Economics

Inflation: Known Unknowns

In my MJS article on inflation, I wrote: Looking forward, the inflation surge is probably over. The upward pressure in rental rates is dissipating, while…

In my MJS article on inflation, I wrote:

Looking forward, the inflation surge is probably over. The upward pressure in rental rates is dissipating, while supply chain problems have already disappeared. Finally, because the Fed has been raising interest rates over the last year and a half, thereby slowing the economy’s growth, the labor market has cooled substantially, further relaxing upward price pressures.

That means that in the absence of any big surprises – like another large disruption to oil markets – inflation is likely to continue to moderate, although perhaps more slowly than most people would like. On the other hand, if the Fed has already overly tightened – as the effects of past interest rate increases continue to ripple through the economy – inflation may fall even faster, although perhaps at the cost of a recession.

What’s one potential big surprise? Here’s a graphic:

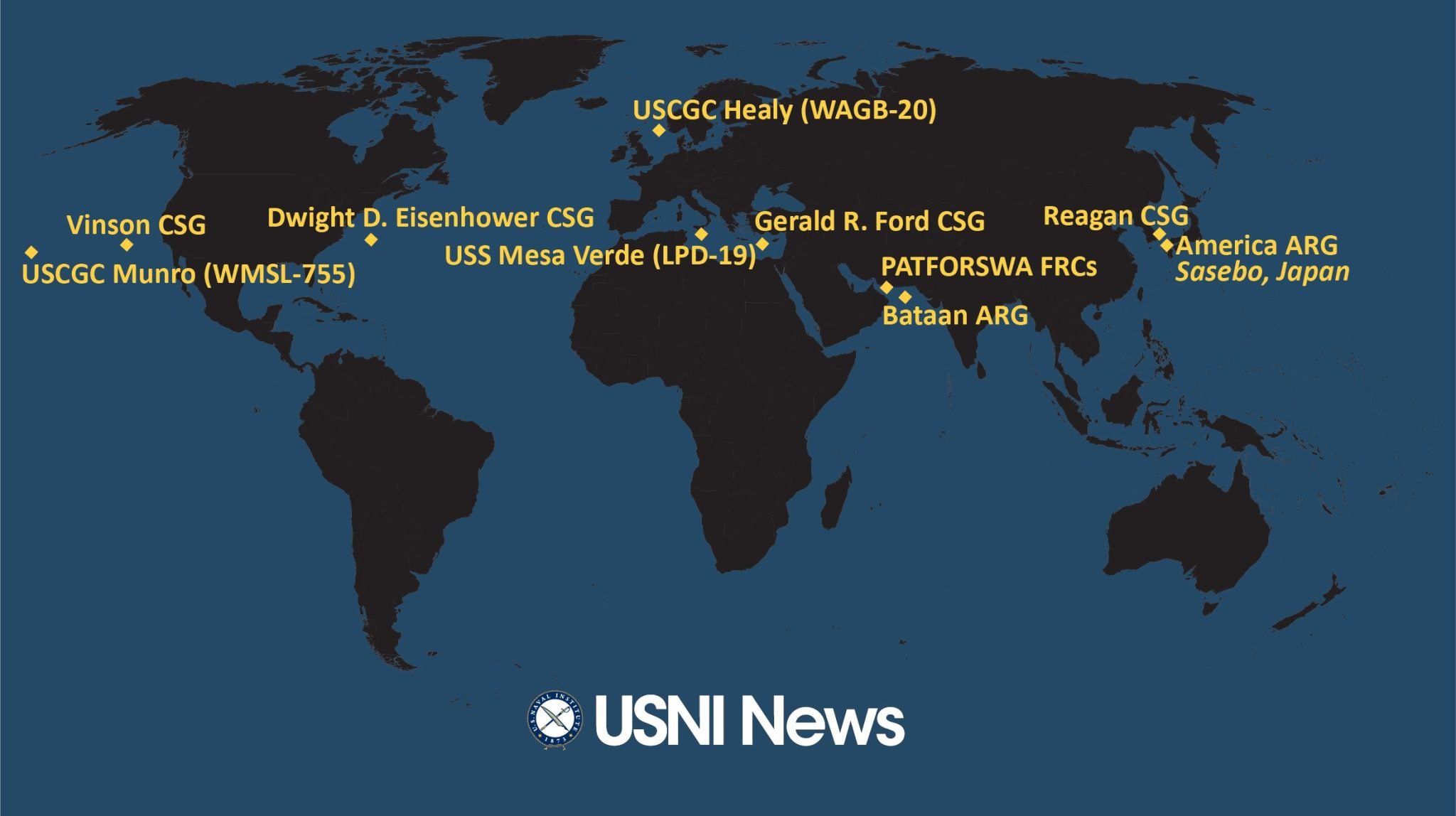

Figure 1: Map as of October 16, 2023. Source: USNI.

Eisenhower Carrier Strike Group (CSG) to Med; Vinson CSG deploying to “Indo-Pacific”. Bataan Amphibious Ready Group (ARG) to Eastern Med.

Here’s another:

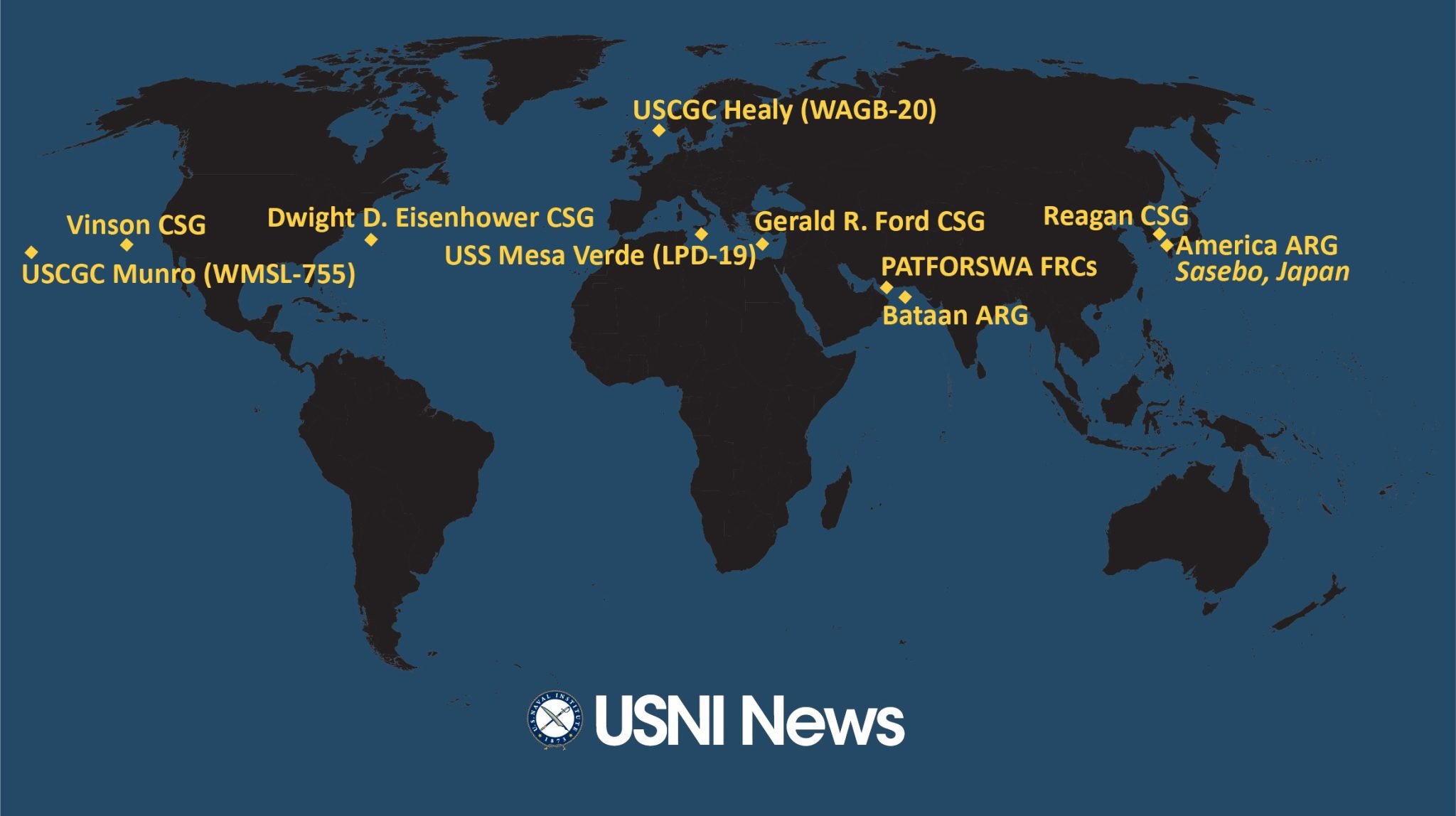

Figure 2: GeoPolitical Risk daily index (blue), and centered 7 day moving average (red). Source: Caldara-Iacoviello, and author’s calculations.

The GeoPolitical Risk index is elevated, and likely to remain so. Expansion of the war to cause a tightening of oil supplies would certainly exacerbate inflationary pressures.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…