Economics

It’s Been A Surprisingly Good Year For Global Financial Assets

It’s Been A Surprisingly Good Year For Global Financial Assets

Authored by Simon White, Bloiomberg macro strategist,

Nearly all global stock…

It’s Been A Surprisingly Good Year For Global Financial Assets

Authored by Simon White, Bloiomberg macro strategist,

Nearly all global stock indexes and bond indexes have posted gains year-to-date in 2023, despite encountering the highest interest rates seen in most parts of the world in almost two decades.

Eastern European assets have generally performed among the best, and China and Hong Kong among the worst. Typically the best outperformers one year go on to underperform the next, and vice-versa.

With the Federal Reserve and most other central banks in the midst of steep rate-hiking cycles at the end of last year, it seemed a pretty good bet that stocks and bonds of most countries would be down in 2023.

But that’s not the way it’s panned out.

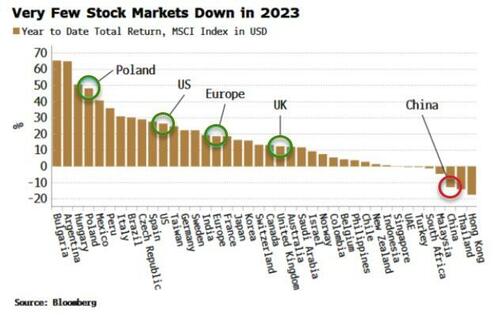

The chart below shows year-to-date returns of MSCI indexes for the largest EM and DM countries.

As is clear, few indexes are down on the year. China and Hong Kong are predictably near the bottom as China continues to stumble in reviving its economy.

China’s travails have weighed down on other Asian markets, with Thailand and Malaysia also down YTD, while Singapore, Indonesia and the Philippines’ returns are meagre.

All indexes are in dollar terms, so this is not a result of a weaker dollar (although the US currency is only marginally weaker on the year).

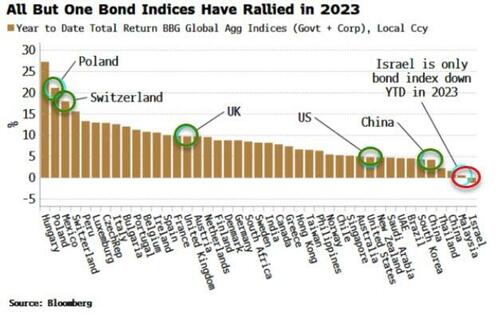

Bonds, too, would have been expected to have a torrid time given rising rates. But only one of the main country Bloomberg aggregate indexes, which include corporate and government debt, is down on the year (Israel – although it has rallied strongly since the beginning of November along with the global move higher in bonds).

(The chart shows local-currency indexes, but the dollar impact is limited as it is virtually unchanged on the year.)

Eastern European bond indexes, e.g. Poland and Hungary, are again near the top of the pile. Both countries have started to cut rates, with a view inflation will continue to moderate, even though price growth still remains well above their pre-pandemic averages. Something several developed-market countries look tempted to try next year too.

Once again, China finds itself near the bottom of the pile, despite being the only country in consumer deflation. Chinese assets continue to be spurned by global investors concerned about a deflationary bust, as well as return of capital in the event of a Russia-style banishment.

However, if one looks through history, the top-performing countries one year – especially in equity markets – typically find themselves among the bottom performers the next year, and vice-versa. If this pattern repeats, 2024 may be a good year for China’s stocks and bonds, while Eastern European assets (Poland, Czechia, Hungary) could find themselves languishing near the bottom.

Tyler Durden

Wed, 12/20/2023 – 09:20

dollar

inflation

deflation

markets

reserve

interest rates

deflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…