Economics

How Do Interest Rates (and Depositors) Impact Measures of Bank Value?

The rapid rise in interest rates across the yield curve has increased the broader public’s interest in the exposure embedded in bank balance sheets and…

The rapid rise in interest rates across the yield curve has increased the broader public’s interest in the exposure embedded in bank balance sheets and in depositor behavior more generally. In this post, we consider a simple illustration of the potential impact of higher interest rates on measures of bank franchise value.

Measuring Bank Value

Given a set of assets, like securities and loans, and liabilities, such as deposits, one can project interest income and interest expense associated with both sides of the balance sheet, discount them to the present, and take the difference. The result is the present value (PV) of an equity interest in the banking franchise as a going concern, often termed the economic value of equity (EVE).

An alternative measure captures the net proceeds from the sale of all assets at their fair value prices after liabilities have been redeemed at par. This measure approximates the liquidation value of the bank available to equity holders. The measure can be roughly proxied using book equity adjusted for the mark-to-market value of assets. One commonly used metric of book equity is tangible common equity (TCE). For banks, the adjusted TCE is calculated by taking common book equity less intangible assets, and then subtracting the difference between the mark-to-market value and the book value of assets.

Types of Risk

The two measures take different views on whether the bank operates until its assets and liabilities mature (EVE), or whether it is forced to liquidate the assets and repay the liabilities immediately at par (TCE). Two risk factors significantly impact these measures of value: credit risk and interest rate risk.

Credit risk reflects the possibility that a borrower fails to honor its financial obligation to the bank. When the default likelihood of a loan increases, the expected repayment falls and the value of the loan declines. Credit risk is the primary driver of valuation for most consumer and commercial loans. Current accounting standards and capital metrics incorporate credit risk into asset values.

Interest rate risk quantifies shifts in the opportunity cost of an investment. One values a fixed cash flow by discounting it at current market rates that reflect the time horizon and riskiness of the asset—the result is a present value that captures the potential cost of locking in that set of cash flows. If interest rates rise, the opportunity cost of holding the investment goes up and the present value of the cash flows declines (and vice versa), even though the cash flows themselves do not change. The longer the maturity of the cash flow stream, the greater the impact of interest rates on the PV. A floating-rate cash flow will increase as interest rates move, offsetting the interest rate changes. Interest rate risk is the primary source of price volatility for risk-free fixed-rate bonds, like Treasury securities.

Value and the Importance of Deposits

Credit risk only impacts asset values. Therefore, when credit risk increases, EVE and the adjusted TCE both decline. But interest rate risk affects the valuation of both assets and liabilities. While rising interest rates reduce the PV of fixed-rate assets, they also decrease the PV of fixed-rate liabilities because alternative sources of financing become more expensive. When rates rise, TCE decreases, reflecting the lower value of fixed-rate assets, but EVE is indeterminate because the asset decline may be more than offset by a decrease in the PV of liabilities. Consequently, the nature of bank liabilities is critical to determining the EVE of the bank.

In aggregate, deposits make up roughly 80 percent of bank liabilities. Hence, EVE calculations are highly sensitive to the behavior of deposits. The bulk of deposits are demand deposits, available for withdrawal without notice. This suggests that deposits are a short-maturity, floating-rate liability. But a significant portion of deposits do not respond one-for-one with interest rates. As a result, a large portion of deposit funding is quasi-fixed-rate and therefore exposed to interest rate risk.

The partial fixed-rate nature of deposit liabilities is summarized by the deposit beta—the ratio between changes in deposit rates and changes in interest rates. For instance, if deposits are considered a perpetuity and a bank has a deposit beta of zero, the rate a bank pays on deposits does not vary over time and therefore can be considered fixed. As interest rates rise, the PV of these deposit liabilities decreases. Because EVE subtracts liabilities from assets, the value of the deposits to the bank increases and EVE increases.

In contrast, a bank with a deposit beta of one has deposits that move in tandem with interest rates, behaving like a floating-rate liability. As interest rates rise, the payments owed to depositors with a beta of one increase, the opportunity cost increases, and the PV of these deposits is unchanged. If assets decline in value, then EVE decreases. In the latter case, deposits are expected to be paid out at par.

Deposit betas may be low because commercial bank deposits are the primary payment instrument for most economic agents and thus offer nonpecuniary benefits to their holders, such as payment services and access to cash. We have illustrated in prior blog posts that the beta of deposits has been less than one over the past thirty years. Thus, while deposits are demandable in principle, they are quasi-fixed-rate and therefore exposed to changes in interest rates.

Two Stylized Examples

To illustrate the importance of the interest rate risk of assets and liabilities, we consider two banks in a stylized financial system. The banks raise funds exclusively via deposits and invest in a mix of cash, floating-rate loans, and fixed-rate long-term securities. For simplicity, we assume their investments are credit-risk-free and that the term structure of rates is flat. They also do not use derivatives to manage interest rate risk. The banks are summarized in the tables below.

Traditional Bank

| Assets | Amount | Liabilities | Amount |

| Cash | 10 | Equity | 10 |

| Securities | 20 | Deposits | 90 |

| Loans | 70 |

Alternative Bank

| Assets | Amount | Liabilities | Amount |

| Cash | 10 | Equity | 10 |

| Securities | 70 | Deposits | 90 |

| Loans | 20 |

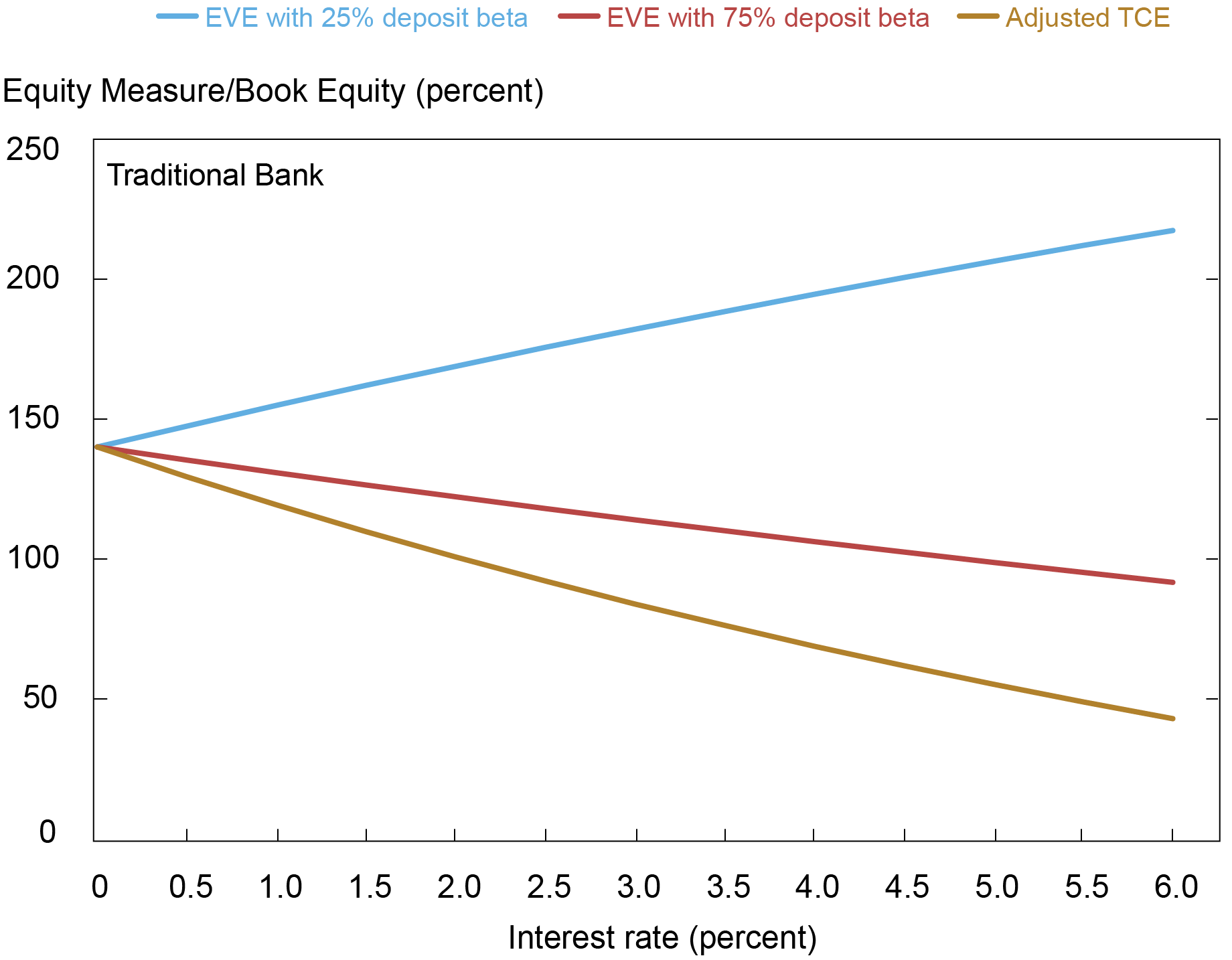

The traditional bank invests primarily in floating-rate loans. This is a simplification, as a nontrivial fraction of bank loans are fixed-rate. The impact of interest rates on measures of bank value for the traditional bank are summarized in the chart below. As interest rates increase from 0 to 6 percent, the adjusted TCE of the bank declines. This is consistent with how the fixed-rate assets of the bank decrease in value as interest rates rise. When we consider EVE, the value of deposits comes into play. Assume that deposit betas are fixed at 25 percent, so deposits are more fixed than floating. As rates rise, the present value of the liabilities decreases more than the present value of the assets, and the EVE of the bank rises. However, if deposit betas are 75 percent, the relation between EVE and rates reverses because the present value of deposits declines less than that of the assets, and the EVE of the bank declines.

Effect of Changing Interest Rates on Traditional Bank

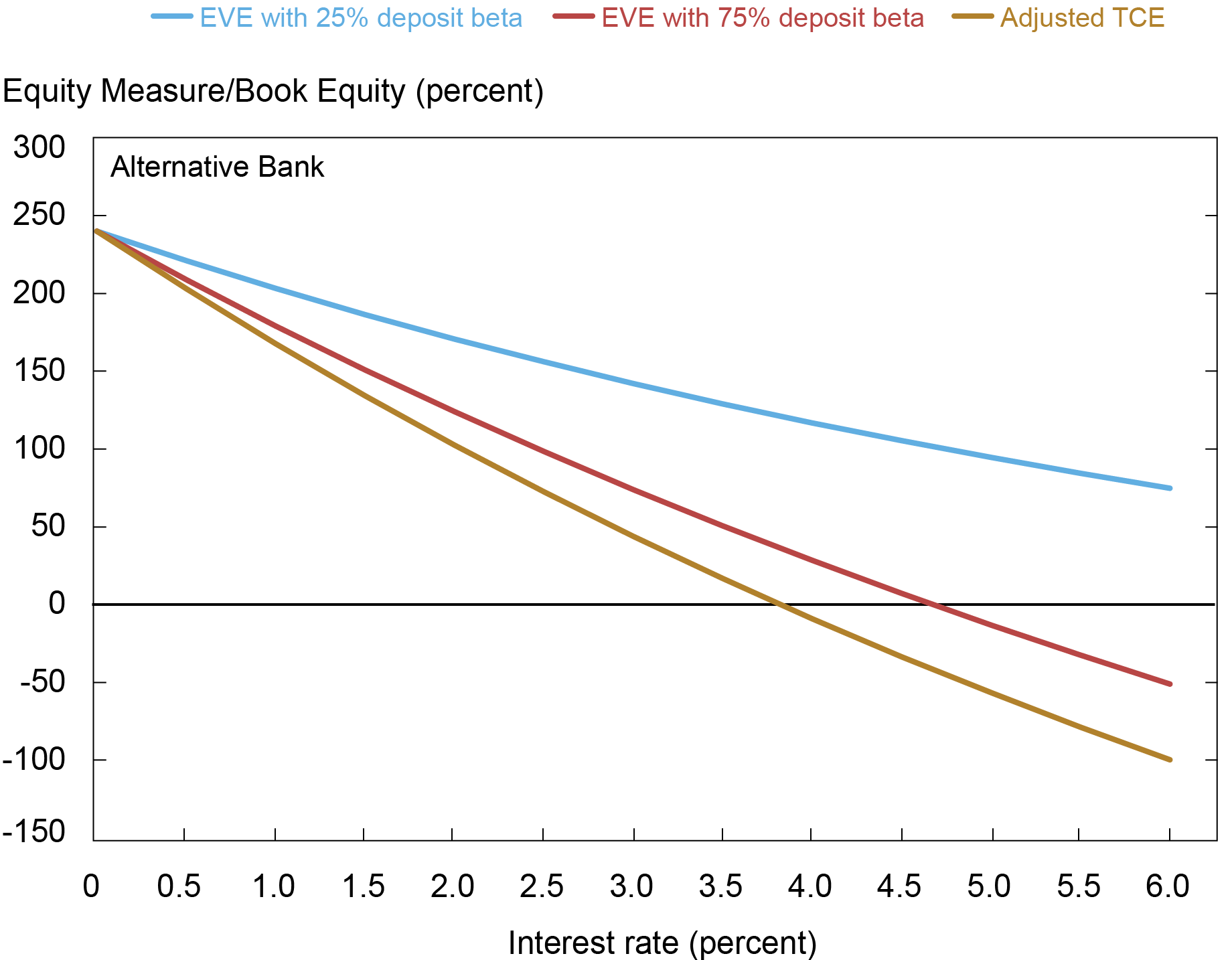

The alternative bank is more exposed to interest rate risk because it holds primarily fixed-rate securities. The sensitivity of value to interest rates for the alternative bank is summarized in the chart below. The adjusted TCE of this bank is more sensitive to interest rates, reflecting the greater interest rate risk of the bank’s asset portfolio. The EVE declines, but less so when the liabilities have a 25 percent deposit beta; a beta of 75 percent results in a significant decline in EVE that approaches the decline in TCE. Recall that, if the deposit beta is one, the adjusted TCE and the EVE are the same for these banks.

Effect of Changing Interest Rates on Alternative Bank

These results illustrate two key factors critical to recent events. The first is the exposure of assets to interest rate risk: holding more fixed-rate assets results in greater interest rate sensitivity. The second is the role of depositor behavior and the importance of capturing the sensitivity of deposits to changes in interest rates. Although fixed-rate asset values fall as rates rise, this decline is offset—and in some plausible scenarios more than offset—by the increasing value of deposit funding. For both banks, the liquidation value of the banking franchise (e.g., adjusted TCE) declines faster than its value as a going concern.

The Role of Deposit Outflows

In the above, we have assumed that depositors continue to finance the bank and thus the bank can hold its assets to maturity. In the absence of credit risk and with the benefit of a low deposit beta, this implies that interest rate fluctuations in the market value of assets are irrelevant for solvency. In effect, the bank can share the unrealized losses associated with its investments in long-dated fixed rate assets with its depositors. The deposit beta determines the extent to which asset losses are transferred to depositors. Indeed, the academic literature on bank value has observed that deposits can act as a hedge to assets that are sensitive to interest rates (see, for example, Flannery and James 1984b, Flannery and James 1984a, and Drechsler, Savov, and Schnabl 2021).

What if depositors decide to withdraw their deposits from the bank irrespective of the rate that the bank offers? In this scenario, the bank may not be able to hold its assets to maturity, and the market value of the assets becomes immediately more relevant in assessing the bank’s financial position. If the bank lacks sufficient cash to meet withdrawals and cannot raise funds from other sources to cover the outflows, it may be required to liquidate its assets at prevailing market prices. Following a rate increase, the market prices of longer-dated fixed-rate securities will be lower. Withdrawals could require a bank to realize these losses via sales, which would depress (or even wipe out) the equity value of the bank. In other words, the TCE (or an EVE with a deposit beta of one) becomes a more relevant measure of bank value.

Wrapping Up

This post reviews how bank valuations are affected by interest rate risk. In theory, bank value and profitability can increase or decrease as interest rate risk materializes. A crucial variable that determines the ultimate impact is the price sensitivity of depositors and whether depositors make it possible for banks to hold their assets to maturity.

Note that we do not discuss the market capitalization of the bank, which is what the equity of the bank trades at on the stock market. The market value of the firm will typically vary across the measures we outline in this post depending on market participants’ expectations around the path of interest rates and the behavior of deposits.

Stephan Luck is a financial research advisor in Banking Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Matthew Plosser is a financial research advisor in Banking Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Josh Younger is a senior policy advisor in the Federal Reserve Bank of New York’s Markets Group.

How to cite this post:

Stephan Luck, Matthew Plosser, and Josh Younger, “How Do Interest Rates (and Depositors) Impact Measures of Bank Value?,” Federal Reserve Bank of New York Liberty Street Economics, April 7, 2023, https://libertystreeteconomics.newyorkfed.org/2023/04/how-do-interest-rates-and-depositors-impact-measures-of-bank-value/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

derivatives

monetary

markets

reserve

policy

interest rates

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…