Economics

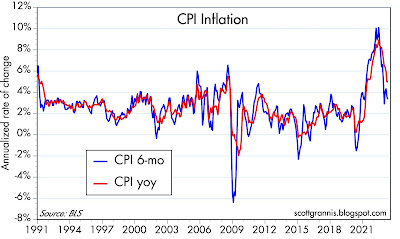

Inflation is so over

Today the bond market is convinced that there will be no more Fed rate hikes. Yet the Fed insists that inflation has not fallen by enough, and that warrants…

Today the bond market is convinced that there will be no more Fed rate hikes. Yet the Fed insists that inflation has not fallen by enough, and that warrants continued monetary restraint; some governors even argue that further rate hikes might be necessary, even as evidence of economic weakness builds. Chalk this up as one more example of how the bond market is usually smarter than the Fed. Fed mistakes like this have been the proximate cause of every recession in my lifetime. This is yet one more reason why individuals—and especially committees like the FOMC—are never as smart as they should be. By extension, bureaucrats are rarely smarter than the collective wisdom of those they are supposed to oversee. Which is why at heart I’m a Libertarian—government should be limited as much as possible.

Chart #4 shows that it takes housing prices (blue line) about 18 months to feed into the shelter component of the CPI (red line). Housing prices have been falling for the past year, and only just now is the shelter component of the CPI beginning to reflect that. That means there’s a lot more disinflation in the CPI shelter pipeline.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…