Economics

Five Top Reasons to Buy Stocks

Five top reasons to buy stocks are validated frequently in my work life. I use those five top reasons to buy stocks about once a month when I weed out…

Five top reasons to buy stocks are validated frequently in my work life.

I use those five top reasons to buy stocks about once a month when I weed out the ones that do not meet those exacting standards of the Five Star Trader advisory service. I provide the names and the rankings of the surviving stocks to Mark Skousen, PhD, who heads Five Star Trader when he is not serving as an economics professor and presidential fellow at Chapman University.

Mark Skousen, head of Five Star Trader and scion of Ben Franklin, talks to Paul Dykewicz.

Five Top Reasons to Buy Stocks: Chose Screen Survivors

The latest screen produced just 25 stocks that met the strict requirements to be worthy of the seasoned stock forecaster’s attention as possible picks in Five Star Trader. I often find more than 50 stocks that make the cut, but the most recent Five Star Trader screen was thin on total numbers amid many reasons for uncertainty.

“Wall Street has continued to struggle in September, especially technology stocks, in the face of stubborn price inflation and the United Autoworkers (UAW) strike,” Skousen wrote to his Forecasts & Strategies investment newsletter subscribers on Monday, Sept. 18. “The Austrian economist Ludwig von Mises was right when he said, ‘Inflation is never neutral.’ When inflation surges, real wages fall behind, and worker strikes are common.”

Skousen questioned whether an economic ‘soft landing” and no recession could be achieved in 2024. Given the Fed’s tight-money policy, new opportunities may not be as plentiful, but they still can be found in the latest Five Star Trader screen, he added.

Five Top Reasons to Buy Stocks: Sales Growth of More than 10%

In the latest screen for the Five Star Trader, a modestly valued and promising educational stock emerged that Skousen quickly recommended within hours of receiving the findings. Skousen’s track record in that service has been strong. How? The screen’s first requirement is that a stock’s achieve sales growth of at least 10% in the last year.

Sales growth is important to attain profit gains. Indeed, sales provide the fuel to rev up a company’s earnings engine.

The best companies usually grow strongly. This part of the Five Star Trader screening process ensures stocks that survive the cut are growing more than 10% annually.

Five Top Reasons to Buy Stocks: Net Profit Margins Top 12%

In the second step of the Five Star Trader screening process, the profit margin requirement is to exceed 12%. That’s not easily accomplished, especially with a recession reportedly brewing.

The companies need to have strong earnings and the 12% threshold eliminates many pretenders from joining the true contenders. Only the strong survive this rigorous raking regimen.

Plus, earnings support share prices. Without potent profits, a stock can fizzle even if it has risen above the rest in the past.

Five Top Reasons to Buy Stocks: Cannot Trade Above 30 Times Earnings

The valuation of a stock is important to avoid overpaying. To avert that risk, no stock survives the Five Star Trader screening process if it trades above 30 times earnings.

For example, if a stock trades at six times earnings, it only needs to go to 12 times earnings to double in value.

I don’t know anyone who wants to overpay, especially when buying investments. Faddish “momentum” stocks can stumble in trying to meet this standard.

Five Top Reasons to Buy Stocks: Earnings Per Share Growth Must Top 25%

Earnings per share growth is an important metric in valuation. The higher the earnings per share (EPS) growth, the better the prospects for a stock to boost its share price.

Investors naturally want to produce a profit on investments, so buying stocks with such a high earnings per share growth rate in the past year positions a company to deliver strong results.

This metric further rewards companies that repurchase shares to boost their EPS growth rate. Just as with net profit margins, earnings per share growth is a key driver of future success.

Five Top Reasons to Buy Stocks: Short Interest Cannot Exceed 10%

Tesla (NASDAQ: TSLA) and SpaceX Founder and Chief Executive Officer Elon Musk told Walter Isaacson for the biographer’s new book about the entrepreneur that they are leeches on the “neck of business.” In the new book, “Elon Musk,” the author shared other colorful stories of Musk’s dislike of short sellers.

Indeed, certain investors specialize in selling stocks short to profit from falling or overblown share prices. Many prominent short sellers publicize their negative views on certain companies to push their share prices down further.

A company that has more than 10% short interest could be facing danger. To avoid short selling fallout, the Five Star Trader screen rejects any stocks that do not have short selling interest below that mark.

As Musk has proven, the presence of short sellers is not necessarily a death knell for a stock. I invested in Arbor Realty Trust (NYSE: ABR), of Uniondale, New York, when certain short sellers were criticizing the company and claiming it was vulnerable to the commercial real estate market softening amid the pandemic-related work-from-home trend.

Since I took the short selling noise in stride and stuck with traditional valuation and analysis as my guide, the stock has rewarded me. It has risen 4.78% in the past month, 16.8% in the past three months and 29.04% so far this year through Sept. 19.

I need to credit Bryan Perry, who heads the Cash Machine high-income investment newsletter, for his recommendation of ABR. He urged investors to buy the stock while it was on sale due to the short sellers trying to drive the share price down. I paid attention and the returns I cited show that I reaped the rewards.

Bryan Perry heads the Cash Machine investment newsletter.

Five Ways to Choose Dividend Stocks: Professor Skousen Shows Success

Skousen uses further personal screening tools to choose his recommendations from the stocks that survive the screen each month. One of those techniques is to check a stock’s price/earnings to growth (PEG) ratio, as he did to choose his latest recommendation.

The PEG ratio is calculated by using a stock’s price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time. Skousen writes that any PEG ratio under 1 is a “screaming buy.” His latest recommendation showed a PEG ratio of only 0.56. Income lovers will like that the stock also pays a dividend.

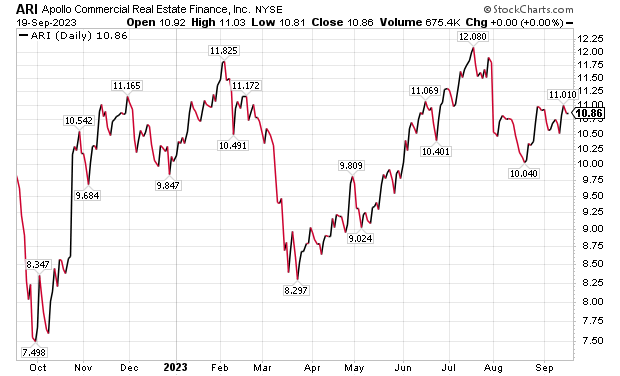

Dividend stocks that have been recommended profitably in Five Star Trader include Apollo Real Estate Finance Income (NYSE: ARI), a New York-based real estate investment trust that primarily originates and invests in senior mortgages, mezzanine loans and other commercial real estate-related debt investments. The recommendation led to a 10.62% in less than three months.

Chart courtesy of www.stockcharts.com

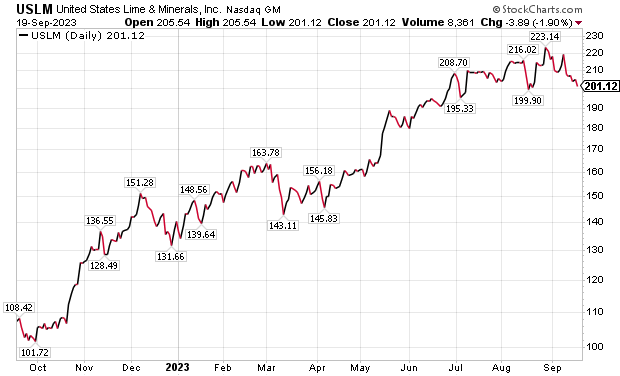

Another example of a successful dividend stock transaction in Five Star Trader involved United States Lime & Minerals, Inc. (NASDAQ: USLM), of Dallas, Texas. Its business has lime and limestone operations and natural gas interests. USLM turned a profit of nearly 4.5% in only 44 days as a pick in Five Star Trader.

Chart courtesy of www.stockcharts.com

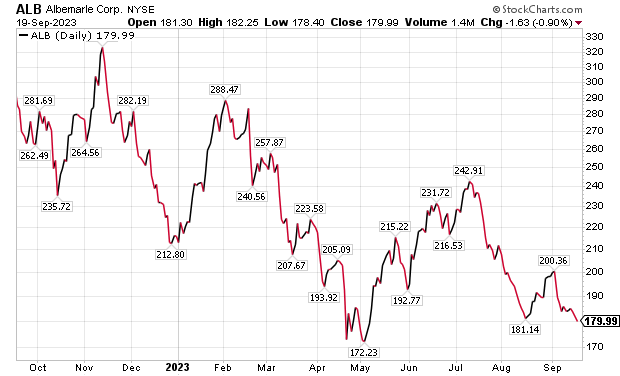

Another winning trade featured Albemarle Corporation (NYSE; ALB), a specialty chemicals company in Charlotte, North Carolina. The stock gained 13.23% in just 45 days before it was sold on June 23. Related options recommendations averaged a gain of 78.99%.

Chart courtesy of www.stockcharts.com

Amid Russia’s continuing war in Ukraine and the defending nation’s recent gains during its counteroffensive, political risk is significant right now. Investors seeking to shift the odds in their favor may appreciate the merit of the Five Star Trader screening process.

The Five Star Trader screen could be especially useful if the economy slides into a recession in 2024, even a mild one. At such times, a successful formula for picking stocks and options, particularly those that are not well known, could reward investors even if other equities fade.

Paul Dykewicz, www.pauldykewicz.com, is an award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Crain Communications, Seeking Alpha, Guru Focus and other publications and websites. Paul can be followed on Twitter @PaulDykewicz, and is the editor and a columnist at StockInvestor.com and DividendInvestor.com. He also serves as editorial director of Eagle Financial Publications in Washington, D.C. In that role, he edits monthly investment newsletters, time-sensitive trading alerts, free weekly e-letters and other reports. Previously, Paul served as business editor and a columnist at Baltimore’s Daily Record newspaper and as a reporter at the Baltimore Business Journal. Plus, Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many other sports figures. To buy signed and specially dedicated copies, call 202-677-4457.

The post Five Top Reasons to Buy Stocks appeared first on Stock Investor.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…