Economics

“Increasing Sense Of Doom” – Manufacturing Surveys Scream Stagflation In July

"Increasing Sense Of Doom" – Manufacturing Surveys Scream Stagflation In July

With broader macro data serially disappointing in recent weeks,…

“Increasing Sense Of Doom” – Manufacturing Surveys Scream Stagflation In July

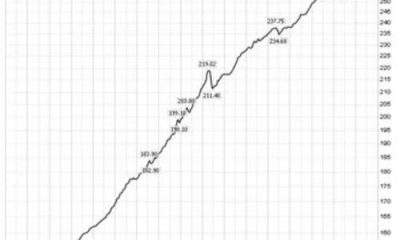

With broader macro data serially disappointing in recent weeks, expectations were for the final ISM Manufacturing print for July to decline from June’s – and it did (from 49.0 to 47.9) but we note that the final print was higher than the preliminary print of 47.0. ISM Manufacturing also rose on the month from 46.4 to 47.6 (better than the 47.0 exp) but still below 50…

Source: Bloomberg

The Manufacturing PMI data has been in contraction (below 50) for 4 straight months and ISM Manufacturing has been in contraction (sub-50) for 10 straight months.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“US manufacturers reported another tough month of trading in August. Output has fallen back into decline after a brief respite in July amid an increasingly steep deterioration in order books. Orders are in fact falling faster than factories are cutting output, suggesting firms will need to continue scaling back their production volumes into the near future.

And under the surface the report screams stagflation:

“An increasing sense of gloom about the near-term outlook has meanwhile hit hiring and led to a further major pullback in purchasing activity.

“The survey meanwhile adds to evidence that the deflationary impact of improving supply chains has peaked, with prices starting to rise at an increased rate again in August. However, falling demand is clearly continuing to dampen pricing power and is keeping overall inflationary pressures in the manufacturing sector very subdued.

New Orders down, Prices Paid up… not a good sign…

Williamson does offer some hope:

“Policy initiatives such as the CHIPS and Science Act and IRA should start to help buoy production in the medium term as capacity in US manufacturing is expanded.

A shifting of the inventory cycle toward restocking should also be evident by the end of the year, given improvements in some survey metrics such as the orders-inventory ratio.”

The good news: New Orders/ Inventories rise again, highest since Feb 20922

The bad news: Inventories drop to 11 year low, and they can only rise from here. pic.twitter.com/XMxQ7Cn6f0

— zerohedge (@zerohedge) September 1, 2023

However, such rays of hope remain currently overshadowed by business confidence turning lower, which indicates that “producers anticipate some further near-term headwinds to any manufacturing revival.”

Tyler Durden

Fri, 09/01/2023 – 10:04

stagflation

policy

inflationary

deflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…