Economics

JPMorgan, Goldman React To Powell’s Hawkish Comments

JPMorgan, Goldman React To Powell’s Hawkish Comments

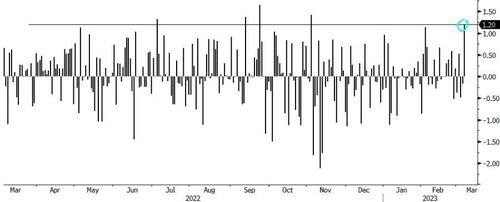

Powell’s remarks today led to the biggest jump in the dollar since November…

……

JPMorgan, Goldman React To Powell’s Hawkish Comments

Powell’s remarks today led to the biggest jump in the dollar since November…

… and a1.5% selloff in SPX, reversing almost of the gains from last Friday’s rally, and with eminis now back below 4000 all three CTA “threshold” levels are on the verge of being broken to the downside.

The reason for the market spasm is that the terminal rate was repriced 16bp higher to 5.63% as Powell put 50bp back on table.

As JPM’s chief economist Michael Feroli explains (in a delightfully titled note available to pro subs), the Fed chair did so by once again jeopardising the Fed’s credibility: “whereas the plan prior to that data round was to hike by 25bps until there was more evidence of disinflation, Chair Powell indicated today that they are prepared to throw out that playbook if the February data don’t reverse some of the January strength.” In other words, yet another painful U-turn by a Fed which after ripping up the forward guidance book, is clearly even more clueless now what is going on.

To JPM’s head of market intel, Andrew Tyler, Powell’s speech today indicates that the “Fed will heavily depend on near-term data for upcoming rates decisions. With January’s macro data mostly printing on the hawkish side, NFP Friday and CPI next Tuesday are the most critical catalysts for Fed’s decision between 25bp and 50bp. Keep in mind that the Fed will start its blackout period this Saturday so CPI will be released during the blackout period, so data itself will be more impactful in absence of guidance from Fedspeeches.” And also recall that last June, having set market expectations for a 50bps hike, the Fed was reduced to using its WSJ mouthpiece, Nick Timiraos, to alert the market 75bps was coming.

Some more from Feroli’s full note:

The strength of the January data seems to have spooked the Fed Chair. Whereas the plan prior to that data round was to hike by 25bps until there was more evidence of disinflation, Chair Powell indicated today that they are prepared to throw out that playbook if the February data don’t reverse some of the January strength: “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.” The phrase “totality of the data” has in the past indicated that data dependency didn’t mean just one month’s data: in this context it apparently means two months’ data. Less surprising was the Chair’s previewing that the March dots are likely to move higher: “…the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.”

At several points, Powell made note of monetary policy lags, such as, “In light of the cumulative tightening of monetary policy and the lags with which monetary policy affects economic activity and inflation, the Committee slowed the pace of interest rate increases over its past two meetings.” That reasoning, however, seems to have less sway now (hard to say how much that reflects the departure of Vice Chair Brainard).

So, what does this mean for March and beyond? Prior to today, remarks from the centrists suggested 25bp was the base case, so that the data just needed to return to the trend prevailing prior to the January round to stick with that plan. Now that Powell has opened the door to 50bp, the bar now has likely changed such that the February data need to reverse some of the January strength to stay at 25bp. If the data push them to 50bp at the March meeting, what does that mean for the May meeting? Either they embrace the sort of hyper-data dependency that then-Governor Stein cautioned against ten years ago, or 50bp is the new incumbent, in which case they could be on a path to getting off three 50s just as the economy heads into the debt ceiling crisis in mid-summer. For now, we are sticking with 25bp for the March meeting, though that is now obviously much more contingent on what the next two weeks of data deliver.

Bottom line: the Fed is looking to accelerate its tightening just as the US economy plaxicos itself, with a debt ceiling crisis on top. Not for nothing Michael Hartnett said that the bear market will end with a credit event in the second half.

And until we wait for the next collapse, here is an excerpt from JPM’s ultra bearish technician Jason Hunter (full note also available to pro subs) on how Powell’s comments could impact the market in the coming days:

The S&P 500 Index slides to retest the key confluence of levels near 3900 after rejecting 4060-4089 tactical pattern resistance. We believe a break through the 3900 inflection can lead to accelerated selling pressure, as that area has acted as a bifurcation for the index from May 2022. It also currently aligns with several trend-following trigger levels for momentum-based strategies. We see the 3760-3764 area as an initial target for a breakdown.

Our base-case forecast that looked for a 1H23 3500 Oct 2022 low retest to set the bottom for the cycle was in part leaning on the fact that the 5s/10s UST curve had already bottomed in Sep 2022. In the supply-constrained period of the 1970s when the sequence of inflation shocks dominated the macro environment, the equity market became positive correlated with the yield curve and bottomed within a 1–5-month period after the curve set the cycle lows. With the recent hawkish repricing pushing the curve through the Sep 2022 trough, that countdown needs to restart whenever the curve bottoms in the future. As such, we think the probability for a deeper S&P 500 Index slide to next support near 3200 and a bottom later within the first half of 2023 has increased.

That takes care of JPMorgan, what about Goldman? In his market wrap analysis, Goldman’s John Flood writes that “Powell said the US central bank is prepared to increase the pace of hikes if data warrant, and sees the ultimate peak Fed rate likely to be higher than expected. In prepared testimony before the Senate Banking Committee, he said the process of getting inflation back to 2% “has a long way to go and is likely to be bumpy.”

Some more from Goldman trader Michael Nocerino on today’s market reaction:

Today’s commentary possibly opens the door for a 50bps hike at the next meeting. This morning the market was pricing in a 22% chance of 50bps hike…post the statement market is now pricing 63% chance.

Yesterday felt like a build up into today and it disappointed for the bulls. Another round of hawkish commentary from Powell and hotter than expected Manheim data (wholesale used vehicle prices rose 4.3% in February (the largest for the month since 2009) spurred a largely risk off session. Off the back of the Powell commentary, rates spiked (especially on the front end, 2yr @ highest level since ’06, 2s10s most inverted since summer of ’80 ), markets rolled and investors are now bracing for the possibility of 50bps at the March meeting (higher for longer getting louder). Surprisingly, the response on the desk was muted (5 out of 10) and when taking a look at our PB the gross up in risk has been swift – investors willing to ride this out until we get more data? Asset Managers had a -19% sell skew which was highest since 2/20/23 and 92nd percentile vs previous 52 weeks. HFs had a -542bp sell skew highest since 2/16/23. All eyes are now on this Friday’s NFP, but a watchful eye remains on JOLTS where GS estimates 10,200k openings vs. 10,500 consensus.

Putting it all together, Goldman Research added 25bps to their forecast: “Whether the FOMC hikes by 25bp or 50bp, we now expect that the median dot in the March Summary of Economic Projections will rise by 50bp to a peak of 5.5-5.75% in 2023. One reason for this is that even if FOMC participants decide on a 25bp hike in March but are split on the pace, they might compromise by engineering a 50bp increase in the peak funds rate shown in the dot plot. We have raised our own forecast of the peak fed funds rate by 25bp to 5.5-5.75% as well by adding a 25bp hike in July.”

Much more in the full notes available to professional subs.

Tyler Durden

Tue, 03/07/2023 – 21:05

dollar

inflation

monetary

markets

policy

interest rates

fed

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…