Economics

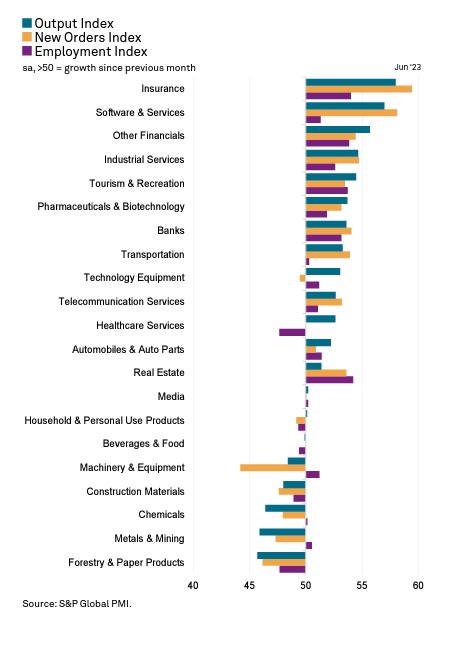

Global Sector PMI: Manufacturing Flops, Services Pop

Based on the recent release of the June Global Sector PMI from S&P Global, the state of manufacturing in various global sectors during June 2023 shows…

Based on the recent release of the June Global Sector PMI from S&P Global, the state of manufacturing in various global sectors during June 2023 shows a divergence in performance between manufacturing and services. Manufacturing-based sectors experienced a drop in output, while services sectors demonstrated growth. Here are some key observations:

-

Manufacturing Sectors: a. Drop in Output: All six sectors that experienced a decline in output during June were manufacturing-based. The sectors with the sharpest drop in production were Forestry & Paper Products, Metals & Mining, and Chemicals. b. Input Costs: Inflationary pressures seemed to be softening, as June witnessed the lowest number of sectors with a rise in input costs in three years.

-

Services Sectors: a. Growth and Performance: The five fastest-growing categories were all services sectors. Financials, particularly Insurance, showed rapid activity growth. Banks and Real Estate companies also experienced increased activity. b. Employment: Real Estate registered the fastest increase in employment among the 21 categories covered. Hiring activity and wage pressures in Real Estate pushed up staff costs.

-

Other Observations: a. Tourism & Recreation: The Tourism & Recreation sector continued to grow solidly but at a slower rate than in the previous four months. The growth of new businesses in this sector also eased. b. Beverages & Food: Output in the Beverages & Food sector remained broadly unchanged. c. Healthcare Services: Workforce numbers in the Healthcare Services sector decreased significantly, reaching the second-largest extent on record (second to May 2020).

Overall, the manufacturing sectors faced challenges with declining output, while services sectors, particularly Financials and Real Estate, demonstrated growth. The softening of inflationary pressures and reduced input costs across various sectors indicate a potential easing of price pressures. However, the decrease in workforce numbers within the Healthcare Services sector suggests a notable exception to the overall resilience in staffing levels.

AI-Assisted

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…