Economics

Further internal demand deterioration in China but PBoC refrains from cutting key interest rate

Further internal demand deterioration in China but PBoC refrains from cutting key interest rate Retail sales in China decelerated to 3.1% y/y in June from…

Further internal demand deterioration in China but PBoC refrains from cutting key interest rate

- Retail sales in China decelerated to 3.1% y/y in June from May’s 12.7% y/y, weakest growth rate since December 2022.

- Q2 GDP growth in China came in below expectations at 6.3% y/y vs. consensus estimates of 7.3% y/y.

- China’s central bank, PBoC left its one-year medium-term lending facility rate unchanged at 2.65% likely due to the risk of a “liquidity trap” scenario.

- China’s proxies stock benchmarks Hang Seng Index, Hang Seng TECH Index & Hang Seng China Enterprises Index outperformed intraday against the mainland “A” shares benchmark CSI 300.

China’s Q2 GDP growth came in below expectations at 6.3% year-on-year versus consensus estimates of 7.3% but above Q1 of 4.5%; 0.8% growth for Q2 on a quarter-on-quarter basis, below Q1’s 2.2% (q/q). Retail sales for June tumbled to single-digit growth of 3.1% year-on-year from 12.7% recorded in May, its steepest growth deceleration since December 2022, almost on par with expectations of 3.2%. On the other hand, industrial production rose to 4.4% year-on-year in June, above expectations of 2.7%, and May’s reading of 3.5%, its highest growth rate since October 2022.

The labour market for youth has remained worrisome, the youth unemployment rate for 16 to 24 years old accelerated to 21.3% in June, a new high from 20.8% in May, that’s around four times the nationwide unemployment rate that remained steady at 5.2% in June.

The growth deceleration in retail sales and continued uptick in youth unemployment have further reinforced the ongoing weak internal demand environment in China since March this year that dented consumer confidence and increased the risk of a deflationary spiral.

A liquidity trap scenario is likely to see less marginal benefits from interest rate cuts

To negate weak internal demand and eroding consumer confidence, expansionary fiscal stimulus measures are likely to be more effective than more interest rate cuts, and accommodating monetary policy in a deflationary environment reduces the “marginal benefit” from an extra added effort of monetary policy stimulus; a “liquidity trap scenario”.

Hence, it is not surprising for China’s central bank, PBoC to refrain from cutting its key one-year medium-term lending facility today and left it unchanged at 2.65% after a 10-basis point reduction in June, which in turn implies a likely similar no-cut scenario for its decision on the one-year (3.55%) and five-year loan prime rates (4.2%) out later this Thursday.

China “A” shares benchmark CSI 300 dragged down by financial stocks

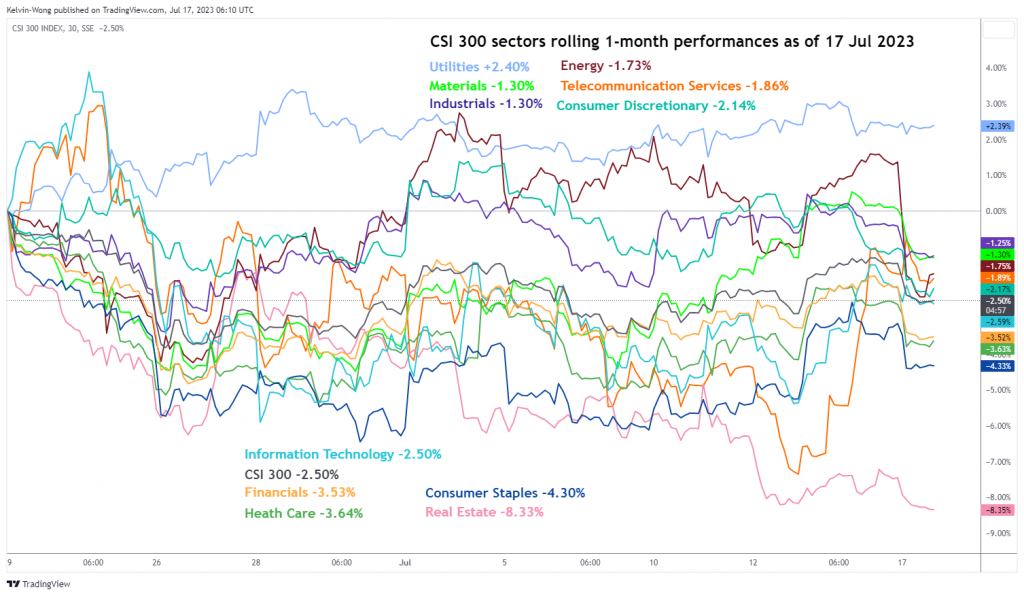

Fig 1: CSI 300 sectors rolling 1-month performance as of 17 Jul 2023 (Source: TradingView, click to enlarge chart)

Interestingly, the China proxies benchmark stock indices listed in Hong Kong do not suffer a steep sell-off; https://www.oanda.com/sg-en/trading/instruments/hk33-hkd/Hang Seng Index (+0.33%), Hang Seng TECH Index (-0.20%), and Hang Seng China Enterprises Index (+0.23%) at this time of the writing.

In contrast, the China mainland “A” shares benchmark stock index, CSI 300 shed -1.1% dragged down by the banks that underperformed intraday likely due to the fear of a “liquidity trap” scenario that led to slower loan growth, the CSI 300 Financials Index shed -1.44% intraday.

monetary

policy

central bank

expansionary

monetary policy

deflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…