CPI (consensus +0.5%). Last month this printed at -0.1% but got revised up to +0.1% on Friday. Core MoM should be stable (+0.4% consensus) but only because Friday’s revisions saw it edge up from 0.3% to 0.4% last month. As strong prints from this time last year edge out of the data, the YoY rates should fall around two tenths each to 6.2% and 5.5% (consensus unchanged at 5.7%), respectively. If you want to get more into the weeds see DB’s Justin Weidner’s preview here.

Staying with inflation, US PPI on Thursday is also important as the medical services component feeds directly into the equivalent within the core PCE number (out Feb 24th).

Elsewhere in the US we have leading indicators (LEI) on Friday which are expected to pickup, but stay in negative territory in January after an awful print for December. January retail sales on Wednesday is also expected to bounce back after a poor end to the year. In fact, according to BofA card data, retail sales will come in far hotter than expected, which may be an even bigger shock to the Fed than a hot CPI print… and certainly the market which is not expecting a big outlier here. More on that in a subsequent post.

There are also a couple of regional factory surveys (NY on Weds and Philli Thurs) which along with industrial production (Weds) are also all expected to bounce to varying degrees. Thursday will also see the usual jobless claims alongside housing starts and building permits (1.350 vs. 1.337k).

Fed speakers will have plenty of opportunity to address the data throughout the week, with at least ten appearances scheduled so far. There are a number of appearances from ECB officials as well. See the highlights in the day by day week ahead calendar at the end as usual.

Shifting to Europe, UK CPI (Weds) and labour market data (tomorrow) will be in focus following the recent more dovish BoE meeting. This week’s CPI will also be calculated with new weights so our UK economists put out a note on the potential impact of the changes here.

Turning to earnings now, with nearly 350 of the S&P 500 members having reported, there will still be a few notable corporates releasing results but the reality is that we are past the biggest potential market movers for the macro world.

Here is a day-by-day calendar of events

Monday February 13

- Data: Japan Q4 GDP

- Central banks: Fed’s Bowman speaks, ECB’s Centeno speaks

- Earnings: Palantir, SolarEdge, DBS Group

Tuesday February 14

- Data: US January CPI report, NFIB small business optimism, UK January employment change, average weekly earnings, Japan December capacity utilization, France Q4 unemployment rate, Eurozone Q4 employment

- Central banks: Fed’s Logan, Harker and Williams speak

- Earnings: Coca-Cola, Norsk Hydro, Airbnb, Marriott, First Quantum Minerals, Carrefour, Telecom Italia

Wednesday February 15

- Data: US February NAHB housing market, Empire manufacturing index, January retail sales, industrial and manufacturing production, capacity utilization, December business inventories, UK January CPI, PPI, RPI, December house price index, Japan January trade balance, December tertiary industry index, core machine orders, Italy December general government debt, Eurozone December trade balance, industrial production, Canada January housing starts, existing home sales, December manufacturing sales, wholesale trade sales

- Earnings: Cisco, Analog Devices, Shopify, Kering, Glencore, Equinix, Heineken, Kraft Heinz, EDF, Barrick Gold, Biogen, Albemarle, ROBLOX, Zillow, Roku

Thursday February 16

- Data: US February Philadelphia Fed business outlook, New York Fed services business activity, initial jobless claims, January PPI, housing starts, building permits, China January new home prices, Italy December trade balance

- Central banks: Fed’s Mester, Cook and Bullard speak, ECB’s Panetta, Nagel and Lane speak, BoE’s Pill speaks

- Earnings: Nestle, Vale, Applied Materials, Schneider Electric, Air Liquide, DoorDash, Repsol, Paramount, Renault, Hasbro, DraftKings, Airbus

Friday February 17

- Data: US January leading index, import and export price index, UK January retail sales, Italy December current account balance, December ECB current account, Canada January raw materials and industrial product price index

- Central banks: Fed’s Barkin and Bowman speak, ECB’s Villeroy speaks

- Earnings: Hermes, Deere, Allianz, Mercedes-Benz

* * *

Finally, turning to just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday, retail sales on Wednesday, and the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week, including governors Bowman and Cook and presidents Barkin, Logan, Harker, Williams, Mester, and Bullard.

Monday, February 13

- There are no major economic data releases scheduled.

- 08:00 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will discuss banking supervision at an ABA conference for community bankers. Text and a moderated Q&A are expected.

Tuesday, February 14

- 06:00 AM NFIB small business optimism, January (consensus 91.0, last 89.8)

- 08:30 AM CPI (mom), January (GS +0.55%, consensus +0.5%, last +0.1%); Core CPI (mom), January (GS +0.49%, consensus +0.4%, last +0.4%); CPI (yoy), January (GS +6.39%, consensus +6.2%, last +6.5%); Core CPI (yoy), January (GS +5.63%, consensus +5.5%, last +5.7%): We estimate a 0.49% increase in January core CPI (mom sa), which would lower the year-on-year rate by one tenth to 5.6%. Our forecast reflects an 8bp boost from larger-than-normal start-of-year price increases for prescription drugs, medical services, car fees, and alcohol. We also expect a 3% rise in airfares on the back of higher oil prices (worth +2bps) and another gain in the car insurance category as carriers seek to offset higher repair and replacement costs. We also assume a smaller drag from used car prices (of -3bps in January following -9bps in December) reflecting the stabilization in auction prices, positive residual seasonality, and last week’s downward revision to the weight of this CPI category (our month-over-month forecast for used car CPI is -0.75%, following -2.0% in December). On the negative side, we forecast a sequentially slower pace of shelter inflation (we estimate rent +0.73% and OER +0.67%) as weakness in new rental pricing begins to offset continued upward pressure on renewing leases. We estimate a 0.55% rise in headline CPI, reflecting higher gasoline and food prices.

- 09:30 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will participate in an interview with Bloomberg TV. On February 9, Barkin said, “With demand slowing but still resilient, labor markets healthy and the added and unfortunately enduring shock of the war in Ukraine, it shouldn’t be a surprise that inflation — while likely past its peak — is still elevated. That, of course, is what makes the case for us to stay the course…Until we’re confident that the things people care about are under control, I think we’ve still got a ways to go.”

- 11:00 AM Dallas Fed President Logan (FOMC voter) speaks: Dallas Fed President Lorie Logan will participate in a moderated discussion at an event hosted by Prairie View A&M University. Text and a moderated Q&A are expected. On January 18, Logan said, “A slower pace is just a way to ensure we make the best possible decisions…We can and, if necessary, should adjust our overall policy strategy to keep financial conditions restrictive even as the pace slows… We need to keep our eyes on the economic and financial outlook and lay out a strategy that is both flexible and robust so we are best positioned to achieve our goals however the outlook evolves.”

- 11:30 AM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook at an event hosted by the Union League of Philadelphia. Text and a Q&A with the audience are expected. On February 10, Harker said, “What is driving our rate increases right now is inflation, and we are starting to see signs, early signs that inflation is starting to move down…At this point, we can go at a pace of 25 [basis-point rate increases] and get inflation under control without doing undue damage to the labor market.”

- 02:05 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a speech at an event hosted by the New York Bankers Association. Text and Q&A with audience and media are expected. On February 8, when discussing the December median projection of 5-5.25% for the fed funds rate by the end of 2023, Williams said, “That still seems a very reasonable view of what we’ll need to do this year in order to get supply and demand in balance and bring inflation down.” He added that further increases of 25 basis points “seems like the right size…we still have our work cut out for us.”

Wednesday, February 15

- 08:30 AM Empire State manufacturing survey, February (consensus -18.0, last -32.9)

- 08:30 AM Retail sales, January (GS +2.5%, consensus +1.9%, last -1.1%); Retail sales ex-auto, January (GS +1.5%, consensus +0.8%, last -1.1%); Retail sales ex-auto & gas, January (GS +1.4%, consensus +0.7%, last -0.7%); Core retail sales, January (GS +1.4%, consensus +0.8%, last -0.7%): We estimate core retail sales rebounded 1.4% in January (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects strength in high-frequency consumer spending data and a likely boost from cost-of-living adjustments to Social Security. We estimate a 2.5% rise in headline retail sales, reflecting a jump in auto sales and higher gasoline prices.

- 09:15 AM Industrial production, January (GS +0.2%, consensus +0.5%, last -0.7%); Manufacturing production, January (GS +0.5%, consensus +0.8%, last -1.3%); Capacity utilization, January (GS 78.9%, consensus 79.1%, last 78.8%): We estimate industrial production increased 0.2% in January, as strong auto production is offset by weak natural gas utilities reflecting warmer weather than the seasonal norm. We estimate capacity utilization edged up to 78.9%.

- 10:00 AM Business inventories, December (consensus +0.3%, last +0.4%)

- 10:00 AM NAHB housing market index, February (consensus 37, last 35)

Thursday, February 16

- 08:30 AM Housing starts, January (GS -2.5%, consensus -2.1%, last -1.4%); Building permits, January (consensus +1.0%, last -1.0%): We estimate housing starts decreased by 2.5% in January.

- 08:30 AM Initial jobless claims, week ended February 11 (GS 195k, consensus 200k, last 196k); Continuing jobless claims, week ended February 4 (consensus 1,688k, last 1,688k): We estimate that initial jobless claims edged 1k lower to 195k in the week ended February 11.

- 08:30 AM Philadelphia Fed manufacturing index, February (GS -5.0, consensus -7.4, last -8.9): We estimate that the Philadelphia Fed manufacturing index rebounded 3.9 points to -5 in February, reflecting the reopening of the Chinese economy and firmer industrial data abroad.

- 08:30 AM PPI final demand, January (GS +0.5%, consensus +0.4%, last -0.5%); PPI ex-food and energy, January (GS +0.4%, consensus +0.3%, last +0.1%); PPI ex-food, energy, and trade, January (GS +0.3%, consensus +0.2%, last +0.1%): We estimate that the PPI final demand index increased by 0.5% in January. We estimate a 0.4% increase for PPI ex-food and energy and a 0.3% increase for PPI ex-food, energy, and trade.

- 08:45 AM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will speak at an event hosted by the Global Interdependence Center. Speech text is expected. On January 18, when discussing the December median projection of 5-5.25% for the fed funds rate by the end of 2023, Mester said she expects the rate to need to go “a bit higher” than that. She added, “I just think we need to keep going, and we’ll discuss at the meeting how much to do.”

- 01:30 PM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will discuss the economic outlook and monetary policy at an event hosted by the Greater Jackson County Chamber. Text and a Q&A with audience and media are expected. On January 18, Bullard said, “Let’s move the policy rate to the right level…then we’ll see how 2023 unfolds.”

- 04:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver welcoming remarks at an event hosted by the Brookings Institution. Text is expected. On February 8, Cook said, “We are determined to bring inflation down to our target…So I think we are not done yet with raising interest rates, and we will need to keep interest rates sufficiently restrictive.”

- 06:15 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic outlook at an event hosted by the Financial Executives International of Northeast Ohio and ACG Cleveland. Text is expected.

Friday, February 17

- 08:30 AM Richmond Fed President Barkin (FOMC non-voter) speaks; Richmond Fed President Thomas Barkin will discuss the labor market at an event hosted by the Rosslyn Business Improvement District. Q&A with audience and media is expected.

- 08:45 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will participate in a discussion at an event hosted by the Tennessee Bankers Association. A moderated Q&A is expected.

- 08:30 AM Import price index, January (consensus -0.1%, last +0.4%): Export price index, January (consensus -0.2%, last -2.6%)

Source: DB, Goldman, Bofa

Tyler Durden

Mon, 02/13/2023 – 10:00

gold

inflation

monetary

markets

policy

interest rates

fed

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…