Economics

Fed Chair Jerome Powell: The Jackass

Unmasking the Idiotic Moves of Fed Chair Jerome Powell March 12, 2023 Jerome Powell, the Chairman of the Federal Reserve, has proven to be a jackass of…

Unmasking the Idiotic Moves of Fed Chair Jerome Powell

March 12, 2023

Jerome Powell, the Chairman of the Federal Reserve, has proven to be a jackass of epic proportions. After the COVID crash, he pushed an unrelenting quantitative easing program that led to a boom phase. He even had the audacity to state that a bit of inflation was good. But now that he got his wish and inflation is running rampant, he wants to battle the monster he created. To call him an idiot would be an act of kindness. His incompetence could push us into a recession, and companies continue to fire people.

The Fed’s monetary policy profoundly affects the economy, and Powell’s misguided actions are causing significant harm. His approach to monetary policy has been nothing short of reckless. Rather than addressing the root causes of the economic downturn, Powell flooded the market with money, creating a false sense of prosperity.

This approach has not worked, and we now see his actions’ consequences. Inflation is rampant, and businesses are struggling to keep up with rising costs. Many companies have had to lay off workers to stay afloat, and the unemployment rate is still high.

But perhaps the most frustrating aspect of Powell’s leadership is his inconsistency. After creating inflation, he is now trying to destroy it. This could push us into a recession and cause even more harm to the economy. It is a classic case of “too little, too late.”

Fed Chair Jerome Powell: Destroying Inflation He Created

To make matters worse, Powell’s actions have made it difficult for investors to make informed decisions. Market technicians, contrarians, and value investors have all been fooled by the new market system. Traditional indicators no longer provide accurate predictions of the market’s movements. This applies to both fundamental and technical analysis.

To deal with the swings, investors must take a contrarian approach. They must examine the speed at which the masses are jumping in, how many of them are jumping relatively to the volume that was doing nothing just a few months ago, how much staying power they have, and so forth.

This sentiment analysis is crucial for investors to make informed decisions. If the masses are jumping in after sitting out for a long time, assuming they have collected a lot of money while sitting on the sidelines would be fair. The sentiment must reach the boiling point, and everyone must be foaming at the mouth before the market puts in a long-term top. It would not be prudent to take a cautious approach at this time.

Markets are likely to test their 2022 Lows.

After conducting a thorough analysis of current market trends and the psychology of market participants, it has become increasingly clear that the markets may soon test the lows witnessed in 2022, and there is a possibility of at least one index trading to new lows. In this scenario, it would be wise to exercise caution and remain primarily in cash while waiting for a more opportune moment to open long positions.

While jumping into the market during a downturn can be tempting, the current situation calls for a more calculated approach. Considering the bigger picture and the potential risks associated with the market’s volatile nature is essential. By staying patient and strategically waiting for the right moment, investors can position themselves to take advantage of the market’s eventual upswing while minimizing potential losses.

Federal Reserve Chair Jerome Powell’s actions have contributed to the current state of the market, and his recent efforts to combat inflation may result in further instability. As investors, we must remain informed of significant developments that may impact the market’s trajectory and adjust our strategies accordingly.

In conclusion, trading requires a strategic and disciplined approach to navigate the ever-changing landscape of the stock market. Staying informed, patient, and disciplined while diversifying our investments can lead to long-term success and mitigate potential losses.

Research

These sources discuss how Fed Chair Jerome Powell’s interest rate policy led to a market meltdown and could lead to a recession.

- “Why Fed Chair Jerome Powell’s Inflation Strategy Could Trigger a Stock Market Meltdown” by Money Morning: https://moneymorning.com/2021/07/20/why-the-feds-inflation-strategy-could-trigger-a-stock-market-meltdown/

- “Why Raising Interest Rates Could Trigger a Market Meltdown” by CNBC: https://www.cnbc.com/2022/03/10/why-raising-interest-rates-could-trigger-a-market-meltdown.html

- “Why Jerome Powell is Treading Carefully on Interest Rates” by The New York Times: https://www.nytimes.com/2021/11/11/business/jerome-powell-interest-rates.html

- “Interest Rates Are Rising. What Could It Mean for the Stock Market?” by The Wall Street Journal: https://www.wsj.com/articles/interest-rates-are-rising-what-could-it-mean-for-the-stock-market-11649952600

- “Higher Interest Rates Could Spell Disaster for the Stock Market” by MarketWatch: https://www.marketwatch.com/story/higher-interest-rates-could-spell-disaster-for-the-stock-market-11646225876.

.

Other Articles Of Interest

Fed Chair Jerome Powell: The Jackass

Read More

AMD Stock Forecast: How MACDs & RSI Signal a Bottom

Read More

Stock Market bottom: The Role of Sentiment

Read More

Technological Progress

Read More

Exploring the Depths of the Unconscious Mind

Read More

The Cycle of Manipulation in Investments

Read More

Is everyone losing money in the stock market?

Read More

Short-Term vs Long-Term Investing Strategies

Read More

Understanding the Kansas City Financial Stress Index

Read More

Minimize the Risk of Losing Money in the Stock Market

Read More

Securing Your Future: The Power of Long-Term Investments

Read More

Investment style: Going Against the Grain

Read More

Mastering Money: Your Financial Playbook

Read More

The Importance of Keeping a Trading Journal

Read More

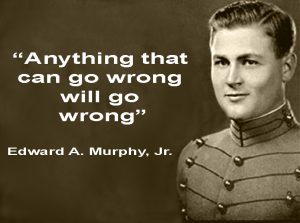

Exploring the Intersection of Investing & Murphy’s Law

Read More

War of Attrition: Strategies for Thriving in Times of Crisis

Read More

Dow Jones Outlook: Understanding the Dangers & Rewards of Crisis Investing

Read More

Financial Stress: The Surprising Opportunity for Savvy Investors

Read More

Financial anxiety: Follow The Trend

Read More

Investment Opportunity & Market Crashes

Read More

Copper outlook VIA CPER

Read More

The post Fed Chair Jerome Powell: The Jackass appeared first on Tactical Investor.

gold

inflation

monetary

markets

reserve

policy

interest rates

fed

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…