Economics

How Long And How Far Will The Fed Lift Interest Rates?

The answer, of course, depends on how soon inflation shows convincing signs of behaving. There are hints that we’re now in the early phase of post-peak…

The answer, of course, depends on how soon inflation shows convincing signs of behaving. There are hints that we’re now in the early phase of post-peak inflation. Today’s update on consumer price inflation for November will be a reality check, which in turn will factor into the Federal Reserve’s monetary policy decision at tomorrow’s FOMC meeting announcement. Meantime, markets are cautiously optimistic that inflation has peaked, but the outlook beyond this binary view remains murky at best.

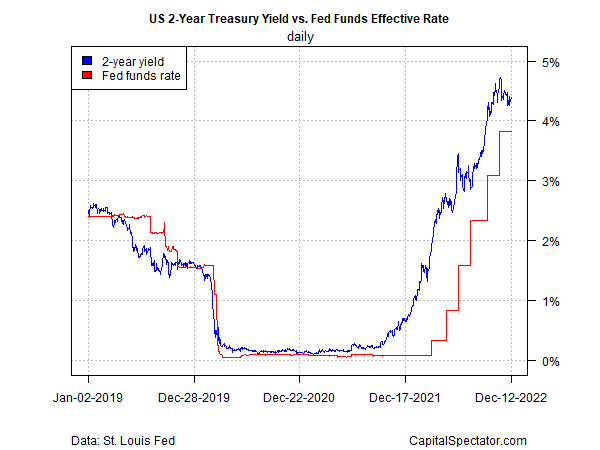

The policy-sensitive 2-year Treasury yield, which is widely used as a proxy for the Fed funds target rate outlook, continues to hold in a trading range of roughly 4.0% to 4.5%. This appears to be the peak range for the cycle and it’s reasonable to assume that only a surprisingly hot run of inflation data in the months ahead will push this yield to new highs.

Meantime, the 2-year/Fed funds-target-rate spread remains close to the lowest level of the year. As the chart below suggests, the market has continues to price in elevated odds that the rate-hiking cycle has turned/is turning in the sense that we’ve seen the biggest rate hikes and the central bank is now decelerating policy tightening.

Fed funds futures agree. Tomorrow’s policy announcement is pricing in a 70%-plus probability for a 50-basis-points rate hike, the first softer increase since the central bank began a run of lifting rates by 75-basis-points in March.

The debate is now focused on how the Fed should slow and then pause its rate hikes. “The easy lifting is done,” says Vincent Reinhart, chief economist at Dreyfus and Mellon and a former senior Fed economist.

The decision to raise rates this year has been a monetary no-brainer so far. When the Fed began hiking in March, it’s policy rate target was 0%-to-0.25% and core PCE inflation – the Fed’s preferred measure of pricing pressure – was rising more than 5% year over year–a huge gap. Assuming the Fed hikes its target rate by 50-basis-points tomorrow to a 4.25%-4.50% range, that will be modestly below November’s core-PCE annual increase of 5.0% through October.

In a word, progress. But the path ahead is less clear from here on out. Much depends on how the Fed defines clear signs that inflation has peaked and, more importantly, is showing signs of easing. The challenge is that clear guidance on such numbers is unavailable and the central bank is arguably making it up as a goes along.

“You still need to tread carefully here,” observes Callie Cox, US investment analyst at eToro, an investment firm. “Powell has been clear that rates could stay high for some time. Furthermore, while the Fed’s flexibility is encouraging, a high-rate environment is not the easiest to invest in. So we could be in for a tougher slog to the highs until inflation comes down significantly, and a recession is not out of the question.”

The key variables that will determine what happens next are obvious: inflation, economic activity and the market’s pricing of interest rates. The uncertainty is how the feedback loop for these variables evolves. The best guesstimate is that we’ve seen the highs of inflation, rate hikes will decelerate and then pause, and economic growth will slow, perhaps to the point of a mild and brief recession but nothing deeper. Surprises on any one of these fronts could change the calculus, perhaps dramatically, and so the crowd waits to see if and when the butterfly flaps its wings.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

inflation

monetary

markets

reserve

policy

interest rates

fed

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…