Economics

Global War Against the Dollar Breaks Out

For nearly a century, the U.S. dollar stood as the backbone of global commerce. That’s all about to end. Those who aren’t prepared could see their…

For nearly a century, the U.S. dollar stood as the backbone of global commerce.

That’s all about to end.

Those who aren’t prepared could see their ENTIRE life savings wiped out…

…which is why today’s issue of Wealth Whisperer tackles the issue head on.

We want our readers in front of the trend, enabling them to make the right moves to set themselves up for a once-in-a-century worldwide realignment.

Global players have already signaled their intentions to diminish the dollar.

Even friendly countries like India and Brazil are pushing hard to destroy the U.S. dollar.

Based on all the available information, we expect the dollar will NO LONGER be the main reserve currency of the world by 2035.

Most of us can’t imagine a time when the dollar didn’t sit atop the global stage, let alone how to manage our investments.

But how did we get to this point?

We’ll explain the snowballs that started this avalanche, and how YOU can capitalize.

The Origins of the Dollar’s Dominance

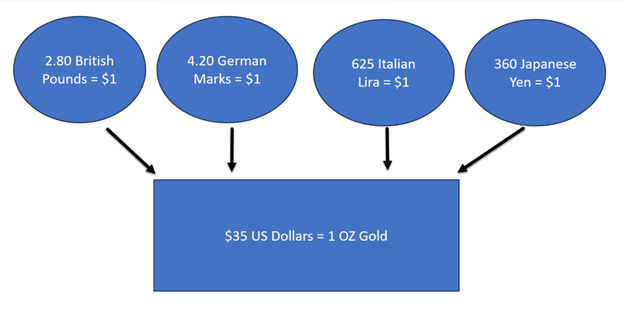

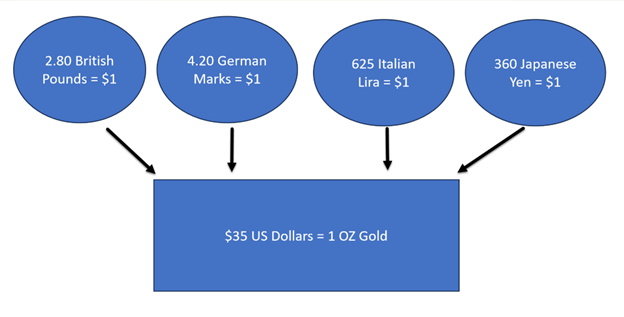

Post-World War II, the major players of Europe and the United States signed the Bretton Woods Agreement, which pegged many of the largest global currencies to the U.S. dollar.

The system was backed by physical gold, which could be converted at $35 per ounce.

By the late 1960s, the growing U.S. trade deficit and diminishing reserves of gold forced the United States to abandon the gold conversion.

With the agreement nixed, countries abandoned their peg to the U.S. dollar.

But by that time, the United States had already established itself at the leader in global trade, making it simply easier to do business with the dollar.

The second significant shift towards the dollar came in the aftermath of the 1973 Oil Crisis.

In response to the oil crisis, the U.S. government negotiated with oil-producing countries, including Saudi Arabia, to ensure a stable supply of oil and to maintain the value of the U.S. dollar.

As part of these negotiations, the U.S. made agreements with some oil-exporting nations to price and sell oil exclusively in U.S. dollars. In return, the U.S. provided security guarantees and economic assistance to these countries.

The Great Unraveling

You’ve probably heard of the BRICS — the group of countries comprising Brazil, Russia, India, China and South Africa.

These countries dominate the manufacturing and trade landscape, second only to the United States.

They’re also some of the largest trading partners with the United States (or were, in Russia’s case).

And they all want to break their reliance on the dollar.

Recently, there’s been talk of a BRICS issued currency — a means to dislodge the U.S. dollar as their reserve.

Picture this…

Right now, Russia and China can trade between one another in rubles or yuan. But they still need to buy things from the rest of the world. And since the rest of the world trades in dollars or their own currency, even China and Russia need the U.S. dollar.

Now assume the BRICS will merge into one giant bloc with a common currency like the eurozone.

For those who can remember, it would be akin to when Germany, Italy, France, Greece and many of the other European Union countries switched to the euro.

Virtually overnight, a bunch of small to medium-tier currencies became one of the top three in the world.

That’s what we’re talking about here amongst BRICS countries.

The difference is they’re not as friendly as Europe and are much more intent on establishing their global political and economic dominance.

While it’s just “talk” for now, we could quickly see BRICS becoming major players.

A new “developing economy” currency would attract many countries in the Middle East and the Asia-Pacific regions.

It wouldn’t just be an economic shift, but a political one.

Large countries like China, Russia and India could exert their influence on smaller nations, even fulfilling China’s ambitious new Silk Road initiatives.

The Result

Lower dollar demand = lower dollar value.

It’s just that simple.

Any asset denominated in dollars would be worth less relative to the rest of the world.

However, there’s a catch.

The more we build at home, the less we need to trade with the world.

That’s why reshoring creates a net increase in the relative value of the dollar.

Think about it this way…

Right now, we import, say, widgets of finished goods at $100 apiece, comprised of:

- $25 in raw materials

- $75 in value-added labor and activities

So, there’s a demand for $100 of non-dollar currency for each product we import.

Now imagine we manufacture that good here and instead import the raw materials.

We’ve shifted that $75 of value-added activity to the United States and reduced our need to trade in a foreign currency by $75 per widget.

Find those raw materials at home, and now you’ve reduced your reliance on foreign currency entirely.

That’s why it’s so important to reestablish our manufacturing base here in the United States.

If and when the BRICS countries band together in a single currency, our dollars won’t go as far.

Everything we import from them, and the rest of the world, will cost us MORE.

The Solution

The global realignment away from the dollar is inevitable…

…but there may be a solution that forces every country to tie themselves to the U.S. economy not for years, but DECADES!

You see, America tackles every challenge with its core strength: innovation.

We simply out-innovate every other country on the planet, whether it’s in military technology, biotech or driverless vehicles.

Renowned technology investor George Gilder believes he’s found the next breakthrough…

…the one that could reshape nearly every industry.

And it could be at the very early stages of a supercycle unlike any other.

Click Here to Reveal George’s Discovery!

The post Global War Against the Dollar Breaks Out appeared first on Stock Investor.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…