Economics

Hawkish Powell & Horrible Data Spark Yield Curve & Crude Pain As Gold & Nasdaq Gain

Hawkish Powell & Horrible Data Spark Yield Curve & Crude Pain As Gold & Nasdaq Gain

From a macro perspective, "bad data" dominated…

Hawkish Powell & Horrible Data Spark Yield Curve & Crude Pain As Gold & Nasdaq Gain

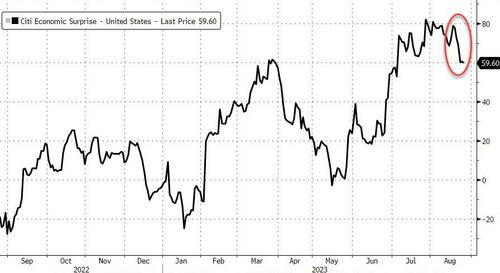

From a macro perspective, “bad data” dominated the week with the Citi macro surprise index tumbling most since April…

Source: Bloomberg

From a micro perspective, it was all about retailers (consumer credit challenges and shrink) and NVDA (keeping the dream alive for the AI bubble). Retail stock ended the week lower and while NVDA exploded higher on the earnings news, it collapsed back in the last two days, down over 10% from its highs…

Source: Bloomberg

Of course, Fed Chair Powell’s address today was a key event, but as Bloomberg’s Cameron Crise notes, while it was tilted hawkish, it really said nothing new…

The “TL;DR” summary of Jerome Powell’s speech more or less boils down to “we’ll hike again if we need to but won’t if we don’t.”

That’s not exactly ground-breaking stuff, which is one reason that the market response has been fairly muted relative to the anticipation of this speech.

Interestingly, despite the bad data, anticipation of Powell’s speech – and his actual speech – sent a hawkish shiver through short-term rate expectations (with a 25% chance now of a Sept hike and a 45% chance of a Nov hike)…

Source: Bloomberg

This is what that looks like for the curve…

Source: Bloomberg

Treasuries were very mixed this week with the long-end dramatically outperforming (2Y +10bps, 30Y -10bps)…

Source: Bloomberg

Which means the yield curve flattened dramatically, inverting deeper (back towards the July FOMC meeting reversal)…

Source: Bloomberg

The 2Y Yield surged back above 5.00%, rising to the July highs and reversing modestly…

Source: Bloomberg

Equities were also mixed with Nasdaq outperforming (along with the S&P) while The Dow was the ugliest horse in the glue factory, ending lower on the week with Small Caps down on the week…

The dollar ended the week marginally higher, bouncing back from Wednesdays plunge…

Source: Bloomberg

Crypto was volatile and mixed but while Ripple rallied and Solana sold off, Bitcoin and Ethereum ended the week practically unchanged…

Source: Bloomberg

Bitcoin glued around $26,000…

Source: Bloomberg

Spot Gold scrambled back above $1900, and held it even with today’s post-Powell puke…

Source: Bloomberg

Oil dropped on Powell’s speech (demand fears) and then accelerated lower on a Tansim tweet detailing the US-Iran deal (supply fears)… and then ripped bck into the green as everyone realized this is not new news.

Oil sliding as algos price in for the 19th time that Biden is about to make a deal with Iran to allow oil exports, even though Iran already exports most of its oil in violation of US sanctions.

— zerohedge (@zerohedge) August 25, 2023

And this is probably nothing…

As of August the implied crude shortfall has really accelerated with the latest 4-week average showing draws of close to 5mbd. About 2mbd come from onshore tanks, with China having shifted from a stockbuilding to a stockdrawing pattern. And an even bigger figure is emerging for… https://t.co/P9fZxEnWho pic.twitter.com/Zv6FTo4oUn

— Giovanni Staunovo???? (@staunovo) August 25, 2023

However, overall, WTI was lower on the week, but managed to get back above $80 by today’s close…

Finally, what happens next?

Source: Bloomberg

Could it really?

Tyler Durden

Fri, 08/25/2023 – 16:00

dollar

gold

fed

bubble

nasdaq

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…