Economics

Inflation is yesterday’s news

Here’s Bloomberg’s take on today’s March CPI release: "data showed inflation moderated last month, but not enough to forestall the Federal Reserve from…

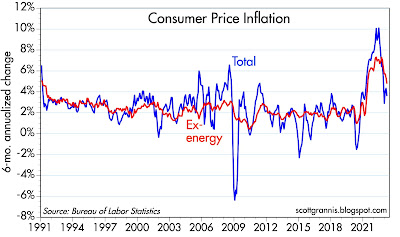

Here’s Bloomberg’s take on today’s March CPI release: “data showed inflation moderated last month, but not enough to forestall the Federal Reserve from raising rates at least one more time this year.”

My take: There are only two things you need to know about inflation today: 1) without the Owners’ Equivalent Rent component (which makes up about one-third of the CPI), the CPI would have declined at a -1.6% annualized rate in March, and 2) OER inflation has peaked and will almost surely decline significantly in coming months. In short, our national inflation nightmare is over. If the economists at the Fed can’t understand this, they should be fired. There is absolutely no reason the Fed needs to raise rates further, and every reason they should begin cutting rates—beginning with the May 3rd FOMC meeting if not sooner.

Chart #4 shows another reason why the CPI is going down in a big way. Growth in the M2 money supply foreshadows changes in the CPI by about one year. Given the behavior of M2 in the past year, the CPI is on track to fall to 2% or less by the end of this year, if not sooner.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…