Economics

Global Luxury Home Prices Just Did Something They Haven’t Done Since 2009

Global Luxury Home Prices Just Did Something They Haven’t Done Since 2009

The global financial system is showing strains as rising interest…

Global Luxury Home Prices Just Did Something They Haven’t Done Since 2009

The global financial system is showing strains as rising interest rates spark turmoil in Western banks. Besides turmoil in the financial sector, another part of the global economy might be cracking, and that’s the luxury home market.

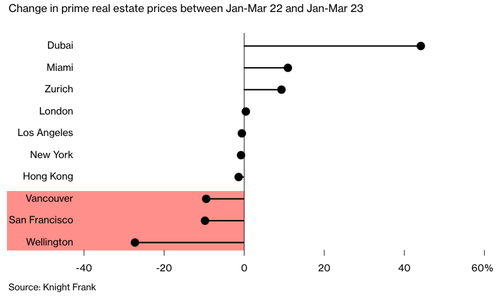

A new report from real estate consultancy Knight Frank reveals luxury home prices in 46 cities across the world slid .4% year-over-year in the first quarter, the first drop since 2009, and is a steep decline from 10% of growth in the fourth quarter of 2021, according to Bloomberg.

Knight Frank’s report showed luxury home prices in Wellington, New Zealand; San Fransico, California; and Vancouver, Canada, recorded the most significant declines. Inversely, luxury home prices were higher in Dubai and Miami.

“The slowdown in growth has overwhelmingly been driven by sharply higher interest rates following a recent tightening in global monetary policy,” Liam Bailey, Knight Frank’s global head of research, wrote in the report.

As the Federal Reserve, the European Central Bank, the Bank of England, and other major central banks continue raising rates — there are increasing risks that overtightening will break financial markets along the way. This might already be seen in the US and Europe, where a series of banking failures have sparked turmoil. There’s concern that banking turmoil has unleashed a credit crunch impacting commercial real estate.

Bailey continued by saying luxury housing markets will likely experience downward pressure through the year’s second half. However, he pointed out there are few signs of a repeat financial crisis.

Historically, such forceful rate increases by central banks produce a ‘hard economic landing.’

The first decline in global luxury housing markets since 2009 is yet another sign of more trouble ahead.

Tyler Durden

Thu, 05/11/2023 – 06:55

monetary

markets

reserve

policy

interest rates

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…