Economics

Fed Gets Its Wish: Inflation Below The Funds Rate… & Final Sales Too!

Fed Gets Its Wish: Inflation Below The Funds Rate… & Final Sales Too!

Authored by Steven Blitz via TS Lombard,

Most important takeaway…

Fed Gets Its Wish: Inflation Below The Funds Rate… & Final Sales Too!

Authored by Steven Blitz via TS Lombard,

Most important takeaway from Q4 GDP data is that short rates are finally above inflation and nominal growth for final sales of domestic product. “Tight” is a matter of opinion, but monetary policy is no longer “easy” and now getting “tighter” — growth and inflation decelerated through the quarter. My expectation of a mild recession beginning in Q2 appears on track. There is the swing to positive real rates, the beginnings of a mild inventory correction, and the “asset crunch” softening growth on into the current quarter (I wrote how the asset cycle changes how monetary policy works in Oct 2019). Next week’s 25 BP hike has all the earmarks of being the last hike. Cuts arrive once employment turns negative, or even just softens to 100,000/month. Getting the dollar weaker will become an unspoken objective – the trade deficit is much too big given government policy aimed at reshoring production. Recession and the inventory cycle will fix the deficit to an extent, but it is the wide policy spread between the US and its major trading partners that needs to narrow – and the turn in US growth will negatively impact the global economy.

My 3% forecast for Q4 growth came in on target. Based on the flow of growth through the quarter and how Q4 GDP growth was put together (2/3 coming from inventory and government spending), I am sticking with 1% for Q1 – will have a closer look tomorrow after Dec income data are released.

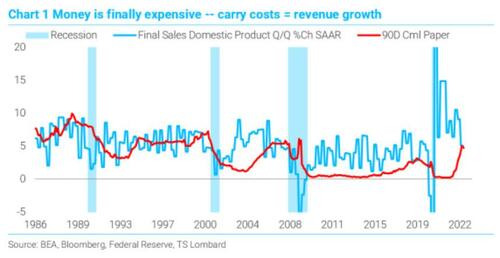

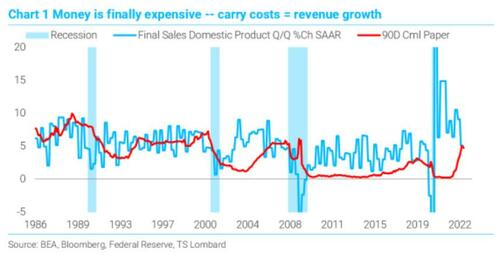

The spread between Q/Q growth in final sales of production (revenue proxy) and 90D commercial paper rates (cost of carry for inventory) is now essentially zero and very likely flips negative in the current quarter. In the cycles beginning 2002, the Fed kept money too cheap too long, ramped up rates late in the cycle, and recessions arrived after this spread turned negative – which should happen in the current quarter (Chart 1).

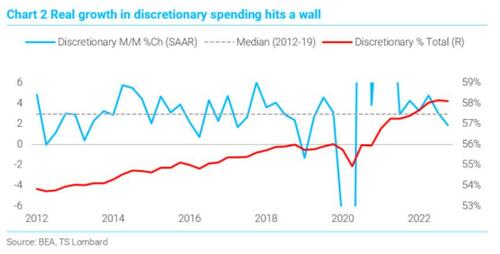

Real discretionary consumer spending slowed to 1.8% Q/Q SAAR in Q4, down from 3% in Q3 and well through the median 2.9% (2012-2019). Discretionary spending has also topped out relative to total spending – often a precursor to recession.

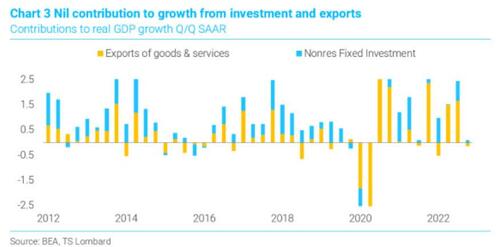

Capital spending (nonresidential) and exports are critical to sustaining growth going forward, and their contribution to growth in Q4 was nil. It is true housing has stabilized, looking at new home sales at the long-term median. Watch in the coming months to see whether sales start dropping towards 500,000. This, not the decline to date, would signal recession.

In sum, the natural slowing of the economy from 2021’s torrid pace has finally delivered to the Fed what it has been waiting for – inflation 100BP below its policy rate and spending decelerating to below trend.

The impact on employment should be in evidence sometime in the next few months.

This all sets up for a mild recession or, failing that, enough of a soft patch for the Fed to cut regardless and thereby raising inflation risk later. But one step at a time.

Tyler Durden

Sun, 01/29/2023 – 10:30

dollar

inflation

monetary

policy

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…