Economics

Key Events And Acronyms This Week: ISMs, PMIs, RBA, ADP, JOLTS And NFP

Key Events And Acronyms This Week: ISMs, PMIs, RBA, ADP, JOLTS And NFP

As we kick off July, US Independence Day tomorrow and an shortened…

Key Events And Acronyms This Week: ISMs, PMIs, RBA, ADP, JOLTS And NFP

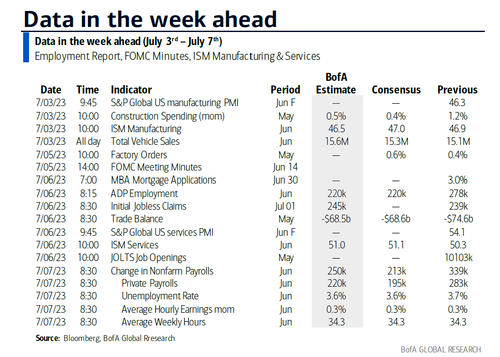

As we kick off July, US Independence Day tomorrow and an shortened Monday trading day will ensure a stop start week but it remains a big one with US payrolls (Friday) and the global PMIs and US ISMs through the week. May’s JOLTS (one month behind), June’s ADP and weekly claims (all Thursday) will give us a payrolls appetizer. Elsewhere according to DB’s Jim Reid, the RBA (tomorrow) is seemingly a 50/50 call and staying with central banks, the Fed minutes are out on Wednesday with the ECB survey of consumer expectations the same day.

In terms of the key event, as usual in the first week of a new month the main event is Friday’s payrolls. With the headline numbers ranging from +217k to +472k over the last 6 months, these are not currently close to recessionary levels (at least not until they are revised drastically lower). However, as Reid notes, the average recession through history has seen payrolls move from an average of just over +100k in the 3-6 months before to very suddenly negative in the first month of the recession where it tends to stay for several months. You don’t tend to get any warning from prior payroll prints that its going to turn negative but with the range this year, and last month being at +339k, we probably need to move down into the 100-200k range before we can be on more near-term recession watch. Even then it still might not happen but that’s probably a necessary condition outside of a shock.

For Friday, DB’s economists expect headline (consensus +225k, DB +200k vs. +339k previously) and private (consensus +200k, DB +175k vs. +283k) payroll gains to slow relative to their three-month averages of +283k and +231k, respectively. This should still edge unemployment back down a tenth to 3.7% (consensus 3.6%) after a surprise spike last month. Hours worked was weak last month and DB’s economists expect that to bounce from 34.3 to 34.4hrs. Hourly earnings are expected to be steady at 0.3%.

In terms of the US ISMs this week, today manufacturing index is expected to come in lower a 46.3 vs 46.9 last month, continuing a trend of all but one month being below 50 since November. Thursday’s services ISM (consensus 51.3, vs, 50.3 last month) is expected to see a rebound from the second surprise stagnation print in the last 6 months. So put any rebound in some perspective. In addition the employment component in both ISMs may be used to fine-tune payroll predictions. The three-month average for the ISM manufacturing employment series stood at 49.5 as of May while that of services was 50.4, near the lows of the last cycle. So one to watch. Broadening the focus, various other global PMIs come through in the first half of the week.

Other notable indicators due include the US trade balance on Thursday and factory orders on Wednesday. A full summary of US events is below:

There will be plenty of activity in Europe as well. In Germany, these include the trade balance tomorrow, followed by factory orders on Thursday and industrial production on Friday. In France, investors will keep an eye on industrial production (Wednesday) and the trade balance (Friday) and, in Italy, PMIs (Monday and services on Wednesday) and retail sales (Friday) are out.

Apart from data, investors may also pay attention to OPEC’s 8th International Seminar running on Wednesday-Thursday, with several CEOs and oil ministers expected among the speakers. With oil prices bouncing around $70/bbl amidst the lack of a demand catalyst, the focus will be on whether some OPEC+ members will again try to put a firmer floor under prices.

Here is a day-by-day calendar of events, courtesy of DB

Monday July 3

- Data: US June ISM, total vehicle sales, May construction spending, China June Caixin manufacturing PMI, Japan Q2 Tankan index, Italy June manufacturing PMI, new car registrations, budget balance, France May budget balance

Tuesday July 4

- Data: Japan June monetary base, Italy Q1 deficit to GDP, Germany May trade balance, Canada June manufacturing PMI

Wednesday July 5

- Data: US May factory orders, China June Caixin services PMI, UK June official reserves changes, new car registrations, Italy June services PMI, France May industrial production, Eurozone May PPI

- Central banks: Fed FOMC meeting minutes, Fed’s Williams speaks, ECB’s Consumer Expectations Survey, ECB’s Villeroy speaks

Thursday July 6

- Data: US June ISM services, ADP report, May JOLTs, trade balance, initial jobless claims, UK June construction PMI, Germany June construction PMI, May factory orders, Eurozone May retail sales, Canada May international merchandise trade

- Central banks: Fed’s Logan speaks

Friday July 7

- Data: US June jobs report, Japan May leading, coincident index, labor cash earnings, household spending, China June foreign reserves, Italy May retail sales, Germany May industrial production, France May trade balance, Canada June jobs report

- Central banks: ECB’s Lagarde and Guindos speak, BoE’s Mann speaks

- Earnings: Samsung

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing report on Monday, JOLTS job openings on Thursday, and the employment situation report on Friday. The minutes from the June FOMC meeting will be released on Wednesday and Fed presidents Williams and Logan have speaking engagements scheduled this week.

Monday, July 3

- 09:45 AM S&P Global US manufacturing PMI, June final (consensus 46.3, last 46.3)

- 10:00 AM Construction spending, May (GS +1.3%, consensus +0.5%, last +1.2%)

- 10:00 AM ISM manufacturing index, June (GS 46.9, consensus 47.2, last 46.9): We estimate that the ISM manufacturing index was unchanged at 46.9 in June, reflecting mixed US surveys, the lackluster rebound in East Asian trade activity, and unfavorable seasonal factors. Our GS manufacturing tracker rebounded by 1.2pt to 47.5.

- 05:00 PM Lightweight motor vehicle sales, June (GS 15.7mn, consensus 15.3mn, last 15.05mn)

Tuesday, July 4

- US Independence Day holiday. NYSE will be closed, SIFMA recommends bond markets remain closed, and there are no major economic data releases scheduled.

Wednesday, July 5

- 10:00 AM Factory orders, May (GS +0.8%, consensus +0.8%, last +0.4%); Durable goods orders, May final (consensus +1.7%, last +1.7%); Durable goods orders ex-transportation, May final (last +0.6%); Core capital goods orders, May final (last +0.7%); Core capital goods shipments, May final (last +0.2%): We estimate that factory orders increased 0.8% in May following a 0.4% increase in April. Durable goods orders increased by 1.7% in the May advance report, and core capital goods orders increased by 0.7%.

- 02:00 PM FOMC meeting minutes, June 13-14 meeting: The FOMC left the target range for the federal funds rate unchanged at its June meeting, but delivered a hawkish surprise to our and most market participants’ expectations with a dot plot that showed a median projection of two additional rate hikes in 2023 rather than one. Chair Powell said during his post-meeting press conference that the main reason for the shift up in the dots is the disappointingly slow decline in core inflation so far this year.

- 04:00 PM New York Fed President Williams speaks: New York Fed President John Williams will participate in a moderated discussion at the annual meeting of the Central Bank Research Association at the New York Fed. Speech text and media Q&A are not expected. On June 25, Williams said that “restoring price stability is of paramount importance because it is the foundation of sustained economic and financial stability. Price stability is not an either/or, it’s a must have.” He added, “It’s not clear that monetary policy actions play a central role in affecting the emergence of financial stability vulnerabilities.”

Thursday, July 6

- 08:15 AM ADP employment report, June (GS +275k, consensus +240k, last +278k); We estimate a 275k rise in ADP payroll employment in June, reflecting strong summer hiring and strength in Big Data indicators. We also note that ADP employment growth has picked up in June in 6 of the last 7 years.

- 08:30 AM Trade balance, May (GS -$69.0bn, consensus -$69.0bn, last -$74.6bn)

- 08:30 AM Initial jobless claims, week ended July 1 (GS 260k, consensus 245k, last 239k); Continuing jobless claims, week ended June 24 (consensus 1,740k, last 1,742k): We forecast that initial jobless claims rebounded by 21k to 260k in the week ended July 1. We suspect that the timing of the Juneteenth holiday may have reduced filing activity in the prior week, as initial claims fell more sharply on average in states where state employees had the holiday off than in states where state employees did not.

- 08:45 AM Dallas Fed President Logan speaks: Dallas Fed President Lorie Logan will speak on a panel about the policy challenges for central banks at the annual meeting of the Central Bank Research Association. A moderated Q&A is expected. On May 18, Logan said, “After raising the target range for the federal funds rate at each of the last 10 FOMC meetings, we have made some progress…The data in coming weeks could yet show that it is appropriate to skip a meeting. As of today, though, we aren’t there yet.”

- 09:45 AM S&P Global US services PMI, June final (consensus 54.1, last 54.1)

- 10:00 AM JOLTS job openings, May (GS 9,668k, consensus 9,968k, last 10,103k)

- 10:00 AM ISM services index, June (GS 51.5, consensus 51.3, last 50.3): We estimate that the ISM services index rebounded by 1.2pt to 51.5 in June. Our forecast reflects net improvement in business surveys (services tracker +1.2pt to 51.4) but the pullback in our GSAI. Resolution of the debt ceiling also argues for sequential improvement.

Friday, July 7

- 08:30 AM Nonfarm payroll employment, June (GS +250k, consensus +225k, last +339k); Private payroll employment, June (GS +225k, consensus +200k, last +283k); Average hourly earnings (mom), June (GS +0.3%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), June (GS +4.2%, consensus +4.2%, last +4.3%); Unemployment rate, June (GS 3.6%, consensus 3.6%, last 3.7%); Labor force participation rate, June (GS 62.6%, consensus 62.6%, last 62.6%): We estimate nonfarm payrolls rose by 250k in June (mom sa). Job growth tends to pick up in June when the labor market is tight, reflecting strong hiring of youth summer workers. Big Data indicators also indicate strong job growth. However, the June seasonal factors have evolved to become more restrictive in recent years. We estimate the unemployment rate declined one tenth to 3.6% reflecting a rise in household employment and unchanged labor force participation (at 62.6%). We estimate a 0.3% increase in average hourly earnings (mom sa) that lowers the year-on-year rate to 4.2%, reflecting waning upward wage pressures and neutral calendar effects.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 07/03/2023 – 09:40

inflation

monetary

markets

policy

fed

central bank

monetary policy

stagnation

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…