Economics

Goldman Sachs’ Epic Hiring Spree Ends With Biggest Round Of Job Cuts Ever

Goldman Sachs’ Epic Hiring Spree Ends With Biggest Round Of Job Cuts Ever

At the end of December, Goldman Sachs Group Inc.’s Executive Officer…

Goldman Sachs’ Epic Hiring Spree Ends With Biggest Round Of Job Cuts Ever

At the end of December, Goldman Sachs Group Inc.’s Executive Officer David Solomon announced in a traditional year-end message to staff that headcount reduction was just weeks away. As early as this week, thousands of Goldman employees are expected to be fired, Bloomberg reported, citing a person with knowledge of the matter.

By mid-week, Goldman will begin the process of firing 3,200 employees — more than a third of those terminated will be from the investment bank’s core trading and banking units. The firings are expected to be the largest ever in its operational history.

Goldman is also expected to reveal the financials of a new credit card and installment-lending business unit that could record more than $2 billion in pretax losses.

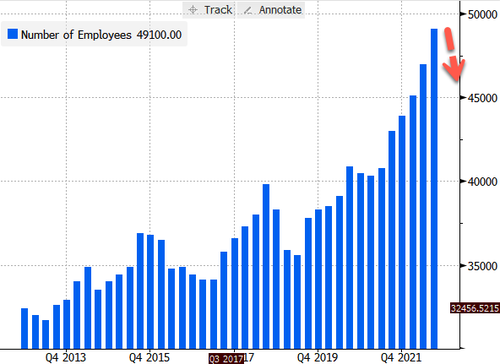

The expected cuts come as Solomon (or ‘DJ D-Sol’ by night) went on a hiring spree in recent years. Since the end of 2018, the headcount at the investment bank has humped 34% to more than 49,000.

And here comes the firing cycle.

Solomon told employees in late December:

“We are conducting a careful review and while discussions are still ongoing, we anticipate our headcount reduction will take place in the first half of January.

“There are a variety of factors impacting the business landscape, including tightening monetary conditions that are slowing down economic activity. For our leadership team, the focus is on preparing the firm to weather these headwinds.”

Goldman’s layoffs have been well-telegraphed by the company for weeks. Wall Street banks are reeling from tightening monetary policy, cross-asset turmoil, and the slowdown of economic activity has forced many firms to slash bonuses, reduce headcount, and announce hiring freezes. Morgan Stanley, Credit Suisse Group AG, and Barclays Plc have all recently announced layoffs or plans to cut jobs in the coming months.

Despite all the gloom, Goldman penned a piece on its website titled “Why the US Can Avoid a Recession in 2023,” and if so, why does the investment need to fire thousands of employees?

Tyler Durden

Mon, 01/09/2023 – 07:44

monetary

policy

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…