Economics

Global Food Prices Slide For Eleventh Month And Could Soon Show Up In Supermarket Savings

Global Food Prices Slide For Eleventh Month And Could Soon Show Up In Supermarket Savings

Inflation re-accelerated in the US and Europe last…

Global Food Prices Slide For Eleventh Month And Could Soon Show Up In Supermarket Savings

Inflation re-accelerated in the US and Europe last month, highlighting sticky price pressures that keep central banks ultra-hawkish and committed to increasing the terminal rate. Interest rate markets are still repricing the ‘about face’ in the disinflation narrative, which has caused cross-asset turmoil. Despite the lingering inflation storm, there is good news: global food prices in February declined for the eleventh consecutive month.

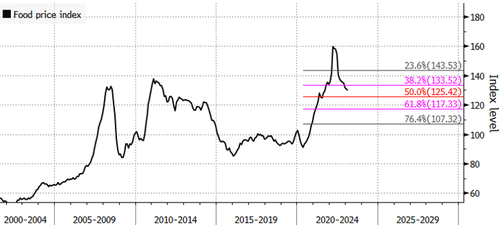

The United Nations’ Food and Agriculture Organization’s Food Price Index fell .6% last month to 129.8. Last month’s decline was driven by the price of slumping cooking oils and dairy products, while grain and meat prices were flat, and sugar prices climbed.

According to the data, the food supply crisis triggered by the Covid pandemic and the conflict in Ukraine is showing signs of improvement. The FAO’s index reached an all-time high following the Russian invasion of Ukraine, but prices have since dropped by 18% from their peak. Nevertheless, prices are still 42% higher than their levels during the onset of the Covid outbreak.

Although global food prices peaked one year ago, consumers have complained supermarket prices are still high. This is because it takes time to filter through, while supermarkets deal with elevated transportation, energy, and labor costs.

However, there is more promising news. The largest US meat company, Tyson Foods, missed Wall Street estimates for quarterly profit last month for operating margins this year in the face of falling – yes, falling – beef prices, easing demand for pork, and an ongoing crash in chicken prices as a result of overproduction.

Fast food restaurant chain Wendy’s Co. reported commodity inflation in the mid-single digits this year and beef prices to be deflationary in its current fiscal year. And Kraft Heinz Co. said there would be no more price hikes in North America, Europe, Latin America, and Asia.

Unless there is another global supply chain disruption or worsening of the war in Ukraine, food prices might not have just peaked, but declines could soon show up in supermarkets.

Tyler Durden

Sun, 03/05/2023 – 08:45

inflation

commodity

markets

deflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…