Economics

IMF Report: “The Global Economy Is Limping”, GDP Growth “Below Historical Average”

In the latest report unveiled by the International Monetary Fund (IMF), the global economy is bracing itself for a slower

The post IMF Report: “The Global…

In the latest report unveiled by the International Monetary Fund (IMF), the global economy is bracing itself for a slower growth rate in 2023 compared to the preceding year. The IMF’s projections indicate a GDP growth of 3% for 2023, down from the 3.5% witnessed in the previous year, a figure significantly below historical averages.

“The global economy is limping along, not sprinting,” Pierre-Olivier Gourinchas, Economic Counsellor and the Director of Research of the IMF, wrote in an article about the report.

This moderation in growth can be attributed to a combination of factors, including the persistent repercussions of the COVID-19 pandemic, Russia’s ongoing conflict in Ukraine, and monetary policy adjustments aimed at reining in inflation. Additionally, a decrease in fiscal support amid high debt levels and the impact of extreme weather events have all contributed to this subdued economic outlook.

Looking ahead to 2024, the IMF’s forecast slightly downgrades global GDP growth to 2.9%, marking a 0.1% adjustment from their previous projection in July.

In terms of inflation, the IMF anticipates a deceleration in global headline inflation, with a projected rate of 5.9% for the current year on a year-over-year basis, followed by a further decline to 4.8% in 2024, a significant drop from the 9.2% observed in 2022. Core inflation, which excludes food and energy prices, is also expected to gradually decrease, reaching 4.5% in the following year. The report suggests that most countries are unlikely to reach their target inflation rates until 2025, raising concerns about the enduring nature of tight monetary policies and their potential impact on elevated interest rates and economic slowdown.

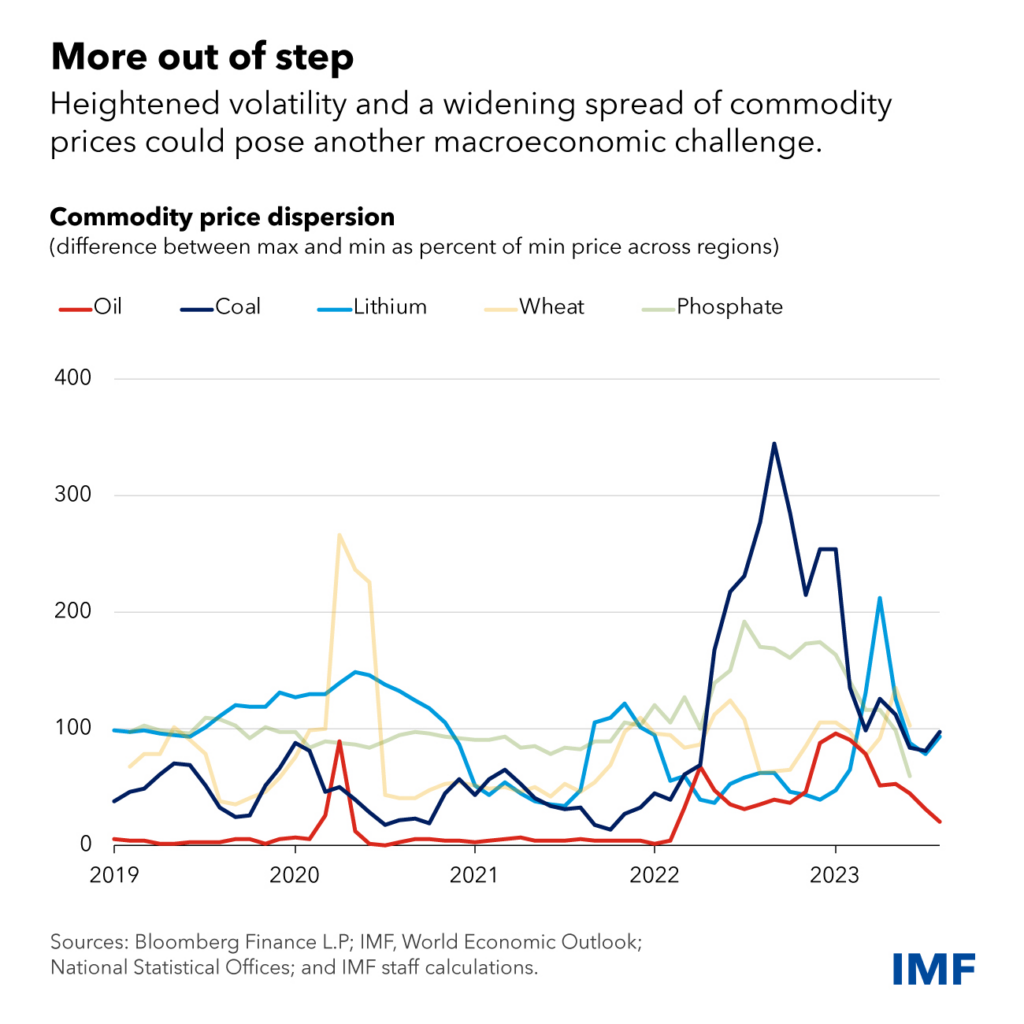

The report also underscores the growing volatility in commodity prices due to climate-related and geopolitical shocks, which poses a substantial risk to efforts to combat inflation. Elevated food prices could further exacerbate the situation, particularly if the conflict in Ukraine escalates.

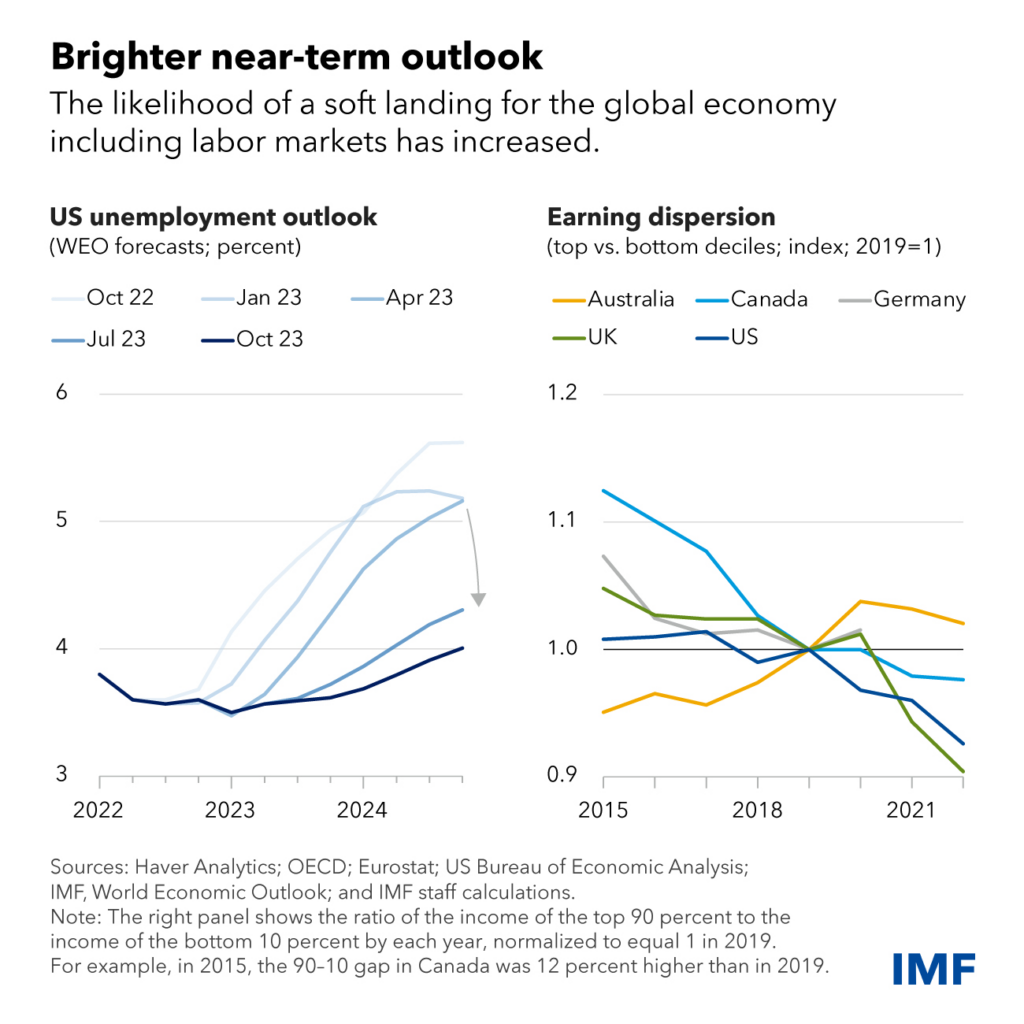

The economic slowdown is more pronounced in advanced economies, with the United States experiencing a relatively bright outlook for 2023, driven by strong domestic consumption and investment activity. However, the IMF’s forecast for U.S. GDP growth in 2024 is a more modest 1.5%, indicating a shift in momentum.

In contrast, the euro area faces a weaker recovery, primarily due to its greater exposure to the Ukraine conflict. The IMF projects an economic output growth of 0.7% in 2023, followed by a moderately stronger 1.2% in 2024.

While many emerging market economies display resilience, China stands as a notable exception. The pandemic-related slowdown and the crisis in the property sector have significantly impacted China’s economic output. The IMF expects China’s economy to expand by 5% in 2023 and 4.2% in 2024.

Despite these challenges, the services sector, buoyed by strong demand, has largely recovered from the pandemic’s impact, providing a brighter outlook for economies reliant on this industry. In advanced economies, labor markets remain robust, with historically low unemployment rates supporting economic activity. However, tighter credit conditions are affecting investments and the housing market, and some economies are witnessing an increase in firm bankruptcies, albeit from historically low levels.

One of the IMF’s primary concerns centers around the Chinese economy, with diminished consumer confidence and low levels of investment posing significant risks to the global economy. The potential intensification of a real estate crisis is a major red flag, prompting the IMF to emphasize the importance of promptly restructuring struggling property developers to preserve financial stability. The IMF recommends a shift away from credit-dependent growth in the real estate sector as a key step for China’s economic sustainability.

In terms of policy recommendations, the IMF emphasizes the necessity of maintaining tight monetary conditions in the absence of inflation targets. Subsequently, a gradual reduction in key interest rates could stimulate economic expansion. Fiscal policy adjustments, including the removal of energy subsidies and the rebuilding of buffers, are also recommended.

Furthermore, the report underscores the significance of the green transition, advocating that a substantial portion of the required climate investments be covered by the private sector, particularly in emerging markets and developing economies. The IMF highlights that major banks and insurance companies have yet to align their policies with net-zero emission targets.

Simultaneously, there is growing concern that commodity prices may experience heightened volatility due to the impact of climate-related and geopolitical shocks, posing a significant threat to efforts aimed at achieving disinflation. Notably, between June and late September, the oil market saw a surge of approximately 25% in prices, driven by extended supply cuts orchestrated by OPEC Plus, the coalition comprising the Organization of the Petroleum Exporting Countries and select non-member nations. However, this surge was subsequently followed by an 11% decline.

Meanwhile, food prices have remained elevated, and the potential escalation of the conflict in Ukraine looms as a disruptive factor that could exacerbate difficulties for numerous low-income countries. Moreover, geoeconomic fragmentation has contributed to a substantial increase in the divergence of commodity prices across various regions, including those of critical minerals.

Finally, the report emphasizes the need to safeguard the flow of critical minerals and agricultural commodities, creating “green corridors” to reduce volatility and expedite the transition to a greener economy.

Information for this briefing was found via IMF, EuroNews, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

The post IMF Report: “The Global Economy Is Limping”, GDP Growth “Below Historical Average” appeared first on the deep dive.

inflation

commodities

commodity

monetary

markets

policy

interest rates

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…