Economics

Finding the new rate hikes hard to digest? Look at the mess they’ve made of US and EU markets

It’s an early night for European stocks which have suffered some devastating outflows here on Thursday thanks to the European … Read More

The post…

It’s an early night for European stocks which have suffered some devastating outflows here on Thursday thanks to the European Central Bank’s (ECB) newly aggressive tone, with some of the post rate hike press conference remarks from the central bank’s Christine Lagarde striking a particularly spicy tone.

European sharemarkets just posted their worst session in six months on Thursday night as investors fled en masse for the commodes.

Just hours after Olde Europe betrayed some brief signs of life with a win to France in the kicking game, markets had to get up again to face the biggest day in Euro-central banking since Dominique Gaston André Strauss-Kahn – also known as DSK – the ex-managing director of the International Monetary Fund (IMF) in Europe, disgraced old Europeans in a New York hotel.

Limoges, France: The capital of Limousin, outside La Place de la Republique about 6 hours after France secured back to back World Cup Finals. Via Stockhead.

Monetary melancholy

It was a monetary policy nightmare with big-ass decisions from the Bank of England (BoE), European Central Bank and well, the Swiss National Bank.

We ended up with a hat-trick of 50 basis point interest rate hikes.

The dash to cash follows some sharp losses across unhappy global markets, which fell following a one, two, three string of central bank rate hits beginning with the US Fed’s revivified policy determination.

Fed chair J Powell started handing out the first packets of sodium picosulfate with the promise that there’s not only still a “ways to go” after lifting rates by 50bps to a 14-year high on Wednesday, but swearing upon the life of his firstborn that the US central bank won’t back down from the inflationary stand off until there’s a clear winner (which isn’t inflation.)

The Fed’s now revamped its targeted rate to between 4.25% and 4.50%.

This suggests a higher-than-expected terminal rate of 5.1%, making further fools of analysts and economists, dashing the hopes of an early 2023 reversal, and tearing the arse out of the Nasdaq and the other two major US indices.

As it stands, the pan-European Stoxx 600 index closed 2.8% lower, in France and Germany both bourses lost 3%.

Tech stocks leading the bleeding down almost 5%.

French and German markets extended their toilet time as the sight of ECB president Lagarde added laxatives to the lifting, telling nauseous reporters to expect “steady” and “significant” rate hikes for the forseeable future.

“We’re not slowing down,” she said, “we’re in for the long game.”

Wall Street

In the states, the major markets all took a major dump overnight.

The Dow Jones has given up the most weight in one session since September.

“The US Federal Reserve’s guidance for protracted policy tightening reduced hopes of the rate‑hike cycle ending anytime soon and increased worries about a potential recession,” says the CBA’s Harry Otley.

With an hour before the close, the Dow Jones index was down by more than 2.2%. The S&P 500 index 2.4% and the index out on point for this kind of stuff – the tech-heavy Nasdaq dropped a massive and just unpleasant 3.23%.

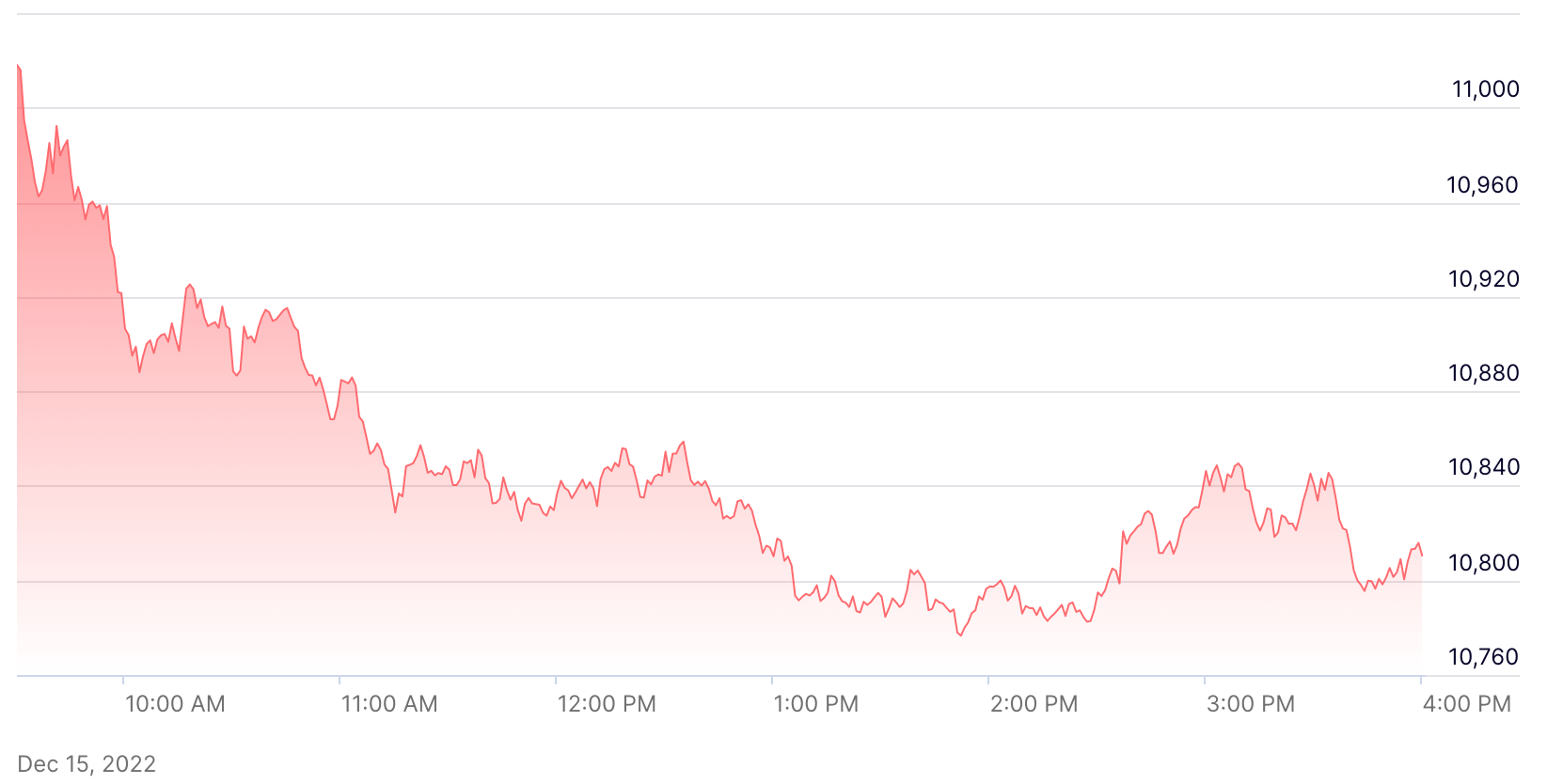

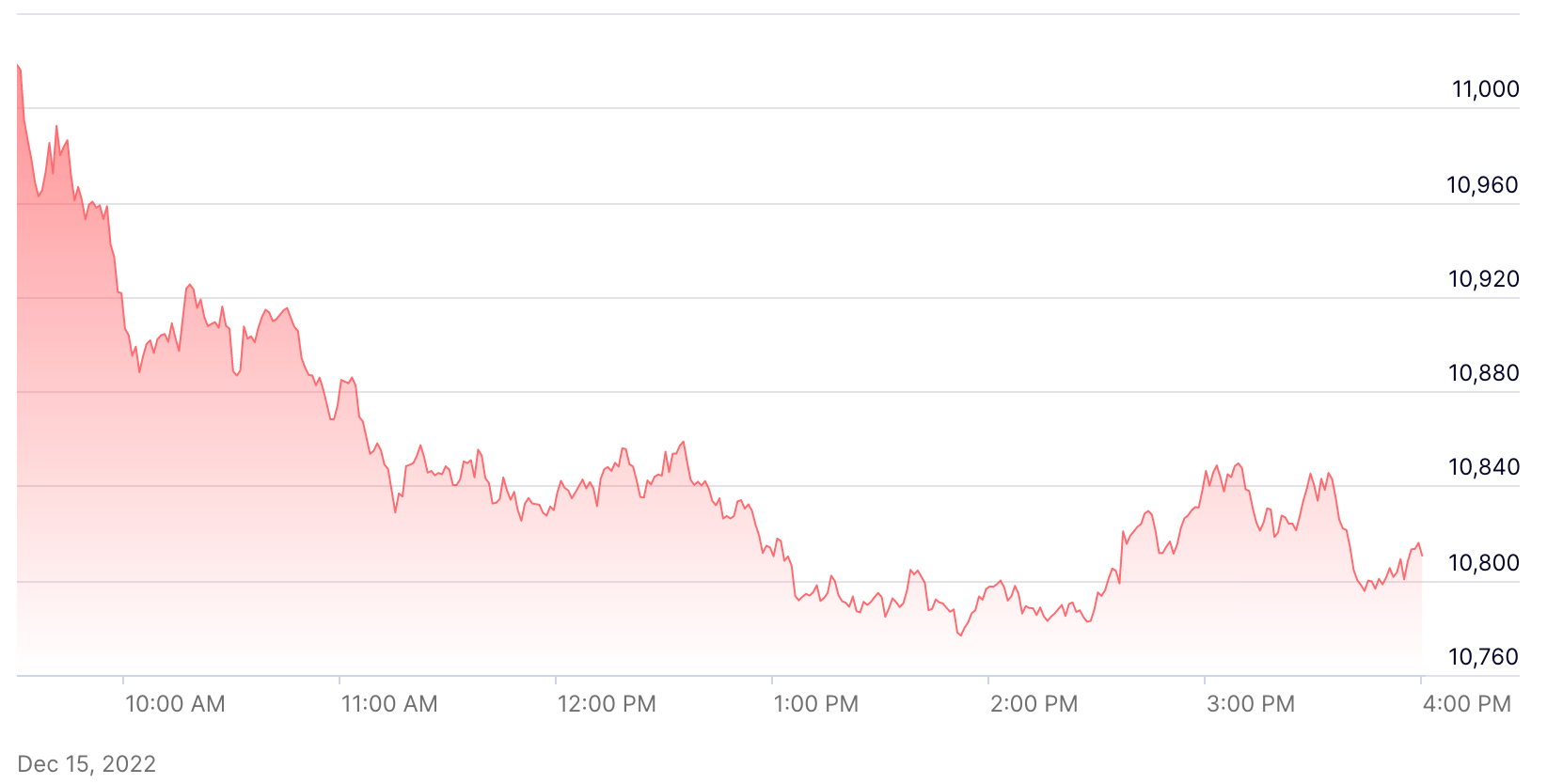

The Nasdaq session looks like this:

The post Finding the new rate hikes hard to digest? Look at the mess they’ve made of US and EU markets appeared first on Stockhead.

inflation

monetary

markets

reserve

policy

fed

central bank

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…