Economics

Federal Tax Haul Nears Record-High Share Of GDP

Federal Tax Haul Nears Record-High Share Of GDP

Federal tax collections are surging — not only in absolute terms, but also as a share of…

Federal Tax Haul Nears Record-High Share Of GDP

Federal tax collections are surging — not only in absolute terms, but also as a share of the nation’s output.

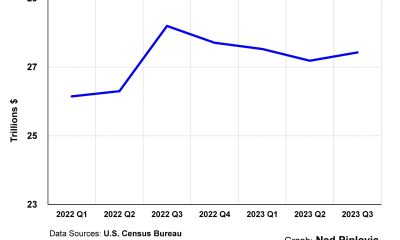

According to a Tax Foundation analysis of Congressional Budget Office data, the U.S. government’s confiscation of wealth soared 21% in the 2022 fiscal year that ended on Sept. 30.

In all, the feds took a record $4.9 trillion — $850 billion more than the $4.05 trillion in 2021, which was itself a record.

That represents about 19.6% of GDP, which is close to a previous peak that accompanied the FY 2000 dot-com bubble. It’s also within shouting distance of the all-time high of 20.5% set during World War II.

What’s most troubling about the record tax haul is that it was accompanied by a $1.4 trillion budget deficit, which helped push the U.S. national debt over $31 trillion this month — not counting the unfunded liabilities associated with Social Security, Medicare and other entitlement programs.

Meanwhile, according to the Committee for a Responsible Federal Budget, policies enacted by the Biden administration will add more than $4.8 trillion to deficits between 2021 and 2031. As Veronique de Rugy points out at Reason, that’s before counting the impact of Biden’s student-loan forgiveness order, which will cost another $400 billion.

And imagine how much bleaker the federal financials are about to look as rising interest rates increase the government’s cost of servicing its enormous pile of IOUs.

Overnight the yield on the 10-year U.S. Treasury hit 4% for the first time since April 2010. When the yield rises above 4.014%, it’ll be the highest since Oct. 2008. At that time the #NationalDebt was still under $10 trillion. Now it’s over $31 trillion. Financial crisis on deck!

— Peter Schiff (@PeterSchiff) October 11, 2022

The juxtaposition of a record-high tax haul and an enormous deficit validates an axiom attributed to Milton Friedman:

“History shows that, over a long period of time, government will spend whatever the tax system raises plus as much more as it can get away with.”

With that in mind, the FY2022 results should galvanize those of us who adhere to a “starve the beast” philosophy — that is, supporting policies that reduce taxes wherever possible, contentedly disregarding objections that tax cuts are “fiscally irresponsible.”

Tyler Durden

Sat, 10/15/2022 – 17:00

interest rates

bubble

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…