Economics

Hedging Against Inflation Using TIPS and I Bonds

Inflation is like kryptonite for bond investors. This article describes two fixed income investments that provide some inflation protection.

Introduction

It is difficult to predict macroeconomic variables such as GDP, wages, productivity, and inflation. Many investors try to do this and routinely fail. Warren Buffett’s advice to Americans is to simply dollar cost average into a broad-based equity index fund during their working years and ignore macroeconomic predictions altogether.

If this is the case, why did I write an article like Death, Taxes, and Inflation last week? The premise of the article is that inflation has become inevitable, on par with death and taxes as certainties in life. I was not attempting to predict the precise level of inflation in the future. Instead, I argued that our experience over many decades suggests that investors cannot ignore the effects of inflation in the years to come.

I followed up with Warren Buffett’s Advice on Stocks vs. Bonds and it probably did not surprise most readers to learn that Mr. Buffett has strongly favored investing in stocks over the years. The call he made on the superiority of stocks in 2010 was particularly prescient but is in keeping with his longstanding beliefs. Actions speak louder than words. If Berkshire Hathaway’s small fixed-maturity portfolio is any indication, Mr. Buffett still strongly prefers investments in stocks over bonds.

If stocks provide higher returns than bonds over long periods of time, why own any bonds at all? This is a valid question for a twenty-five year old just starting out, but there are good reasons for most investors to maintain an allocation to bonds.

A bond allocation can soften the volatility of a portfolio and help investors stay in the game for long periods of time rather than reacting in panic during a bear market. I’ve compared bonds to a financial flu shot that can protect against investor panic and I still think this is a valid reason to hold bonds. This is particularly true for investors who rely on their portfolio to cover living expenses. It is hard to stay rational if next month’s mortgage payment depends on selling stocks at a good price this month.

If one accepts the premise that some allocation to bonds is useful for most investors, then the question becomes how to achieve positive inflation-adjusted returns or, at a minimum, to not lose purchasing power over time. During the long years of extremely low interest rates, it was extremely difficult to avoid losing purchasing power in real terms while insisting on safety of principal. However, the situation has changed and there are now reasonable options for investors to consider.

There are many choices for bond investors including treasury securities, municipal bonds, investment grade corporate bonds, high-yield non-investment grade bonds, as well as more esoteric options including bonds denominated in foreign currencies. For purposes of this article, I have focused on treasury securities because they have no credit risk and interest is exempt from state income tax.1 However, interest rate risk, duration risk, and inflation risk remain critical issues when investing in treasury securities, as I described in The Risks of Investing in Bonds earlier this year.

This article describes two options for reducing inflation risk when investing in bonds: I Series United States Savings Bonds (I Bonds) and Treasury Inflation Protected Securities (TIPS). There are no firm rules that dictate whether I Bonds or TIPS are superior at all times. However, we can examine the features of these securities and establish a framework for assessing the relative attractiveness of I Bonds vs. TIPS. I will apply this framework based on conditions in June 2023.

Inflation Expectations

The United States Treasury issues securities that are not inflation protected as well as inflation protected securities (TIPS). Regular treasuries pay interest in nominal terms while TIPS pay a real rate and principal is adjusted based on actual inflation. Buyers of TIPS are locking in a real return while those who buy regular treasuries are locking in a nominal return and are accepting the risk of inflation eroding principal.

Before we delve into the intricacies of I Bonds and TIPS, let’s take a brief look at how inflation expectations have evolved in recent years. The following chart displays the ten year breakeven inflation rate which the St. Louis Fed calculates as the difference between the regular ten year treasury note and the ten year TIPS.2

As of June 6, 2023, the ten year breakeven inflation rate stood at 2.2% which is slightly above the Fed’s 2% inflation target. However, we can see that inflation expectations vary significantly over time. During periods of soft economic conditions, inflation expectations tend to decrease precipitously, as we can see in the shaded areas of the graph corresponding to the financial crisis and the pandemic.

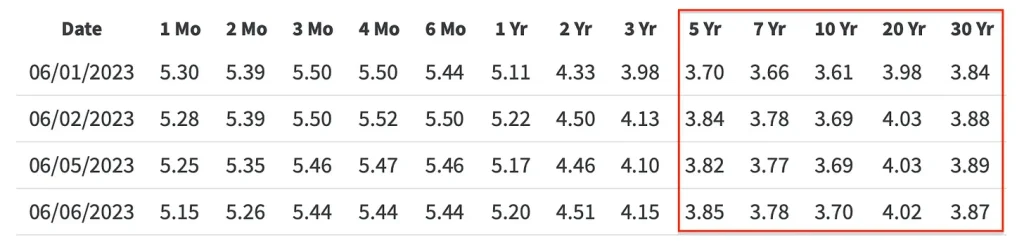

We are not restricted to observing inflation expectations for the ten year breakeven since it is possible to compare the yield of regular treasuries and TIPS across the yield curve. The first table below shows the yields available on regular treasury securities and the second table shows the yields available for TIPS in early June 2023:

Regular Treasury Securities:

Treasury Inflation Protected Securities:

Although TIPS can be purchased on the secondary market for shorter maturities, they are only offered at auction for terms of five years and longer. In contrast, regular treasury securities are auctioned for terms as short as one month. From the tables above, we can observe the following embedded inflation expectations as of June 6:

- 5 Years: 3.85% – 1.71% = 2.14%

- 7 Years: 3.78% – 1.59% = 2.19%

- 10 Years: 3.7% – 1.5% = 2.2%

- 20 Years: 4.02% – 1.55% = 2.47%

- 30 Years: 3.87% – 1.64% = 2.23%

We should keep in mind that the Federal Reserve’s stated inflation target is 2%.

For many reasons, discussed in more detail in Death, Taxes, and Inflation, I view 2% as the minimum level of inflation that one can expect over the long run. The market is pricing in somewhat higher inflation, perhaps recognizing that the Fed is not likely to follow a period of high inflation by temporarily lowering their target below 2%.

Despite recent high levels of inflation, the market is not pricing in a large long term failure of the Fed’s stated 2% policy objective. We can see evidence of this by observing that the yield curve is currently “inverted” — that is, short term treasuries are offering higher yields than longer term treasuries. The market is acknowledging that inflation is high in the short run but expects a quick reversion to the 2% target.

The market is buying into the Fed’s narrative that we should experience a period of disinflation in the years to come. Market observers often confuse the term disinflation with deflation. Disinflation refers to a period of a declining, but still positive, rate of inflation. Deflation refers to a period of declining prices. The market expects prices to rise in the future, just at a lower rate than over the past couple of years. The market does not expect there to be a decline in the price level.

At a basic level, investors who expect inflation to be higher than the breakeven levels listed above should favor inflation protected securities over regular treasuries. Investors who believe that the economy will experience inflation lower than breakeven levels should favor regular treasury securities.

If we believe the Fed is serious about generating inflation of at least 2%, it makes sense to favor inflation protected securities to hedge against inflation overshooting the target, as we have seen over the past two years. For example, if inflation averages 4% over the next five years, investors in the five year TIPS should expect an annual return of approximately 5.71% compared to 3.85% in the regular five year treasury note.

Let’s now turn our attention to a more detailed examination of I Bonds and TIPS to determine which option makes the most sense in today’s environment.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

- Despite the recent drama over the debt ceiling, the prospect of the United States government defaulting on treasury obligations is almost nonexistent. A government that is able to issue debt in its sovereign fiat currency has no incentive to default. Such a government may resort to money printing resulting in inflation risk, but contractually due payments on principal and interest are very unlikely to be missed.

- The Fed provides a more precise description as follows: “The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities (BC_10YEAR) and 10-Year Treasury Inflation-Indexed Constant Maturity Securities (TC_10YEAR). The latest value implies what market participants expect inflation to be in the next 10 years, on average.”

dollar

inflation

deflation

reserve

policy

interest rates

fed

money printing

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…