Economics

Hutchins Roundup: Climate risk exposure, inventor productivity, and more

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want…

By Elijah Asdourian, Nasiha Salwati, Lorae Stojanovic, David Wessel

What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Banks have been reducing climate risk exposure since 2015

Examining supervisory data on loan portfolios of the largest U.S. banks from 2009 to 2021, Ralf Meisenzahl of the Chicago Federal Reserve finds that banks have been reducing lending to areas prone to climate risks since 2015. Between 2014 to 2020, banks reduced the number of mortgages they held in higher-risk counties—those with a risk one standard deviation above the mean of coastal river flooding or wildfire—by between 6.3% and 11.5%. Banks reduced their climate exposure by cutting lending most sharply in counties where they already had high mortgage balances. Lending to borrowers with low credit scores was particularly attenuated. Commercial real estate and home equity lines of credit, both considered riskier loans, decreased in wildfire- and flood-prone areas. However, banks expanded lending to higher credit score borrowers in risky areas. Meisenzahl hypothesizes that banks concentrate on higher credit score borrowers in higher-risk areas because those borrowers are less likely to default following large losses from extreme weather events.

Inventors are less productive after joining large firms, slowing innovation in the US

Using data on the employment history of 760,000 inventors and patent approvals from 2000-2019, Ufuk Akcigit of the University of Chicago and Nathan Goldschlag of the Census Bureau find that large, incumbent firms are hiring a higher proportion of the inventors in the U.S. than they used to, and that those inventors are less productive when they work for large firms. The authors find that though inventors are paid 12% more when they join an incumbent firm and apply for roughly as many patents as inventors at young firms, their patents are cited with around half the frequency. Further, the authors find that the increasing concentration of inventors at incumbent firms accompanied an overall decline in entrepreneurial investors who found their own firms. Taken together, the findings suggest that the current distribution of investors in the U.S. may be restricting the pace of innovation.

Requiring out-of-state sellers to collect state sales taxes increased cross-border shopping

A 2018 U.S. Supreme Court ruling known as Wayfair allowed states to collect sales taxes on items purchased by its residents, often online, from out-of-state sellers. The ruling largely ended the practice of consumers buying online and avoiding sales taxes. Donald Bruce, William F. Fox, and Alannah M. Shute of the University of Tennessee find that the ruling may have incentivized Tennessee consumers to cross state lines to shop in neighboring North Carolina where sales tax rates are nearly 3 percentage points lower. Using county-level data, the authors find that the ruling lowered sales tax revenue growth in counties Tennessee shares a border with North Carolina, and, in turn, boosted sales tax revenue growth in those North Carolina counties. Before the 2018 ruling, businesses had an incentive to locate in states with no sales tax since they weren’t required to collect taxes from consumers in other states unless they had a physical presence in that state. After the ruling, the authors find, states with higher sales tax rates saw faster growth in business applications than other states because there were fewer incentives to locate in low-tax jurisdictions.

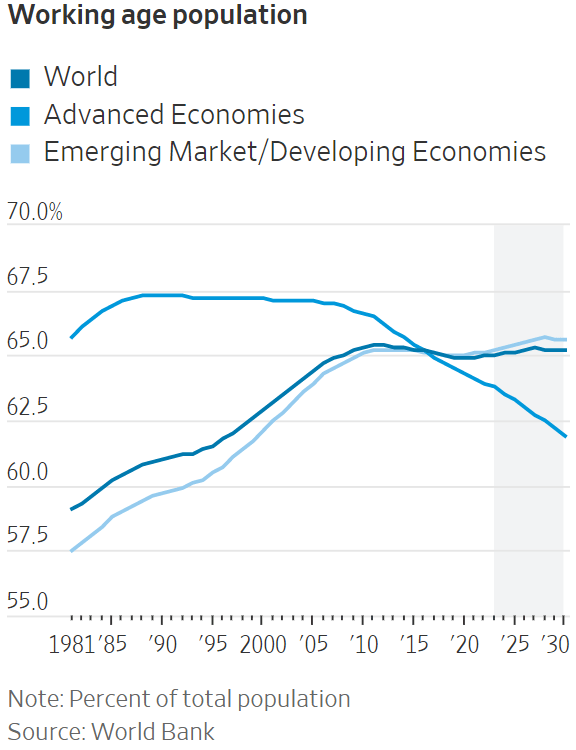

Chart of the week: Working age population projected to continue declining across advanced economies

Chart courtesy of the Wall Street Journal

Quote of the week:

“I think the scale and diversity of our challenges — the pandemic, climate change, conflict, fragility, and basically everything to do with inequality — is all part of what we set out to do when we talked about reducing poverty and sharing prosperity. But guess what? These things are intertwined, and they threaten our collective condition. So, we’ve seen decades of very hard work and progress getting turned back in a very short period of time … The lack of access to good schools, decent healthcare, and reliable infrastructure, not just physical but also very importantly digital infrastructure, locks entire communities in a cycle of poverty. The aspirations of people around the world are universal; they want jobs and a quality of life. But, we live in a world of greater polarization and extremes,” says Ajay Banga, candidate for President of the World Bank Group.

“Countries are facing diverse sets of challenges and experiencing them differently, and that’s the landscape in which the World Bank is operating. It has to pursue both climate adaptation and mitigation, reach out to lower-income countries, and not turn its back on middle-income countries. It has to think globally but recognize national and regional needs. That task is great. We have an abundance of challenges and a scarcity of time. We have to, in the case of climate change, halve emissions by 2030 (that’s just seven years away), and reach net-zero by 2050. Fortunately, the World Bank was designed to do hard things. Born of war, forged as an institution of peace, the World Bank has a proven capacity to rise and meet great challenges.”

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…