Economics

Hutchins Roundup: Information technology investments, teleworking mothers, and more

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want…

By Elijah Asdourian, Alexander Conner, James Lee, Louise Sheiner

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

IT investments grow sales faster than employment and increase market concentration

Investment in information technology is associated with increases in firm size, employment, and sales, according to Erik Brynjolfsson and Wang Jin of Stanford and Xiupeng Wang of Boston University. A 1% increase in IT intensity, measured by the IT capital expenditure per worker, was associated with a 0.056% increase in firm employment the following year and a 0.1% increase in sales. Notably, IT investments allow a firm to increase revenue more than employment, consistent with the “scale without mass” theory of digitization. Further, they find that IT investments are likely to lead to an increase in firm size; a 1% increase in IT intensity is associated with a 0.03% increase in the number of establishments. IT investments are thus one of the main driving forces for the increase in firm size, decline of labor share, growth of superstar firms, and increased market concentration in recent years, they conclude.

Mothers most strongly value the option to work from home

Does work from home improve job satisfaction? Using data collected in Australia between 2019 and 2021, Inga Lass of the German Federal Institute for Population Research and Esperanza Vera-Toscano and Mark Wooden of the University of Melbourne find that women who could work from home reported significantly higher job satisfaction while men were indifferent between remote and in-person work. Women with children who worked at home between 60% and 80% of the time reported nearly one point higher job satisfaction on a 10-point scale, while women without children reported around a quarter-point increase. The authors hypothesize that workers who prefer remote work value the flexibility to handle both work and non-work commitments, and “that matters more to women given they continue to shoulder most of the responsibility for house and care work.”

Multinationals transmit credit shocks to overseas affiliates

Using data on the balance sheets of German multinational parent corporations and their affiliates, Marcus Biermann of Bielefeld University and Kilian Huber of the University of Chicago show how a large cut in lending by Commerzbank in 2008, Germany’s second-largest bank before the Global Financial Crisis, affected the companies’ overseas affiliates. They find that parent companies responded by drawing credit from overseas affiliates, rather than from other banks, while shielding domestic arms from the pain. As a result, parent firms with average reliance on Commerzbank saw overseas affiliate sales fall by 9% and the affiliates’ short-term asset holdings contract by 5% between 2008 and 2010. Affiliates recovered after 2011, especially those with access to developed credit markets to help offset the demands of their parents. The authors find that the transmission of Commerzbank’s lending cut through multinational corporations’ internal capital markets had a large negative effect on countries outside of Germany.

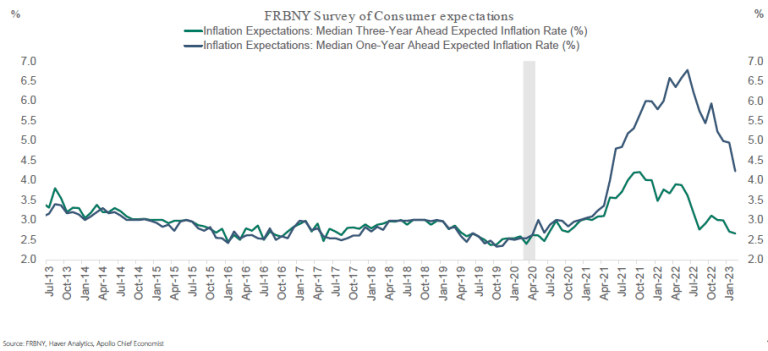

Chart of the week: Survey-based measures of inflation expectations are falling

Chart courtesy of Apollo Global Management

“[Silicon Valley Bank] failed because the bank’s management did not effectively manage its interest rate and liquidity risk, and the bank then suffered a devastating and unexpected run by its uninsured depositors in a period of less than 24 hours…. I am committed to ensuring that the Federal Reserve fully accounts for any supervisory or regulatory failings, and that we fully address what went wrong. Our first step is…to take an unflinching look at the supervision and regulation of SVB before its failure,” says Michael S. Barr, Vice Chair for Supervision at the Federal Reserve.

___

“[W]e should review the lessons of fiscal policy.… I see strong similarities in the genesis and development of [the savings-and-loan] debacle [and SVB’s failure]. Excessive fiscal stimulus from the Johnson and Nixon administrations baked inflation into the economy. The resulting mismatch of rising short-term liability costs and falling long-term asset values, which accelerated when the Fed began the necessary interest-rate rises to bring inflation under control, doomed the S&Ls. The SVB incident is isolated to a handful of banks, but it is fair to ask the regulators where we might see more pressure in the financial system from the inflation that mismanaged fiscal policy has engendered,” writes Randal Quarles, chairman of the Cynosure Group and former Vice Chair for Supervision at the Federal Reserve.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

inflation

monetary

markets

reserve

policy

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…