Economics

Green Bubble Burst: US ESG Fund Closures In 2023 Surpass Total Of Previous Three Years

Green Bubble Burst: US ESG Fund Closures In 2023 Surpass Total Of Previous Three Years

For years, green and socially responsible investments,…

Green Bubble Burst: US ESG Fund Closures In 2023 Surpass Total Of Previous Three Years

For years, green and socially responsible investments, aka ESG (Environmental, Social, and Governance), have dominated the investing world. However, according to Bloomberg, a seismic shift is underway as BlackRock and other money managers unwound an increasing number of ‘green’ products amid soaring backlash and investor scrutiny.

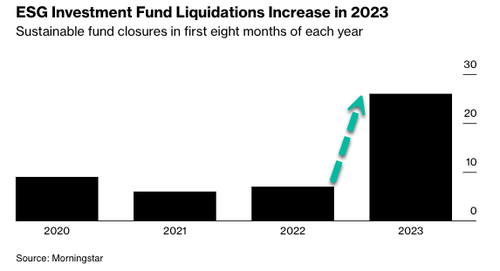

Data from Morningstar shows State Street, Columbia Threadneedle Investments, Janus Henderson Group, and Hartford Funds Management Group have unwound more than two dozen ESG funds this year. The latest unwind comes from BlackRock, who told regulators last Friday it plans to close two ESG emerging-market bond funds with total assets of $55 million.

So far this year, the number of ESG funds closing is more than the last three years combined. This trend comes as investors pull money out of these funds as the ESG bubble has likely popped.

We asked this question in early summer: Is The ESG Investing Boom Already Over?

In January, BlackRock’s Larry Fink told Bloomberg TV at the World Economic Forum in Davos that ESG investing has been tarnished:

“Let’s be clear, the narrative is ugly, the narrative is creating this huge polarization. “

Fink continued:

“We are trying to address the misconceptions. It’s hard because it’s not business any more, they’re doing it in a personal way. And for the first time in my professional career, attacks are now personal. They’re trying to demonize the issues.”

By June, Fink’s BlackRock dropped the term “ESG” following billions of dollars pulled out of its funds by Republican governors, most notably, $2 billion by Florida Gov. Ron DeSantis.

The crux of the issue that Republican lawmakers have with radical ESG funds is that they were trying to impose ‘green’ initiatives on the corporate level to force change in society, and many of these initiatives would be widely unpopular at the ballot box during elections.

Remember these comments from Fink?

Alyssa Stankiewicz, associate director for sustainability research at Morningstar, told Bloomberg, “We have definitely seen demand drop off in 2022 and 2023.”

Also, let’s not forget about the ‘greenwashing‘ across ESG industry.

Matt Lawton, T. Rowe Price Group Inc.’s sector portfolio manager in the Fixed Income Division, recently concluded: “It’s becoming increasingly difficult to find credible sustainability-linked bonds.”

The tide is reversing for Fink: “Backfire: World’s Fourth Largest Iron Ore Producer Stops Purchasing Carbon Offsets.”

Don’t forget this: “McDonald’s Scrubs Mentions Of “ESG” From Its Website.”

Oops, Mr. Fink.

Tyler Durden

Fri, 09/22/2023 – 06:55

bubble

iron

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…