Economics

Guest Contribution: “Inflation in the euro area: A view from the price level”

Today, we’re pleased to present a guest contribution by Laurent Ferrara (Professor of Economics at Skema Business School, Paris and Director of the International…

Today, we’re pleased to present a guest contribution by Laurent Ferrara (Professor of Economics at Skema Business School, Paris and Director of the International Institute of Forecasters).

Against the current background of high inflation rates, questions arise on the way central banks can control inflation and their strategy to reach their objective. Since 1990, main central banks around the world have progressively adopted a framework of inflation targeting. This means that their objective of price stability is set through the evolution of the annual growth rate in general price level, i.e. inflation rate, around a targeted value (e.g. 2% for Fed and ECB).

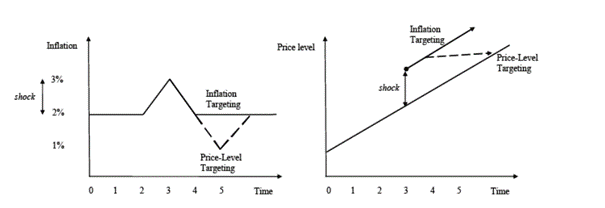

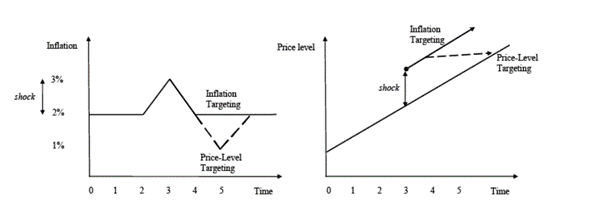

One of the well-known issues of this inflation targeting approach is that, by focusing on the growth rate of prices, it does not account for the value of past inflation rates. We say that “bygones are bygones”. Targeting an average of 2% over time, as the Fed does, is a way to alleviate this issue. An alternative would be to directly target the price level. This approach allows for more flexibility by accounting for deviations to the target after an unexpected shock. For example, assuming an inflation target at 2%, if inflation increases to 3% after a given shock, rational economic agents will expect a 2% inflation in the wake of this shock, while it would be only 1% under a price-level target regime. This is well explained in Figure 1 taken from this VoxEU post.

Figure 1: Inflation and price-level targeting compared

Source: Minford and Hatcher, 2014, VoxEU

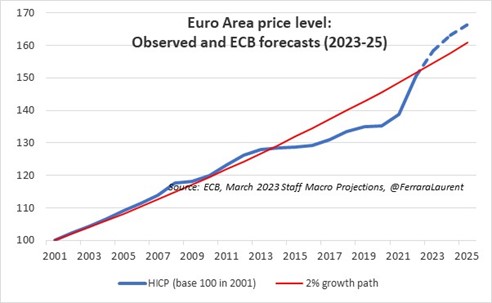

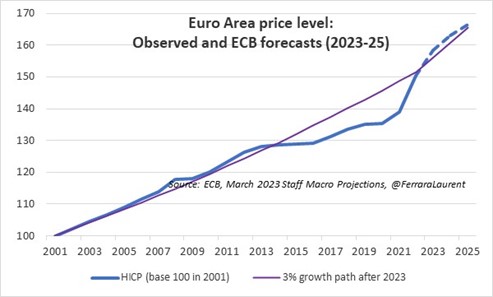

It is informative to have a look at the euro area through the lens of a price level analysis. After years of having a level of inflation below the price level implied by a 2% inflation since 2001, the observed price level has now almost reached this “theoretical” price level in 2022 (see Figure 2). The sharp increases in the level of prices in 2021-22 have thus erased 9 years of evolutions below the 2% trend.

Figure 2: Price level in the euro area and price level implied by the 2% path

Source: Eurostat and ECB March 2023 macro projections

What is interesting is to consider the inflation forecasts for 2023-25 released by the ECB in its March 2023 Staff Macro Projection Exercise (+5,3% in 2023, + 2.9% in 2024 and +2.1% in 2025): The price level is likely to persistently exceed the “theoretical” price level implied by a 2% growth path. For the first time in the history of the euro area, we will observe a significant and persistent gap between the two lines of Figure 2 (about 3.5% in 2025), suggesting that euro area citizens will permanently face high prices for goods and services. Moreover, if we assume that inflation will go back to the 2% target after 2025, then the two lines will evolve in parallel after this date (as in Figure 1, right panel).

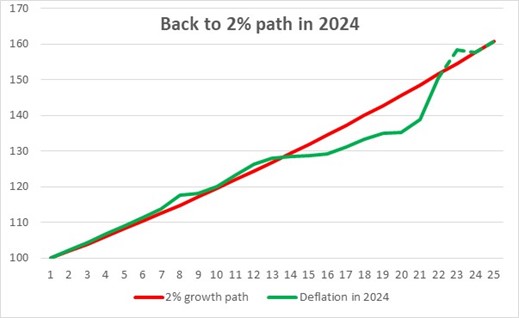

So how could policy-makers close this gap? The first option is to tighten the monetary policy stance in order to bring the price level back to the 2% path line. This is what the ECB is currently doing by increasing its main refinancing interest rate. But this monetary policy tightening can be done in two ways: hard or soft. A hard tightening would imply a rapid return to the 2% line, by generating a deflation of about -0.5% in 2024 (Figure 3). Very likely that this scenario would also imply an economic recession within the euro area in 2024.

Figure 3: Price level scenario with a deflation in 2024

Source: Eurostat and author’s computation

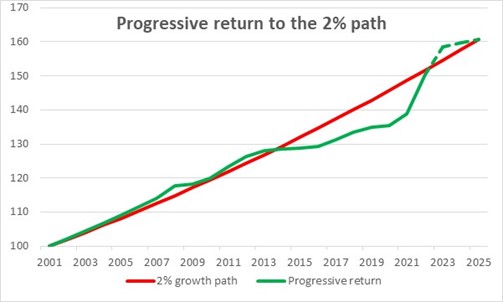

A soft monetary tightening would imply an inflation rate well below the target for both 2024 and 2025. For example, an inflation rate of 0.8% in 2024 and 0.7% in 2025 would send the price level back to the 2% path in 2025 (see Figure 4). This second scenario is certainly the preferred one, as the euro area would certainly escape an economic recession and all its associated costs in terms of employment and income.

Figure 4: Price level scenario with a progressive return to 2% path

Source: Eurostat and author’s computation

There is a second option, more complex to implement but often advocated by leading economists like Olivier Blanchard, that is to increase the inflation target. After all, there is no strong theoretical argument in favour of the 2% value. This value is mainly based on past periods considered by policymakers as periods of price stability. So why not using a target of 3% or 4%? Figure 5 shows a theoretical effect of a shift to an inflation target of 3% starting from 2023. We see that the expected price level will be aligned with the one implied by a 3% inflation target.

Figure 5: Price level scenario with a 3% target from 2023

Source: Eurostat and author’s computation

A price level analysis suggests that to avoid a persistent gap between observed general level of prices and the level of prices implied by a 2% inflation target in the euro area, the ECB is likely to continue to tighten its monetary policy stance in upcoming months. An alternative would be to increase inflation target but that’s another story that will fuel debates among academic and policy circles for the months to come …

This post written by Laurent Ferrara.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…