Economics

Hutchins Roundup: Remote work, construction productivity, and more

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want…

By Elijah Asdourian, James Lee, Nasiha Salwati, David Wessel

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Saved commute time provides substantial benefits to those working from home

In a survey of workers and employers across 27 countries, Cevat Giray Aksoy of King’s College London and co-authors find that workers saved an average of two hours of commute time per week in 2021 and 2022. These savings were concentrated among people who had the option to work from home, who saved an average of 72 minutes per day. Workers reallocated 40% of their saved time to working, 34% to leisure, and 11% to caregiving activities. In the United States, the highly educated saved the most commute time, though they also had the longest commutes to start with. Employers reported that work from home will be cut in half when the COVID-19 pandemic ends, bringing the average saved commute time down to one hour per worker. Still, the authors estimate that even this amount of time saved will be worth 2.2% of after-tax earnings for the average American worker.

Measurement error does not fully account for the slowdown in construction productivity

Austan Goolsbee and Chad Syverson of the University of Chicago find that several measures of productivity in the U.S. construction sector have declined over the 1970-2020 period, challenging the view that the recorded productivity declines have been solely due to measurement error. Using physical measures of residential construction activity such as housing units per worker, the authors find that productivity in the residential construction industry has been stagnant in recent decades. Real output in the construction sector has not kept up with its use of intermediate goods, suggesting a decline in the sector’s ability to transform intermediates into finished products. The authors also find that U.S. states with more productive construction sectors do not experience growth in their share of total construction activity, suggesting that misallocation (where inputs do not flow from low-productivity to high-productivity places) may be further contributing to the slowdown in aggregate productivity.

Fiscal support led to inflation

Fiscal support during the early stages of the pandemic led to inflation, according to Galina Hale of the University of California, Santa Cruz, John Leer of Morning Consult, and Fernanda Nechio of the Federal Reserve Bank of San Francisco. Using data from 10 different advanced and emerging economies, the authors show that a fiscal support package totaling 10% of GDP increased inflation by 40 basis points 3 months after announcement. This effect rose to 60 basis points if consumer sentiment was rising at the time. Fiscal support measures to consumers had inflationary effects while those to firms did not, the authors report. The authors’ results do not explain the high levels of inflation occurring from mid-2021 onwards, as fiscal support announcements took place when economies were largely shut down.

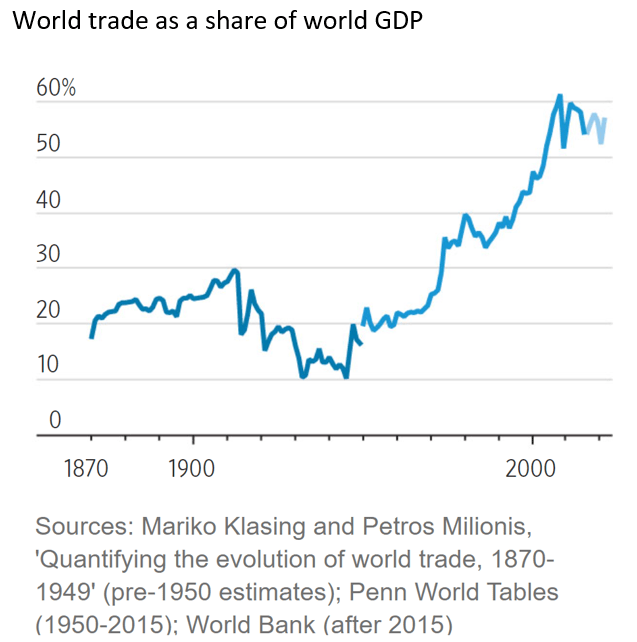

Chart of the week: Global trade no longer rising as a share of overall economic activity

Chart courtesy of the Wall Street Journal

Quote of the week:

“[M]y own view is that we’re going to have to get the funds rate above 5% in order to get inflation, really on a sustained downward path to 2%. 2%, of course, is our long-run goal … That doesn’t mean we have to keep increasing interest rates until inflation reaches 2%. Because we have to realize that our policy actions do affect the economy with some lag. But we’re just at the start of a restrictive policy stance and I think we need to be higher than current levels in terms of the funds rate,” says Loretta Mester, President of the Cleveland Fed.

“I do take encouragement for the fact that we’re starting to see policy actions affect demand, right, because — what we’re trying to do is we’re trying to set our monetary policy to get demand into better alignment with supply. We know that both in product markets and labor markets demand has been well above supply. We’re starting to see that, we’re starting to see some slowing, especially in the mortgage market, the housing market, because of higher mortgage rates. We’re seeing it in some manufacturing conditions are easing off. We still have some ways to go. And that’s why I think we’ve made a lot of progress on the funds rate. I do believe we need to keep going a little bit more to get to a sufficiently restrictive stance so that we can get that inflation really sustaining — on a sustainable path to 2%. But at least we see now that policy is having the intended effect.”

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

inflation

monetary

markets

reserve

policy

interest rates

fed

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…