Economics

Hutchins Roundup: Loose monetary policy, unemployment insurance, and more

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want…

By Elijah Asdourian, James Lee, Nasiha Salwati, Louise Sheiner

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Accommodative monetary policy breeds financial instability

Loose monetary policy increases the risk of financial crises, find Maximilian Grimm of the University of Bonn and co-authors. More specifically, if monetary policy is 1 percentage point below the natural rate of interest (the rate expected to prevail at full employment and price stability) for five years, then the probability of a financial crisis rises by 5.5 percentage points 5-7 years later and 15.5 percentage points 7-9 years later. When monetary policy is too accommodative, credit and asset prices grow too quickly, creating financial instability. Potential short-term economic gains come at the risk of heightened financial disasters and low economic growth, a tradeoff policymakers should keep in mind, the authors conclude.

Generous unemployment insurance raises fertility rates during economic downturns

Birth rates and infant health usually decline during recessions. Using data on births, infant health outcomes, and unemployment insurance (UI) from 2000 to 2019, Lisa Dettling of the Federal Reserve Board and Melissa Kearney of the University of Maryland find that these declines are the results of liquidity constraints, not increased unemployment per se. “When UI provides 100 percent replacement,” the authors write, “unemployment rates exert essentially no effect on births.” They find similarly that recessions’ negative effects on infant health disappear when liquidity-constrained mothers receive generous UI. These findings help explain trends in fertility rates during the COVID-19 pandemic, which declined as unemployment increased but rebounded before the labor market recovered. UI replacement rates were above 100% during the early months of the COVID-19 pandemic, removing the liquidity constraints that would have otherwise kept birth rates low while unemployment remained elevated.

Changes in monetary policy rates influence firms’ price expectations

Using business surveys taken directly before and after meetings of the U.K.’s Monetary Policy Committee, Federico Di Pace of the Bank of England, Giacomo Mangiante of the University of Lausanne, and Riccardo Masolo of the Catholic University of the Sacred Heart find that firms’ price expectations do not change in response to monetary policy surprises, as measured by how much financial markets respond to the announcement. However, firms do adjust expectations in response to changes in the monetary policy rate, regardless of whether that change was anticipated by markets. Interest rate changes tend to receive more public attention and media coverage than policy surprises and are thus more likely to inform firm expectations. “Firms do not respond to monetary announcements the same way financial markets do,” the authors conclude.

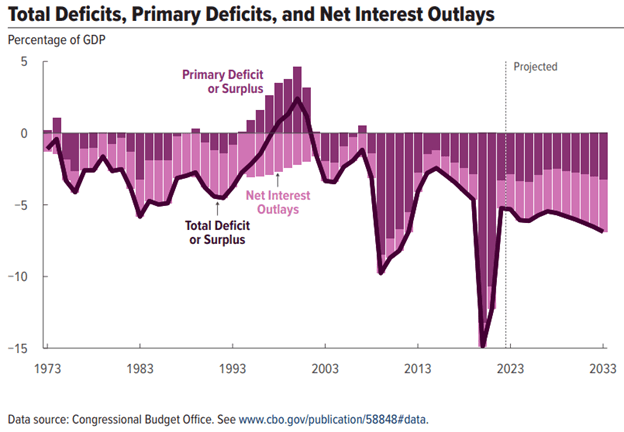

Chart of the week: Deficit projected to grow in the coming decade as interest outlays climb

Chart courtesy of Congressional Budget Office

Quote of the week:

“In moving forward with monetary policy, we need to manage two risks. The most important risk I see is that if we tighten too little, the economy will remain overheated and we will fail to keep inflation in check. That could trigger a self-fulfilling spiral of unanchored inflation expectations that would be very costly to stop … [C]entral banks aren’t sufficiently proactive in addressing high inflation, the road back to price stability is longer, the labor market is weaker, and the scars on the economy can last long after inflation is finally reduced. We must stay focused on bringing inflation back to target in a sustainable and timely way,” says Lorie Logan, President of the Dallas Fed.

“At the same time, if we tighten too much or too fast, we risk seeing the labor market weaken much more than is necessary to control inflation. Those job losses would be very costly, too, particularly for lower-income households. My own view is that, given the risks, we shouldn’t lock in on a peak interest rate or a precise path of rates. After raising rates at a historically rapid pace during 2022, the FOMC decided at our most recent meeting to increase rates by a more historically typical increment of a quarter percentage point. I anticipate we will need to continue gradually raising the fed funds rate until we see convincing evidence that inflation is on track to return to our 2% in a sustainable and timely way … I think we need to see the economy evolving more or less as forecasts predict. When inflation repeatedly comes in higher than the forecasts, as it did last year, or when the jobs report comes in with hundreds of thousands more jobs than anyone expected, as happened a couple weeks ago, it is hard to have confidence in any outlook.”

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

inflation

monetary

markets

reserve

policy

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…