Economics

Guest Contributions: “Energy shocks and core inflation in the US and in the Euro Area: this time is different”

Today, we are pleased to present a guest contribution written by Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti of the Bank of…

Today, we are pleased to present a guest contribution written by Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti of the Bank of Italy. The views presented in this note represent those of the authors and do not necessarily reflect those of the Bank of Italy.

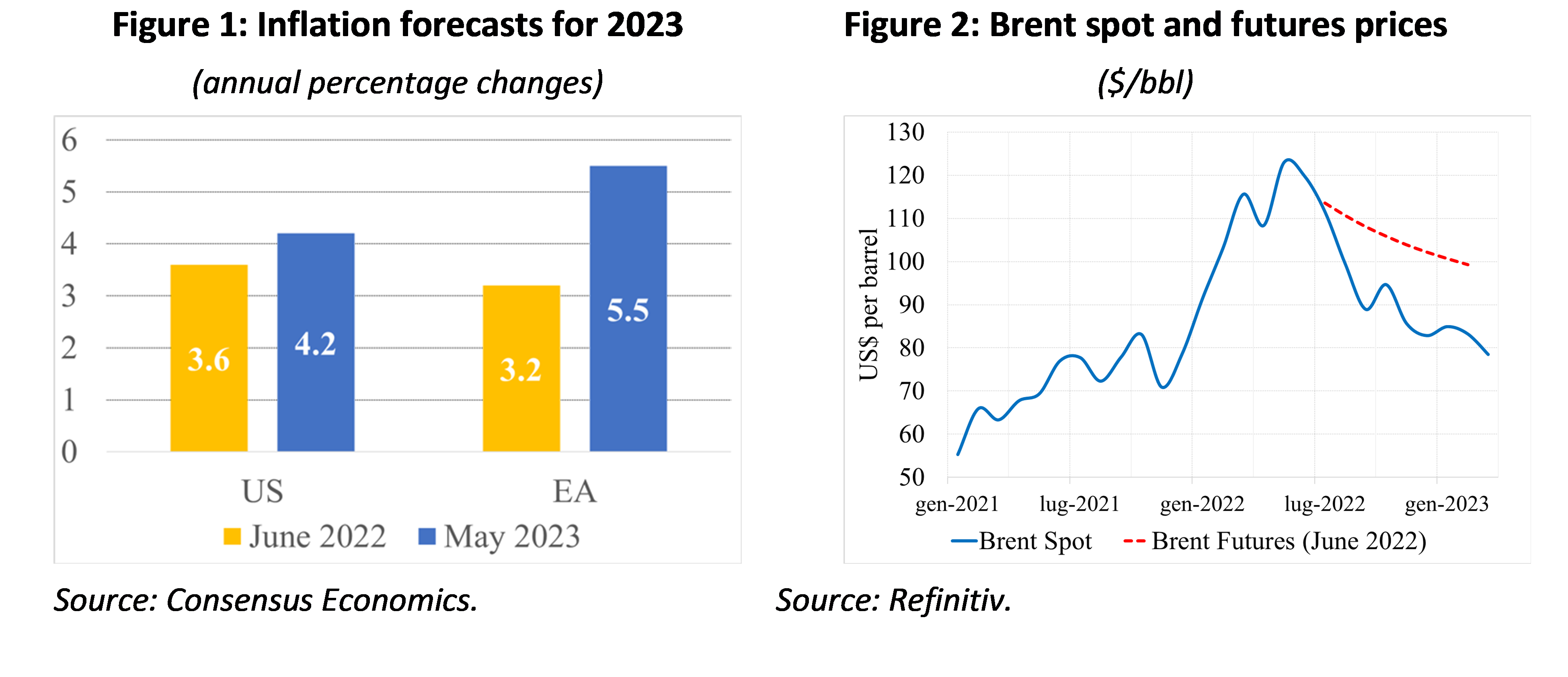

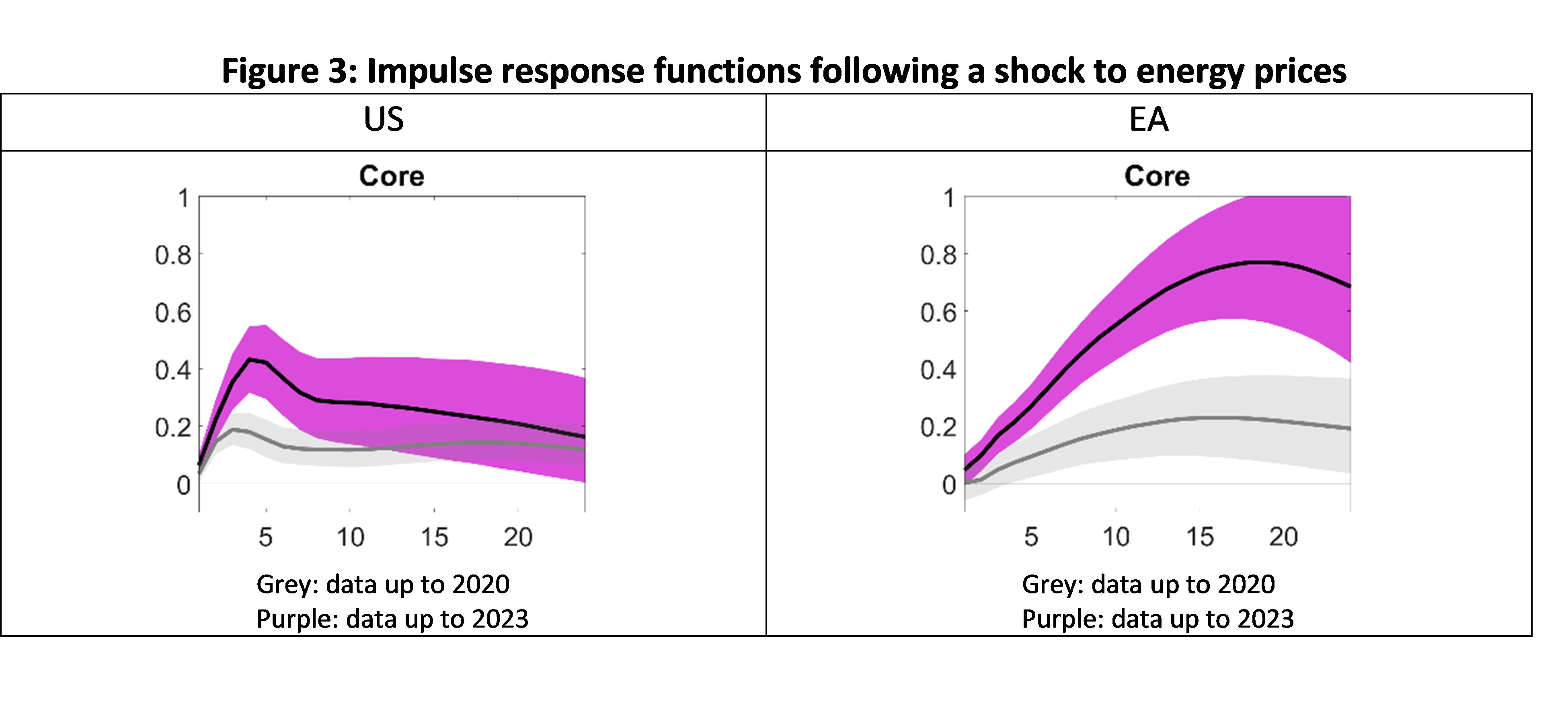

Inflation rates in both the United States and the euro area (EA) have decreased since around the middle of 2022. However, their fall has not occurred as rapidly as initially anticipated. Despite the significant decrease in energy prices, which dropped more drastically than what was projected by futures prices one year ago, professional forecasters have consistently adjusted their predictions for inflation upwards. This trend has been particularly noticeable in the euro area (EA), as depicted in Figures 1 and 2. Unforeseen increases in core inflation, specifically in non-energy industrial goods and services, have been the primary catalyst behind these unexpected inflation hikes.[1]

This bears the question whether surprisingly high core inflation in these economies is the result of the delayed pass-through of past energy prices and what can be expected going forward, given the pronounced fall in energy prices since mid-2022. The analysis summarized in this column concludes that, when it comes to the US, energy prices account for a negligible fraction of core inflation hikes in the past two years. This is not the case for the euro area, where the pass-through was sizeable and still ongoing.

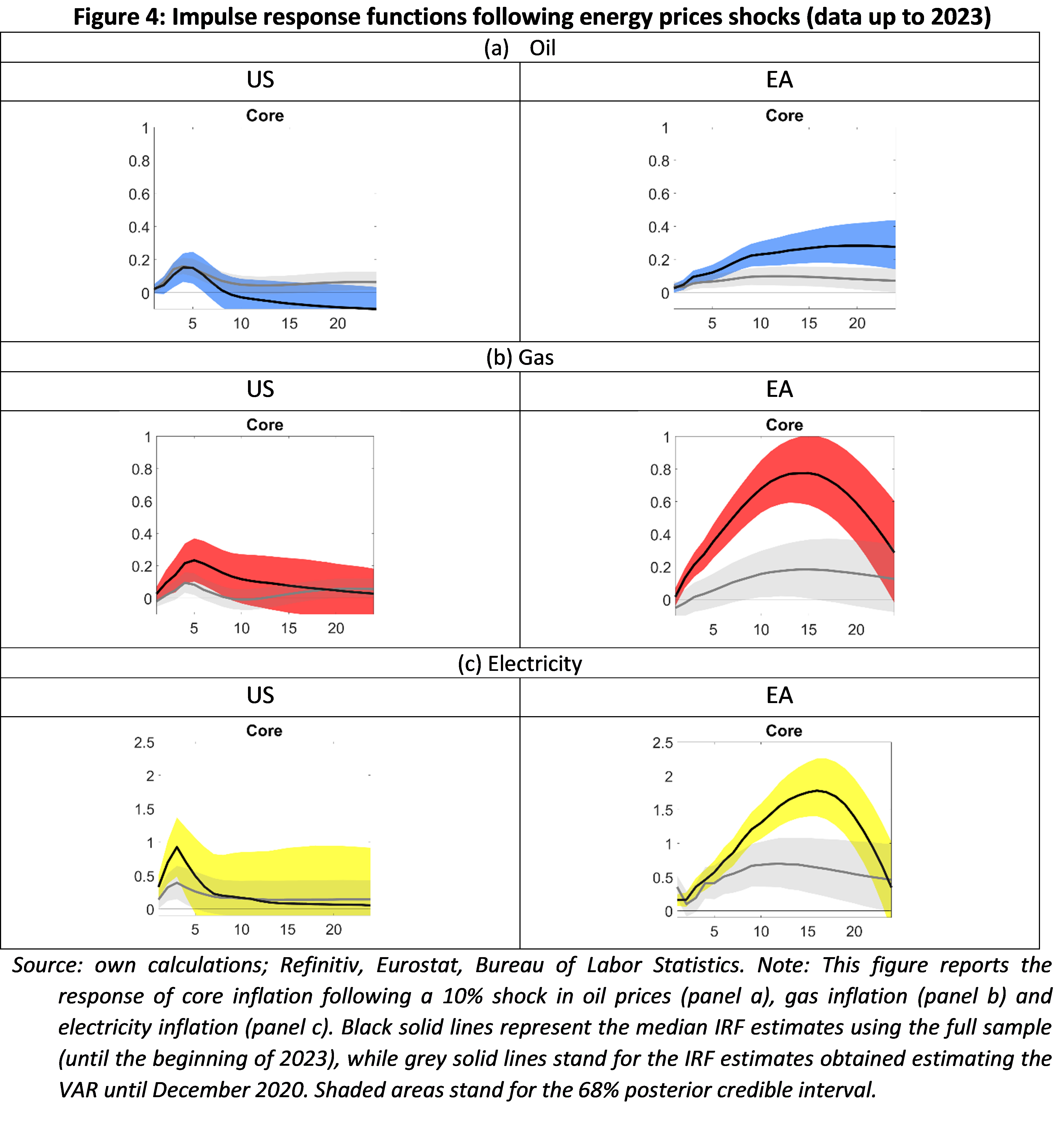

The pass-through of energy prices to core inflation can be gauged on the basis of the response of core prices to an unexpected change in energy prices in the context of Vector Autoregression models. We estimate such a model with data up to 2020 first (therefore excluding the 2021-2022 energy price shock), to then extend the sample to the last available 2023 data point. The baseline specification includes consumer energy inflation, food inflation, core inflation[2], the unemployment rate, and negotiated wages growth.[3]

Using data up to 2020, a sample that pre-dates the most recent energy price shock, a 10% increase in consumer energy prices leads to a relatively muted rise in core inflation for both the United States and the euro area (EA), by approximately 0.1 to 0.2%, as illustrated in Figure 3 within the grey-shaded regions. However, when the analysis is extended to include the data in 2023, which incorporates the energy price shock of 2021-2022, the response of core inflation to changes in energy prices rises significantly in the EA (as indicated by the purple-shaded areas in Figure 3). This suggests that the surge in energy prices caused a shift in the relationship between core prices and energy input costs. Indeed, following a 10% energy price shock, the maximum impact on core inflation resulting from an energy price shock is estimated at 0.8% for the EA (a fourfold increase) and at 0.4% for the US (only a twofold increase).

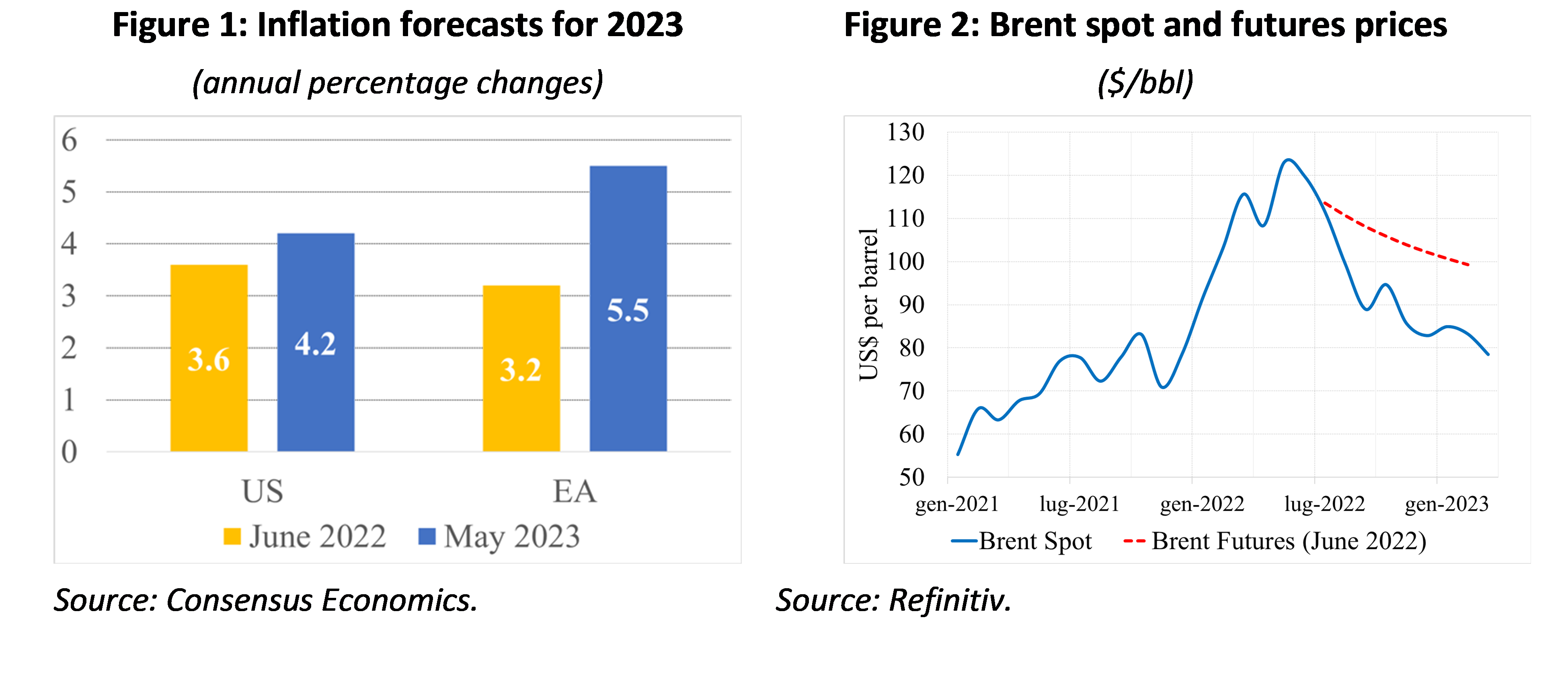

A more granular analysis – see Figure 4 – reveals that the sharp increase in the sensitivity of EA core inflation to energy prices is mostly explained by the stronger sensitivity of core inflation to gas and electricity price shocks. Our conjecture is that the exceptional size of the shock to these costs induced a non-linear adjustment of final prices. This likely reflects both the unprecedented size and duration of the shocks in the EA. The shock to energy prices in the EA was indeed of historical proportions. For example, between beginning of January 2021 until their peak in the summer of 2022, spot gas prices rose by roughly a factor of 17 in the EA (based on TTF prices; this compares to a factor of 3.8 in the US, based on Henry Hub prices). A shock of these proportions is likely to have triggered some non-linearity along the transmission chain in the EA.

This explanation would be consistent, for instance, with pricing models in which firms face a fixed cost of price adjustment. Cavallo et al. (2023) show that indeed in general models with menu costs “large shocks travel fast”.[4] Faced with a shock to their production costs, firms need to decide whether to reset optimally their price and pay the menu cost, or to leave prices unchanged at the cost of lower profits. The latter alternative become less and less appealing the larger the shock is, and therefore the more distant the actual price from the profit maximizing price is.[5]

Two conclusions emerge from the analysis. First, core inflation in the US is unlikely to benefit from the normalization of energy prices. US core inflation is currently bolstered by the sustained pace of growth of shelter prices and of the prices of items such as garments, furniture and some non-shelter services. It will take time, and probably some slack in the labour market, before these prices start decelerating durably. Second, in the EA there is scope for a deceleration of core prices due to lower energy prices. In the EA, both goods and services prices are still influenced by past energy price shocks. As these prices have started to fall they should contribute meaningfully to cooling down core prices.

[1] US core inflation forecasts for the last quarter of 2023, elicited from the SPF, rose from 2.9% to 3.4% between Q2-2022 and Q1-2023. In the case of the EA, SPF core inflation forecasts were revised over the same period from 2.3 to 4.4%.

[2] Consumer prices are measured on the basis of the HICP in the EA and of the CPI in the US. For the US, we consider a measure of core inflation that excludes the “housing” component. This component has a disproportionate weight in US core inflation (about 40 percent) and is completely insensitive to energy prices. It would therefore strongly bias downwards the sensitivity of US core prices to energy prices and distort the comparison with the EA. The index of core inflation net of housing also features prominently in the monetary policy debate in the US, as Fed officials and in particular FOMC Chair Powell have often referred to it as “the most important category for understanding the future evolution of core inflation. See “Inflation and the labour market”, by Jerome H. Powell, November 30 2023, available here.

[3] The energy shock is identified by assuming – as standard in this literature – that all the variables in the system may respond contemporaneously to the energy shock, but that consumer energy prices respond only with a lag to other shocks.

[4] Cavallo A., F. Lippi F. and Miyahara K. (2023), “Inflation and misallocation in New Keynesian models”, ECB Forum on Central Banking, Sintra, 27 June.

[5] See also Nakamura, E.,and J.Steinsson,‘‘Five Facts about Prices: A Re-evaluation of Menu Cost Models,’’ Quarterly Journal of Economics, 123 (2008), 1415–1464 and J. Vavra “Inflation Dynamics and time-varying volatility”, the Quarterly Journal of Economics, 129 (2014), 215-258.

This post written Kevin Pallara, Luca Rossi, Massimiliano Sfregola and Fabrizio Venditti.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…