Economics

Goldman: Has Ethereum Become A Deflationary Asset?

Goldman: Has Ethereum Become A Deflationary Asset?

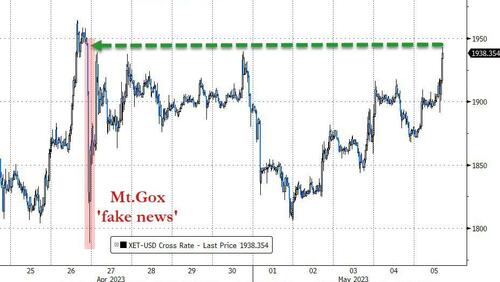

After the flash crash drop last week on ‘fake news’ about Mt.Gox holdings moving, Ethereum…

Goldman: Has Ethereum Become A Deflationary Asset?

After the flash crash drop last week on ‘fake news’ about Mt.Gox holdings moving, Ethereum has outperformed and erased all those losses (and above $1950) as banking sector chaos is enabling decentralized financial systems to showcase their transparency and resilience versus traditional markets….

Source: Bloomberg

Ethereum’s relative performance to bitcoin has been volatile in recent weeks around the major Shapella upgrade, but once again ETH is outperforming BTC in recent days…

Source: Bloomberg

One potential driver of ETH’s regained popularity is its appeal as a deflationary asset, a topic Goldman’s Crypto desk recently explained:

Ether, as an asset, is the fuel powering and securing the Ethereum protocol.

To use the Ethereum network, users pay fees in ETH to execute transactions and use applications built on Ethereum.

In return, this fee and staking rewards (denominated in ETH) incentivize validators to secure the network. ETH’s value is a function of multiple factors, depending on one’s view of ETH as an asset – a store of value, means of exchange or a financial asset.

At its genesis in 2014, ~72m ETH supply was pre-mined, with current supply at ~118m ETH (Etherscan).

Since then, ETH’s economics have undergone changes on the back of Ethereum protocol’s two recent protocol upgrades – the London hard fork and the Merge.

-

The London hard fork introduced changes to the fee mechanism, whereby the gas paid for transaction is quoted in form of a base fee plus and op on to tip the validator (priority fee). The base fee is burnt and the validator receives the tip and block reward. The base fee burn decreases the net ETH issuance (the later in form of staking rewards). However, it heavily depends on Ethereum network activity. More on-chain activity = more ETH burnt.

-

Following the Merge, Ethereum’s transition to Proof of Stake (background on PoS – here) reduced ETH issuance by ~90% (Daily ETH issuance declined from ~13k to ~1.7k ETH). (More on ETH supply – here).

On the back of these upgrades, the net ETH issuance is lowered by (i) the base fee burn and (ii) the decline in block rewards.

This is what led ETH to be referred to as ‘ultra sound money’ (best explained by Justin Drake at Devcon Bogota).

Has ETH become a deflationary asset?

Since the Merge (Sep’22), ETH has become an increasingly deflationary asset over the past months (Figure 1).

In 2023 alone, ~374k ETH has been burnt (Figure 1).

In April, daily ETH issuance has been deflationary every day.

This trend is on the back of increased on-chain activity, led primarily by DEXes, NFT platforms and stablecoins.

Tyler Durden

Fri, 05/05/2023 – 12:45

markets

deflationary

store of value

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…