Economics

Fun Fisherian Graph

In working on a revision to fiscal theory of the price level chapter 5 on sticky price models, and a revision of "Expectations and the neutrality of interest…

In working on a revision to fiscal theory of the price level chapter 5 on sticky price models, and a revision of “Expectations and the neutrality of interest rates” I came up with this fun impulse-response function. It has an important lesson about interpreting impulse response functions.

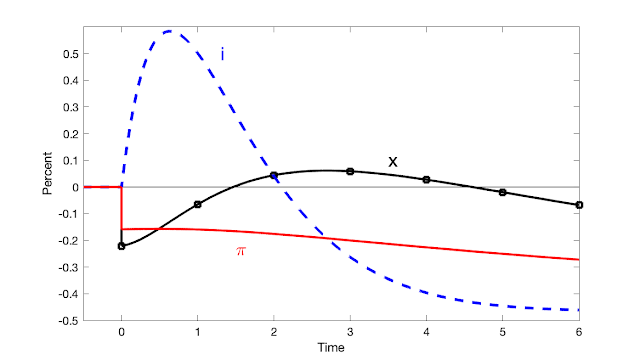

It’s a response to the indicated interest rate path, with no change in fiscal policy, in a simple new-Keynesian model with short-term debt.

Rational expectations new-Keynesian models have the implication that higher interest rates raise inflation in the long run. They also tend to raise inflation in the short run. I’ve been looking for better mechanisms by which higher interest rates might lower inflation in the short run in these models, without adding a contemporaneous fiscal austerity as standard new-Keynesian models do. Fiscal theory explores a model based on long-term debt that does the trick, but has a lot of shortcomings. So I’m looking for something better.

This graph has only short term debt. I generate the pretty interest rate response by hand. It follows (i_t=30e^{-1.2t}-29.5e^{-1.3t}-0.05.) Then I compute inflation and output in response to that interest rate path.

Wow! Higher interest rates lead to high real interest rates, send inflation down, and create a little recession. Once inflation is really lowered, the central bank can lower interest rates. The price level (not shown) falls nearly linearly, as we often see in VARs.

Doesn’t this look a lot like the standard story for the 1980s? A big dose of high real rates lowers inflation, and then the Fed can follow inflation downward and get back to normal at a lower rate.

That analysis is totally wrong! In this model, a higher interest rate always leads to higher inflation in both the short and the long run. Inflation is a two-sided moving average of interest rates with positive coefficients. Inflation declines here in advance of the protracted interest rate decline starting in year 2. Lower future interest rates drag inflation down, despite, not because of the rise in interest rate from year 0 to year 2, and despite, not because of the high real interest rates of that period. Those high real rates add interest costs on the debt and are an inflationary force here. If the central bank wants a disinflation in this model, it will achieve that sooner by simply lowering interest rates immediately. The Fisherian effect will kick in faster, and it will not be fighting the fiscal consequences of higher interest costs on the debt.

Beware facile interpretations of impulse-response functions! It would be easy to read this one as saying high interest rates bring down inflation and cause a recession, and then the central bank can normalize. But that intuition is exactly wrong of the model that produces this graph.

The model is [ begin{align*} E_t dx_{t} & =sigma(i_{t}-pi_{t})dt\ E_t dpi_{t} & =left( rhopi_{t}-kappa x_{t}right) dt \ dv_{t} & =( rv_{t}+i_t-pi_{t}-tilde{s}_{t}) dt end{align*}] Parameters are (kappa = 0.1, sigma = 0.25, rho = 0.1, r = 0.01.) I used a lot of price stickiness and an unrealistically high (rho) to make the graph prettier.

inflation

policy

interest rates

fed

central bank

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…