Economics

Higher-For-Longer’s Day Of Reckoning Is Looming

Higher-For-Longer’s Day Of Reckoning Is Looming

Authored by Simon White, Bloomberg macro strategist,

The pressure on the Federal Reserve…

Higher-For-Longer’s Day Of Reckoning Is Looming

Authored by Simon White, Bloomberg macro strategist,

The pressure on the Federal Reserve to relent on keeping rates higher for longer will become acute in the coming months as recession risk rises and inflation remains benign.

Recessions are rarely surprising, but they are often shocking. They are a feature of the business cycle and therefore their occurrence is to be expected. But their very nature means that the abruptness with which they occur is a shock that catches most people – and the market – unawares.

We are in a period now where the risk of a recessionary shock has risen and will continue to rise – right at the time when a soft or no-landing outcome has become the dominant narrative.

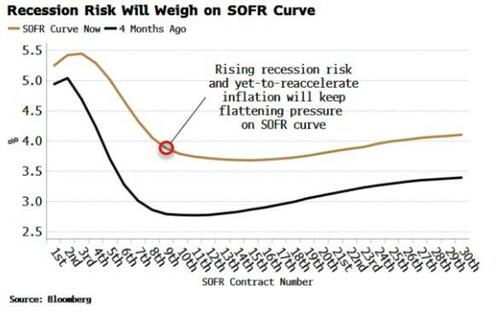

Pressure on the Fed to cut rates will intensify in the coming months, especially if inflation has not yet begun to re-accelerate (as I think it eventually will). These dynamics will add to flattening pressure on the fed funds and SOFR curves, and steepening support for the yield curve.

The shock of recessions is explained by two key features:

-

the suddenness of their onset; and

-

the wide gulf between actual growth and expectations when they occur.

Recessions are regime shifts. They happen when hard, real-economy data and soft, market and survey-based data begin reinforcing one other negatively. Worse-than-expected economic data will negatively impact markets. Weaker markets, if they persist, will negatively affect the real economy through channels such as wider credit spreads and a deterioration in the wealth effect from falling asset prices.

A further weakening in the real economy feeds back into markets and surveys, denting confidence yet more. If this process continues past a certain threshold, there is a cascading effect, and a recession rapidly occurs.

The chart below shows how hard and soft data interact. There are frequent occasions when soft data becomes stressed, but if the hard data does not worsen as well, a recession is averted. However, if soft-data stress bleeds into the hard data, then a recession is highly likely. Moreover, it happens swiftly.

The Fed has been criticized in the past for being influenced too much by the state of markets in deciding how to conduct monetary policy – the so-called Fed put everybody loves to hate. But what it is trying to do is to prevent these feedback loops from germinating in the first place.

The long-and-variable lags of monetary policy are short and consistent in their impact on markets. Therefore if the Fed can nip weaker soft data in the bud, it can hopefully prevent a recession – an economic state where monetary policy is a lot less effective, and the downturn harder to fix.

We can see from the chart above that currently hard data has become stressed along with soft data, and that both are above the threshold that has previously coincided with recessions. We are quite conceivably at the beginning of a feedback loop, and thus the rapid onset of a slump.

Recessions happen as Hemingway described how one goes bankrupt: first gradually, then suddenly. We can see this abruptness by looking at claims data.

Generally the percentage of US states whose continuing claims are rising sharply on an annual basis is subdued. But when it starts to rise past a low threshold, it typically shoots considerably higher, and this coincides with a recession. The very essence of recessions’ abruptness is captured in this chart. Other indicators also capture this regime-shift behavior.

Recessions’ shock power is amplified by the fact that typically economic and market expectations are most wrong when they occur. Predictions invariably extrapolate a trend linearly, so when that trend suddenly changes direction, the gap between expectations and the new trend is at its widest, and market moves can be most extreme.

In fact what we find is that forecasters’ estimates overshoot actual GDP more frequently – and the magnitude of the miss is bigger – when the economy is in recession compared to when it is not. Recessions not only creep up on you, they also deliver the biggest negative surprises.

The Fed’s higher-for-longer stance will be increasingly tested as growth slows.

Downward revisions to payrolls, big drops in job openings and cracks in consumer confidence are some of the recent signs of an economy that is perhaps entering the event horizon of a recession.

Inflation is likely to re-accelerate at some point, but as it is one of the most lagging of indicators, recession risk is poised to rise much more quickly than price growth.

This combination is likely to put significant pressure on the SOFR and fed funds rates curves, especially as the Fed resists cutting rates. The ~100 bps of Fed cuts priced in for next year is prone to rising again (its recent peak was ~160 bps). Similarly, the yield curve should continue to steepen.

It would be a shock, but not a surprise, if and when the Fed moves to cut rates. But until then the notion of higher for longer is going to face an increasingly challenging test.

Tyler Durden

Thu, 09/07/2023 – 08:45

inflation

monetary

markets

reserve

policy

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…