Economics

Huge Boomer Assets Should Fuel More Market Growth

For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary: With all eyes focused on … Read m…

For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

With all eyes focused on the Fed’s interest rate decisions and M2 mopping-up operations (cutting M2 money supply by about $1 trillion), most pundits ignore our bloated Baby Boomer population bomb now in transition from The Great Society into their Golden Years on the long Glide Path to the Great Beyond.

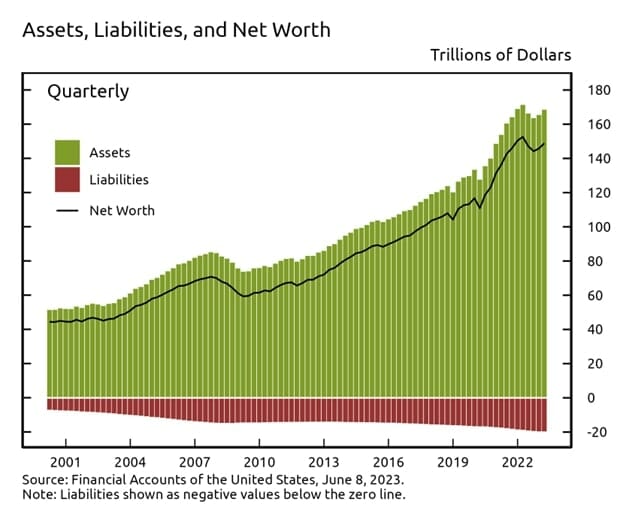

We keep hearing about those “mountains of debt” growing higher, but how often do we hear about the 90% of that iceberg that lies beneath the surface, the unseen wealth supporting that debt. “Net worth” is what those two words imply – the net value of one’s estate after accounting for all debts. That figure is now over $150 trillion (about $450,000 per person), according to the Fed’s accounting. In this chart, the debt line on the bottom is growing, but the green giant is growing faster, and few pundits talk about it.

If you want to focus on a single generation that won the asset lottery, it’s the campus protestors that began invading the planet the year after I was born (1945), called the Baby Boomers. I’m the last of the “Silent Generation,” although I refuse to be silent about the silliness of that name for my generational cohort.

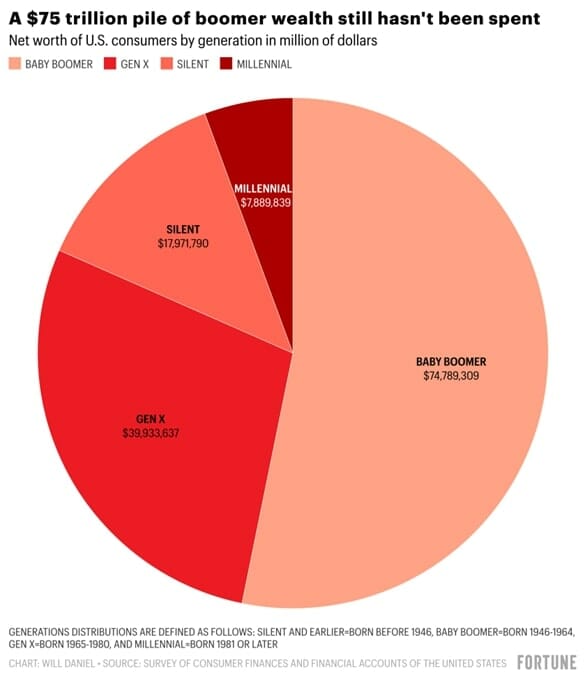

Here’s the breakdown of the birth ranges and the generational wealth and cash we all now control:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Note that Baby Boomers control over half the nation’s wealth, including over half of all cash in Money Market Funds. Not bad for those who once lectured about the evils of capitalism. Time to shop, Boomers!

Born 1946 to 1964, Baby Boomers are now 59 to 77. How did they pull this caper off? I’d call it good luck in a three-part trifecta of good timing involving a stock boom, wage inflation, and a peace dividend:

1: Stock market savings

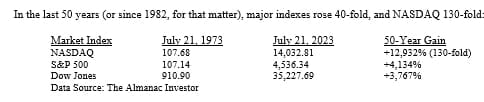

Baby Boomers entered the work force about the time stocks took off, so they rode the greatest bull market of the century. Near the stock market’s nadir in the mid-1970s, three seeds of future gains were sown: (1) the birth of super-charged NASDAQ stocks in 1971; (2) ERISA in 1974 gave birth to self-directed 401(k) pension plans; and (3) discount brokers were born May 1, 1975, allowing low commissions and self-directed accounts, allowing us all to control our own investing fate.

In the last 50 years (or since 1982, for that matter), major indexes rose 40-fold, and NASDAQ 130-fold:

2: Wages rose

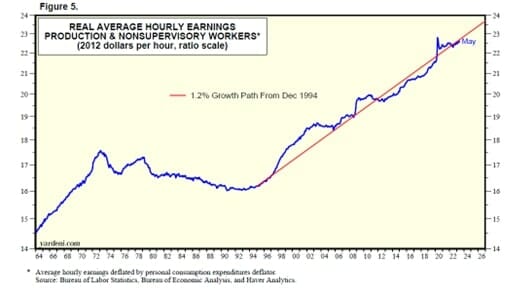

First through inflation, then through business expansion. In their youth, many Baby Boomers were campus radicals who didn’t trust anyone over 30, storming the Bastille of the capitalist system. Sure enough, they suffered through their parents’ Keynesian follies run amok in the 1960s and the stagflationary 1970s, but then we all started climbing the wage ladder, as real wages soared in the ‘90s:

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

3: Good Geopolitical Timing:

The Green Revolution, the end of the Cold War, and the Tech Boom delivered a Peace Dividend, so the Baby Boomers became Stock Market Lottery Winners, garnering something like $75 trillion in assets to play around with in their final years, and $9 trillion in ready cash assets to throw into the stock market, or Las Vegas slots, or into grandchildren’s Christmas stockings.

In the bad news media, all we hear about is the shortage of M2 in the Fed’s tightening cycle, but M2 is still $1 trillion above its pre-pandemic trendline, and demand deposits (mostly checking accounts) are $2 trillion above the pre-pandemic trendline. The sum total of all bank deposits plus money market mutual funds (MMMF) hit a record $22.8 trillion in 2022 and is still $2 trillion above its pre-pandemic trendline, and Baby Boomers hold $2.5 trillion more than they did at the end of 2019, before the pandemic struck. (Corporations also have a boatload of cash. Corporate cash flow hit a record high at the end of 2022.)

Those still working also have a lot more disposable cash, and – as Ed Yardni likes to say – “Consumers are still doing what they do best.” They shop! He says that those who doubt Consumer Power should observe that “both inflation-adjusted wages and total disposable income have been rising again in recent months after mostly stagnating during 2021 and 2022. Real average hourly earnings rose 1.5% over the past 11 months through May.”

He adds that, “Consumers also have other sources of record unearned income including (during May, at a seasonally adjusted annual rate): proprietor’s income ($1.9 trillion), interest income ($1.8 trillion), dividend income ($1.7 trillion), Social Security benefits ($1.4 trillion), and rental income ($0.9 trillion). May’s total was $7.7 trillion, equivalent to 65% of wages and salaries.”

Yardeni also opines that “American consumers spend money when they are happy and spend even more money when they are depressed,” something akin to alcoholics who either celebrate or drink in sorrow.“They’ve been going shopping to release some dopamine in their brains to make themselves feel better.”

No Recession (or Market Crash) is Likely with Record-High Cash on the Sidelines

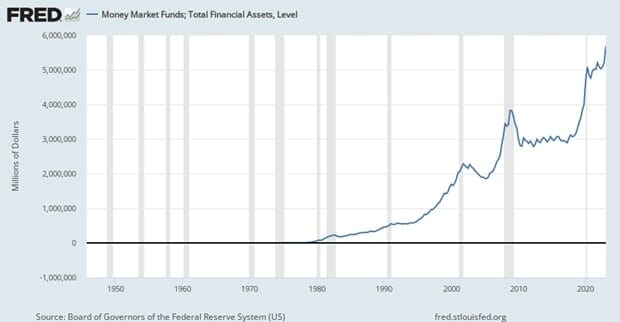

The payoff for investors is that there is little likelihood of a market crash – or a steep correction – with such a record amount of cash on the sidelines, including a record $5.7 trillion in Money Market Funds.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

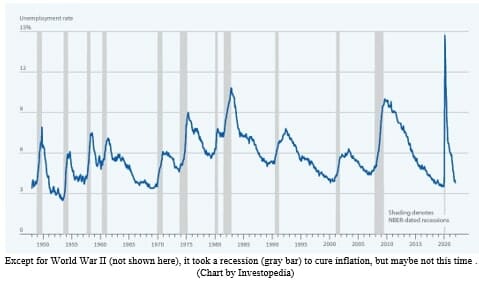

With consumers purchasing goods and services, to get that dopamine fix, a holiday season approaching, and with investors rushing back into stocks for Fear of Missing Out (FOMO), there is little likelihood of a necessary recession (“hard landing”) to cure inflation. Ed Yardeni calls this “The Case for Immaculate Disinflation,” that inflation will be slowly cured by Fed policies returning to normal with no necessity of some moonshot to 6% or higher on the Fed Funds rate to fight phantom “permanently high” inflation, the same way they mistakenly ignored the early inflation onset for a full year, falsely calling it “transitory.”

It turns out that the Consumer Price Index was indeed “transitory,” but only after the Fed acted to treat the disease with respect instead of ignoring it. Once they raised rates and cut off QE, inflation peaked (in June 2022) almost immediately and began falling. The Fed waited far too long to act, but they finally wised up.

Economic historians say the only way to bring down high inflation is with a recession. In the last century, the only exception was in the 1940s, during and after World War II. Well, streaks are made to be broken.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This could be the only time since World War II when inflation will be cured without a recession, since the pandemic was also a unique historical outlier, just like World War II was. The pandemic recession was an entirely man-made creation, through lockdowns – and so was the “helicopter money” inflation that came during the lockdown year (2020) and the Biden series of benefits, checks, and high-spending bills in 2021. The Fed was in charge of the morning-after hangover pill. It hurt for a while, but the medicine is working.

Now that our heads are presumably clearer, we are left with hefty personal bank and brokerage accounts. This should prevent the onset of that once-thought-certain recession or the much-anticipated market crash.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…