Economics

Eurozone PMIs “Paint A Disheartening Picture” Of The Economy

Eurozone PMIs "Paint A Disheartening Picture" Of The Economy

On the heels of Christina Lagarde’s more-hawkish-than-The-Fed comments yesterday,…

Eurozone PMIs “Paint A Disheartening Picture” Of The Economy

On the heels of Christina Lagarde’s more-hawkish-than-The-Fed comments yesterday, the European Union’s economy appears to be deteriorating faster than anticipated.

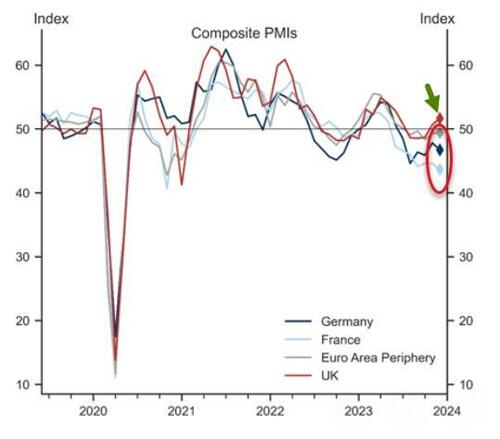

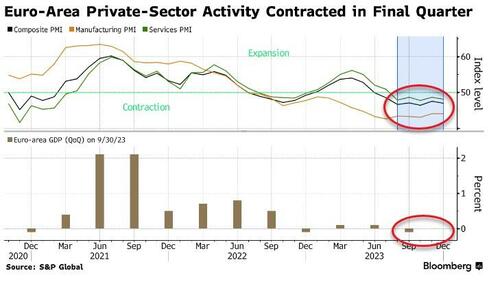

The Euro area composite flash PMI fell by 0.6pt to 47.0 in December, below expectation, raising the risk that the region may experience a recession in the second half.

“Once again, the figures paint a disheartening picture as the Eurozone economy fails to display any distinct signs of recovery,” adding that,

“On the contrary, it has contracted for six straight months. The likelihood of the Eurozone being in a recession since the third quarter remains notably high.“

The decline in the composite index was broad-based across sectors, with the manufacturing output index falling (by 0.5pt) to 44.1, and the services activity index falling (by 0.7pt) to 48.1.

The composition of the December report showed the new orders and backlogs indices broadly unchanged, with the new export orders index declining.

The employment index printed at below 50 for the third consecutive month, as firms, according to the press release, “scaled back operating capacity in line with the worsening order book situation”

Firms’ future output expectations continued improving for the third month in a row, driven by firms “growing more optimistic regarding the year-ahead outlook for output in December, with sentiment at its brightest since August”, although this was limited to the manufacturing sector.

“The survey suggests the broader picture is one of an economy still contracting. That creates downside risks for our forecasts as well as the European Central Bank’s and should keep market expectations for an interest-rate reduction before June alive,” said David Powell, Bloomberg economist.

Turning to price pressures, the input price component edged down slightly, but remains well into expansionary territory, while the output price component grew again in both sectors.

Across the various Euro area regions:

-

France: The French composite flash PMI decreased by 0.9pt to 43.7 in December, below consensus and our expectations. The decline was driven by both sectors, though largely skewed towards the services sector, where the index fell (by 1.1pt) to 44.3.

-

Germany: The German composite flash PMI decreased by 1.1pt to 46.7 in December, below consensus and our expectations. The deceleration was driven by both sectors, though skewed towards the services sector, where the index fell (by 1.2pt) to 48.4.

-

Periphery: The periphery composite PMI increased by 0.1pt to 49.4, driven by the services sector, where the index rose (by 0.2pt) to 50.7.

Separate data for the UK showed companies saw the strongest rebound in output in six months, reflecting more stable borrowing costs and higher demand for services.

Goldman notes three main takeaways from today’s data.

-

First, while we see renewed weakness in Euro area activity, we remain cautiously optimistic for the way ahead, based on the continued improvement in forward-looking indicators across the board. However, we will monitor near-term services activity developments closely, since the December weakness is mostly driven by the services sector.

-

Second, while we continue to see selling prices on the rise everywhere in the Euro area except for France, we no longer observe the intensification in input costs inflation recorded in November, with input price dynamics being quite mixed in the Euro area in December.

-

Third, UK growth momentum continues to pick up, driven by the services sector, with sentiment among firms fairly positive on both consumer demand and business investment. This is now being accompanied by some tentative relief in cost pressures, with the output price index edging down in December.

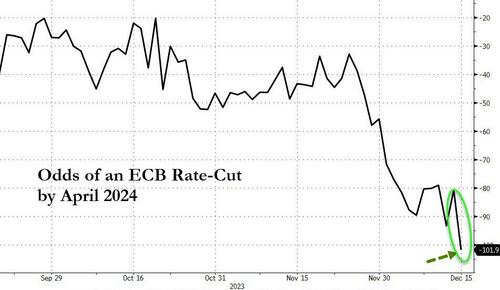

Against the background, the odds of an ECB rate-cut by April have topped 100% for the first time…

Will Christine bend the knee to the market’s will? Or, unlike Powell, can she act apolitically.

Tyler Durden

Fri, 12/15/2023 – 08:07

inflation

fed

central bank

expansionary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…