Economics

FREE WHELAN: This week we’re putting our money where our mouth is

The theory that the biggest quality companies in the world are long-term immune from rate rises based on usual valuation … Read More

The post FREE WHELAN:…

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine money manager.

Writing to you from the school holiday Disaster Recovery site in East Gippsland where the prawns are fresh and the market still continues to tick over.

Always a good chance to get my head around some bigger picture things while away and there is some real gold in my reading list.

Firstly, a while ago there was some things written about the VIX being a handy timer for market overweight/underweight. I was one of them. Lighten when volatility goes below a number and add when panic is properly embedded.

Seemed like an easy way to navigate the year and not be too tied to any corrections.

However volatility didn’t behave in the usual ranges it was meant to. In fact it has slowly declined for most of the year.

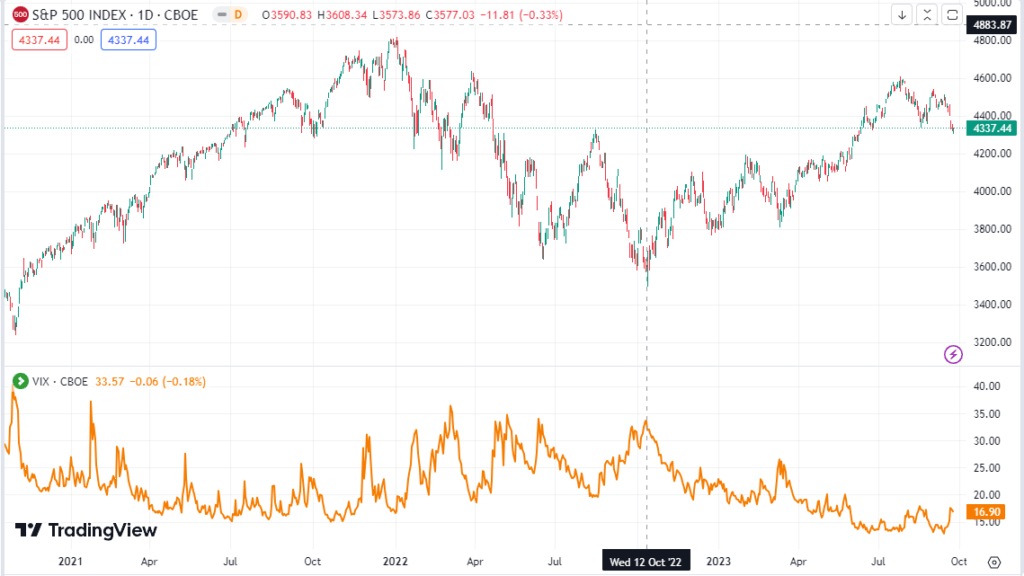

Here is a chart of the S&P 500 with the VIX in the orange line below it dwindling below 20.

Not a lot of signal there.

Options

Not sure why I was thinking about volatility (eight-hour drives will do that to you) but an old guest on the podcast, CIO of QVR, Dr Benn Eifert is (in my opinion) one of the gurus of the options market.

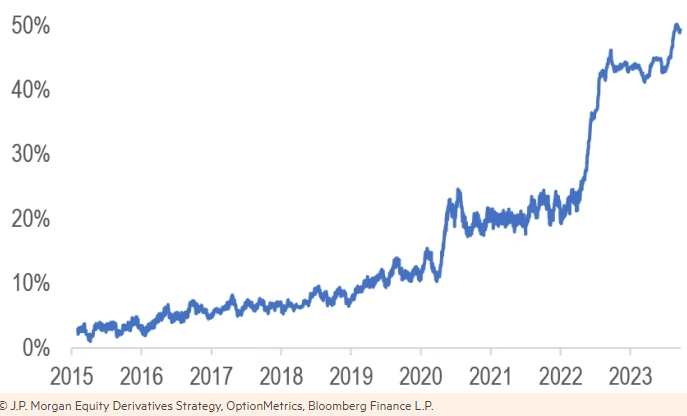

Put really simply, his thesis went that the rise of zero days to expiry options (pure directional trading, no time value left in them) trading is sucking the life out of the VIX.

The VIX is made up of various options contracts and the change in price for them and while I won’t go into the maths of it (because it’s hard) it does say that certain trading in certain options is an indication of higher volatility which is usually indicative of a more panicky market. Markets are usually panicky going down, not up.

0 DTE options aren’t part of that makeup but (according to Benn) their use has detracted away from participants using the usual ones they‘d use which would relate to the VIX.

If this theory holds true that’s not going away. 0 DTE options now make up over 50% of the S&P 500 options volume.

So anyone wanting to point to the VIX to tell you how the market is doing, maybe pump the brakes, okay?

India

More good news from the subcontinent with JP Morgan announcing it will be adding Indian bonds to its emerging market bond indices.

This has taken years and means index trackers will need to allocate to Indian bonds, more flow goes into that market and another big milestone is passed for the fifth largest economy in the world. With more international flow comes a lower cost of borrowing for Indian companies, lowering overall costs and assisting growth.

All great news.

Americaaaah.

Finally, keep an eye on yields.

The US 10-year is now above 4.50% which is the highest in 16 years. Markets are now pricing in more and more that growth is stubborn and inflation therefore stubboner.

You just can’t keep the US down. Just have a look at the US Dollar Index on a weekly chart.

It’s gone up every week since mid July.

Phenomenal.

We are putting our money where our mouth is this week based on the theory that the biggest quality companies in the world are long-term immune from rate rises based on usual valuation methods.

Buying some Nvidia this week on a long term portfolio position.

I continue to bang the table that if you zoom out on a chart and see long term weakness in super-huge, quality, cashed up companies then seriously consider adding them to long-term holdings.

As mentioned, more of a thinking piece today instead of any determined ideas to act on but that’s what the week ahead is for!

All the best and stay safe,

James

PS: A lovely little podcast this week where Heath and I pick markets apart like a pair of red-bellied piranha on a bloated cattle carcass from somewhere upstream.

Listen here, with joy.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

The post FREE WHELAN: This week we’re putting our money where our mouth is appeared first on Stockhead.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…