Economics

In Striking Reversal, Renters Finally Hit “Breaking Point” Forcing Landlords To Slash Prices

In Striking Reversal, Renters Finally Hit "Breaking Point" Forcing Landlords To Slash Prices

For much of the past year, as the housing market…

In Striking Reversal, Renters Finally Hit “Breaking Point” Forcing Landlords To Slash Prices

For much of the past year, as the housing market cratered, potential middle-class homebuyers who found themselves locked out of buying a house due to the explosive surge in mortgage rates, had no choice but to continue renting in the process pushing asking rents even higher as the housing market tanked. But with US consumers increasingly stretched well beyond their breaking point in a world where the price of everything continues to soar, making rent itself an unaffordable luxury for many, the rental juggernaut has finally come to a sudden halt, and according to Bloomberg, “after a record surge in housing costs and ballooning expenses for everything from food to energy, America’s renters have had enough.”

In what may be the best news for renters – and bulls desperate for a Fed pivot – rent gains are finally starting to slow in many parts of the US, cooling a years-long boom that sapped affordability from coast to coast. That’s because with demand from tenants is suddenly sinking, landlords have little choice but to ease off big increases.

It’s a dramatic reversal from the situation we described just months ago, when people were fighting over a limited supply of apartments, getting on waiting lists or paying multiple application fees to land one home. Now, particularly in pandemic boom markets such as Las Vegas and Phoenix, the application piles have thinned out and listings are lingering longer. And in the latest attempt to crush the US economy by an unknown elite, the measures of US household formation have even turned negative.

But wait, you may say: it’s not like housing is a discretionary choice – after all, everyone has to live somewhere, right? Well yes… and unlike recent years, young people who otherwise might be striking out on their own are instead staying with the parents or, like 18-year-old Coleby Hillenbrand, cramming into tiny apartments with multiple roommates…. and we aren’t talking Manhattan.

“I was able to round people up and make rent affordable,” said Hillenbrand, who lives with his girlfriend and another couple in a tiny two-bedroom outside of Kansas City. “People our age aren’t making enough money to afford rent on their own.”

To be sure, this is one crisis that is good news for most Americans, because in a US housing market that recently hit the most unaffordable level in history as mortgage rates rise for homebuyers, any sign of a rental cool-off is welcome news. Then again, it’s bad news when one consider how it emerged: as Bloomberg notes, it’s the product of economic turmoil as people struggle with soaring costs of goods and services and wages that aren’t keeping up. With a recession looming, the safe move is to stay put. For the Federal Reserve, aggressively raising interest rates to curb inflation, an easing of one of its key measures would be a positive sign.

The plunge in rents is especially good news for markets: “Rents have had a historic run-up, way beyond what fundamentals would justify,” said Susan Wachter, a real estate professor at the University of Pennsylvania’s Wharton School. “The Fed will not ease up until inflation abates, which requires rents to slow, the sooner the better and the harder the better, for quick relief.”

As we observed recently, rents nationally increased 7.5% in September from a year earlier, above pre-pandemic levels, but down from a peak jump of nearly 18% at the start of the year, when vacancies also were lower, according to Apartment List. More importantly, on a sequential basis, rents had their first drop in over two years. Preliminary October data show a dropoff that’s faster than the typical seasonal decline and would be the steepest in month-over-month data dating back to 2017, said Igor Popov, the listing platform’s chief economist.

Of course, due to the significant lag, the sharp slowdown has yet to show up in the consumer price index that’s closely watched by the Fed, about a third of which is tied to the cost of shelter. That measure of rents rose at a record annual pace last month, but as we discussed in “With Krugman Humiliated, This Is What Goldman Thinks True Rent Inflation Is” it will be slow to reflect more recent shifts because the index tracks what renters are paying as well as the costs homeowners would incur if they had to rent back their homes (i.e. Owner-Equivalent Rent), rather than new leases that are more apt to change. As we have been saying since last summer, these indicators lag the actual market. It might be six or nine months before the more recent slowdown is reflected in the CPI, said Mark Zandi, chief economist for Moody’s Analytics. Of course by then the US economy will be smouldering rubble if the Fed keeps hiking at its current 75bps/month clip.

And while prices may be finally sliding, renters are feeling the strain of inflation now. Unlike homeowners who can fix mortgages for 30 years, they can – and usually will – face rent increases every year, or sooner if they’re on a month-to-month lease. And they’re more likely to have less stable jobs and incomes.

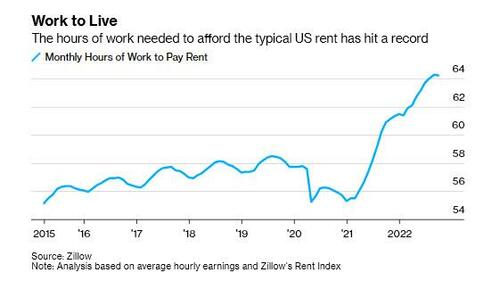

The average American had to put in more than 64 hours of work in September to pay the typical monthly rent, according to an analysis by Zillow. That’s just a hair below the August level, which was the highest in data going back to 2015.

“Rent became unaffordable for people in lots of markets,” said Jeff Tucker, a senior economist at Zillow. “We shouldn’t be surprised that fewer people will go out and sign a lease. Throw on other inflationary challenges and that’s going to shrink rental demand.”

The demand slowdown has been most acute in metropolitan areas such as Phoenix, Atlanta and Las Vegas, where rent growth was especially dramatic in recent years, said Jay Parsons, chief economist for RealPage, a rental-data tracker.

Meanwhile, in a demographic double whammy, household formation is freezing up – as young Americans put marriage and having children on hold during the coming crisis – sending apartment demand negative for the first time for any third quarter in at least 30 years, according to RealPage data dating back to 1992. And while tenants are leaving rentals at normal rates (and going back to live in their parents basement or splitting apartments with friends), the problem for landlords is that a lot fewer are moving in.

Take Rachel McIntyre Smith, a multimedia coordinator in Chattanooga, Tennessee, who moved back in with her parents on her 25th birthday in July. She loved the freedom of living alone until her landlord jacked up the monthly rent on her $1,100 one-bedroom by another $200, swallowing half her salary with utilities factored in.

“The last few months I was constantly thinking about how I was going to shrink my grocery bill or gas budget,” Smith said. “Now I can sleep better.”

As noted at the top, while the slump in the for-sale market has helped landlords because sidelined homebuyers would need to live somewhere, even that tipping point has been reached as rents shot up so high across key metro areas that many are now looking for cheaper alternatives instead, like living with family, according to Apartment List’s Popov. And frustrated homesellers are listing houses for rent instead, increasing supply.

As Bloomberg notes, the slowdown is so widespread that rents have fallen month-over-month in 69 of the top 100 US cities in September; still, the rates of change vary widely by geography, and many markets are still quite heated. Rents in the New York, San Diego, Miami and Orlando, Florida, areas, all jumped by at least 12% last month from a year earlier, according to Apartment List data, still gangbusters relative to pre-Covid levels.

And while it’s normal for rents to dip in the months leading into the winter holidays, if demand doesn’t return by next spring, problems for landlords will worsen, Popov said. There’s a near-record amount of newly-built apartments under construction and heading for completion, adding to the rental inventory.

“The question is where is the economy in March, April, May, when people are normally out looking for apartments?” Popov said. Well, we have an answer… and Popov won’t like it.

The good news for those who can afford to rent still is that it is now a buyer’s, er renter’s market: Cynthia Woodward says she’s juggling more vacant homes than any time in her 11 years as a Las Vegas property manager. Normally, out of the 130 homes she manages, a few will be empty. But now she’s got a dozen, including one that was broken into in the dark of night, the thieves leaving with a new washer, dryer and refrigerator.

“Lately activity is ice cold,” Woodward said. “Where are the people?”

Well, when the people are spending all their money on food and gas housing has become an unattainable luxury.

Tyler Durden

Tue, 10/25/2022 – 17:45

inflation

markets

reserve

interest rates

fed

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…