Economics

Higher interest rates have solved the inflation problem

As I’ve been pointing out for over two years, rapid growth in the M2 money supply is a big deal, and one that has not received much attention, if any….

As I’ve been pointing out for over two years, rapid growth in the M2 money supply is a big deal, and one that has not received much attention, if any. At first (i.e., mid- to late 2020) it was OK, because the public felt comfortable holding on to large amounts of cash in their bank deposit and savings accounts at a time of great Covid-related uncertainty and economy-wide lockdowns. But starting early last year, when the worst of the Covid panic was subsiding and life was beginning to get back to normal, people began spending that money. Soon, a flood of spending collided with supply shortages and a still-crippled economy, and the result was higher prices. By the end of last year, inflation was galloping towards 10% or so, but the Fed ignored it, asserting it was merely “transitory.” It wasn’t until March of this year that the Fed began to get worried. True to form (unfortunately), the Fed was—once again!—late to the inflation party, and they have been trying to catch up ever since. As we now know, they embarked on an impressive series of rate hikes which took short-term rates from 0.25% last March to now 4.5%. That marked the most aggressive monetary tightening in history.

Last week the Fed reiterated its intention to snuff out inflation with still more hikes. Sadly, they are now overstaying their welcome at the inflation party, because we know that inflation peaked many months ago. Unfortunately they didn’t get my memo on the subject.

The market is rightly concerned to be worried by all of this.

When all is said and done, the Fed has but one job: to keep the demand for money in line with the supply of money. When the supply of money exceeds the demand for it, inflation is the result, as Milton Friedman taught us long ago and which the experience of the past several years shows us. (I should add that, according to their official mandate, the Fed is also charged with maintaining full employment, but we’ll put that aside, especially since they now hint that they won’t feel comfortable until they see the economy weaken significantly.)

Over the past six months or so, it has become quite clear that higher interest rates have served to bolster the demand for money. No longer are people trying to aggressively spend down their bank balances, because now they can earn a decent rate of interest on their cash. Put another way, the Fed has raised interest rates by enough to once again bring money supply and demand back into balance. It’s also the case that supply chain problems have all but dried up. We know all of this because sensitive prices (e.g., housing prices, commodity prices, the value of the dollar and the price of gold) have fallen. Money demand looks to be much more closely aligned with money supply these days.

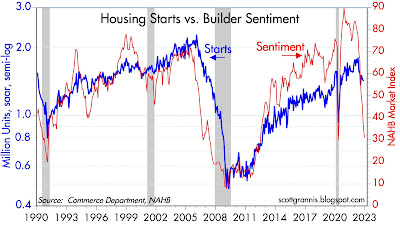

In the housing market it’s beginning to look like interest rates are too high, in fact, as the following charts illustrate.

dollar

gold

inflation

commodity

monetary

money supply

interest rates

fed

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…