Economics

Federal Reserve – “moderate the pace of our rate increases”

In today’s edition of “everybody has to be a closet macroeconomist to invest in this market”, we have the following speech from the Fed with the…

In today’s edition of “everybody has to be a closet macroeconomist to invest in this market”, we have the following speech from the Fed with the following payload in the last paragraph, and the bold-font is my own:

“Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

This is the so-called “pivot” that everybody was waiting for and markets exploded in reaction – the fed funds curve shot down, long-term bonds went up (yields down), “risk-on” stocks ramped up (check out AMC!), etc, etc.

This likely means that the December 14 Fed announcement will involve a rate hike from 3.75-4.00% to 4.25%-4.50% and perhaps another quarter point up on February 1st. At this point, the statement of “moderate the pace” does not really matter since January 2022 to today has been the sharpest interest rate acceleration for nearly 40 years.

In Canada, the December 7 announcement will likely involve a quarter point increase to 4% from 3.75%.

There is this implicit notion that stamping down on demand through the monetary policy levers will result in decreased inflation.

My question is on the supply side. Skilled labour, land titles, and imports of stuff from China (aside from the common discretionary goods that you typically see at the entrance of Costco – let me tell you those 60 inch televisions are damn cheap!) are not increasing in quantity.

You can actually infer this from a couple places.

One is walking into the dollar store. While $1 is now a distant memory of the pre-Covid era, what you can get now for $1.25 at the local Dollarama (TSX: DOL) is even less than before. Mind you, there is a reason why they’re trading at nosebleed valuations – customers will still pay up because they can’t afford it anywhere else!

The second place to make some inferences is Amazon. I’ve noticed the typical bulk re-marketed imports from China (ones that aren’t destined for Dollarama, an amazing retailer that Amazon-proofed itself) becoming significantly more expensive than a few years ago. A good example is reasonable-quality bike lights. There are plenty of others.

Of course, going through Costco or Amazon is not representative of a whole economy, but they are two small data points to consider. It leads to the narrative-breaking question of – what if monetary policy cannot cure consumer price index inflation? What if the central banks level off their interest rates, and wait for the effects to come in, and inflation does not wane?

I’m not saying this will happen, but rather that the narrative of the central banks once again going into a loosening mode to cause the markets to skyrocket in value might be premature.

There are a few other cross-currents I would like to illustrate.

One is challenging the assumption that higher interest rates will stomp down on demand, especially on consumer goods. The Bank of Canada has made considerable efforts as of late to try to avoid ‘entrenched inflation expectations’, especially around avoiding the wage inflation spiral. However, if the mentality of inflation is already in the minds of many, logically speaking this would mean to purchase real goods before the price of it increases… due to inflation. Every time I walk through Costco (always a mad-house), I wonder how much purchasing goes on with this psychology in mind.

Another item missing from the equation is the effect of quantitative tightening. While banks still have plenty of reserves stored up in central banks, there is a slow and steady liquidity withdrawal from the market. One positive tailwind is that government fiscal situations have improved with the inflation and hence there is less competition for financing when the governments to go the bond market to roll over their debt.

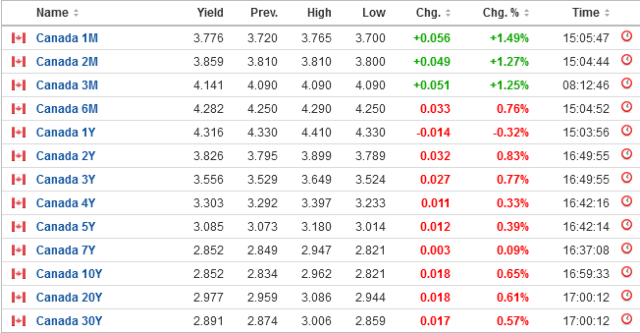

Finally, the omnipresent yield curve inversion. It is extremely inverted.

30-Year Canadian yields peaked at 3.7% back in October. Today they are at 2.9% (an investor in a long-term bond ETF like XLB would have made a quick 15%). However, today, a fixed income investor has to decide whether to get 4.3% out of their 1-year money (or even higher if you go GIC shopping) versus a lower long-term rate.

This reminds me of the scenario in the early 80’s where an investor had a choice of taking 20% for 1-year money, or 15% for 30-year money. Emotionally it feels very difficult to take the lesser 15%, but these people would have made out very, very, very well with that decision.

Something makes me think that today is a similar situation.

However, 2.9% is a really low, and nominal, rate of return. The game has fundamentally changed since the early 80’s and we are forced into the asset market casino to keep up with inflation instead of being able to rely on fixed income for sustenance. In the early 80’s if you invested a million dollars in those 30-year government bonds, you have a $150k cash stream for 30 years, plenty enough to live on even after taxes. Today, that same investment yields $29k/year, which in terms of purchasing power, can’t even buy you a Toyota Corolla these days.

This is not a good sign. It is a sign of an economy that is really struggling to make returns on capital. It is why banks have such gigantic reserves at central banks at the moment – it is too risky to lend.

There are a lot of cross-currents and this is confusing me. Normally for investing you want to ensure that your sails are facing the macroeconomic winds and right now I have a limited read on the situation. In terms of portfolio action, I am comforted that cash once again is giving something, but my appetite for risk at the moment is quite muted.

dollar

inflation

monetary

markets

reserve

policy

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…