Economics

IMF Draws Up Nightmare Scenario Of Housing Crisis

IMF Draws Up Nightmare Scenario Of Housing Crisis

By Ye Xie, Bloomberg Markets reporter and analyst

China’s housing market has a reputation…

IMF Draws Up Nightmare Scenario Of Housing Crisis

By Ye Xie, Bloomberg Markets reporter and analyst

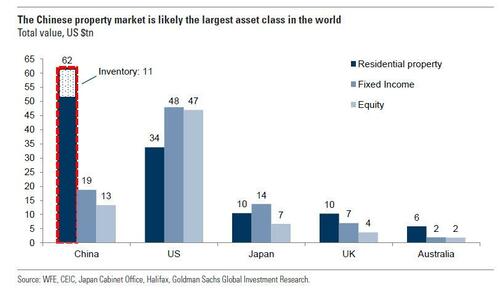

China’s housing market has a reputation as the most-important sector in the universe (in late 2021, Goldman estimated it as the world’s largest asset class at over $60 trillion)

So its continued slump naturally raises concerns among officials, even those beyond China’s borders. The International Monetary Fund, for instance, this week painted a bleak picture of how China’s housing slump may morph into a banking crisis. In one scenario, 15% of small banks may go under.

Such a scenario remains a left-tail risk, but it underscores what’s at stake as President Xi Jinping attempts to keep the economy afloat.

Recent lending data showed that long-term household loan demand, a proxy for home mortgages, remains fairly weak, even as broad credit growth shows signs of improvement. In the debt market, the struggles of a Chinese developer that until recently was able to access state-backed funding shows there’s no light at the end of the tunnel of the crisis.

In its global financial-stability report, the IMF devoted one section to a discussion of China’s housing woes. The underlying problem is well-documented. Declining home sales and a lack of access to financing are worsening the credit crunch among developers. That reduces their ability to complete the construction of apartments. The stalled projects lead home buyers to boycott mortgage payments, which puts pressure on banks, which causes them to turn more cautious in lending to the sector.

In such a vicious cycle, many developers are on the brink of collapsing. The IMF’s analysis showed that 45% of developers might not be able to cover their debt obligations with earnings, and 20% of them could become insolvent if their inventory value is marked to current property prices.

It’s small wonder, then, why about 70% of offshore bonds of developers trade at 40 cents on the dollar or less, suggesting that debt restructuring may be inevitable for a large share of the sector.

More importantly, property developers’ failures could spill over into the banking sector, particularly small banks. If 10% of banks’ exposure to distressed developers and 10% of the mortgages related to unfinished homes become non-performing loans, the IMF estimates that 15% of the banks in its study, which represents 10% of China’s total banking assets, would fail to meet minimum capital requirements and require bailouts. (The 15% estimate is close to what other economists are saying.)

The chain reaction doesn’t end here. Constrained by falling revenue from land sales, local governments have limited resources to support the real-estate sector. If so, “there could be adverse spillovers to the broader corporate sector, where vulnerabilities are already high,” the IMF warned.

As a watchdog, the IMF’s job is to be the Cassandra who sounds the alarm. Understanding the risk, Beijing has already stepped up its support for the market. But so far, there are few signs of a meaningful turnaround in the market, with consumer confidence stuck at rock bottom. The longer the crisis drags on, the more likely the nightmare scenario becomes a reality.

Tyler Durden

Wed, 10/12/2022 – 19:25

dollar

monetary

markets

bailouts

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…