Economics

EUR/USD Falls as US Dollar Strengthens

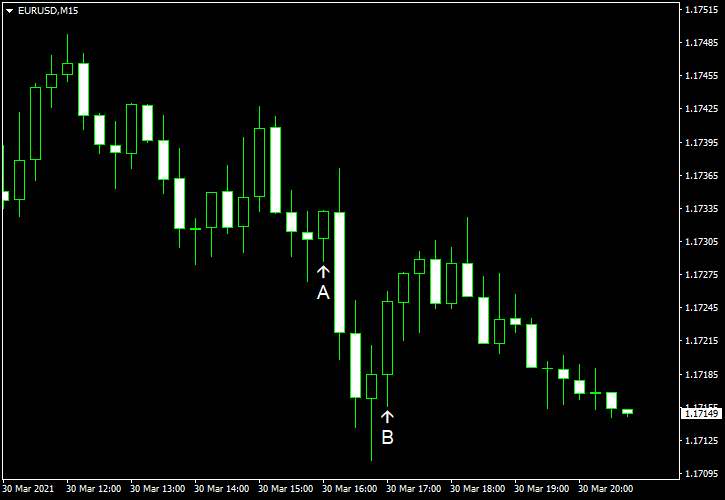

EUR/USD fell today amid the broad-based dollar strength. Market analysts explained the good performance of the US currency by rising US Treasury yields….

EUR/USD fell today amid the

S&P/

Consumer confidence jumped to 109.7 in March from 90.4 in February, much more than analysts had predicted — 96.9. (Event A on the chart.)

On Friday, a couple of reports were released (not shown on the chart.):

Both personal income and spending dropped in February. Personal income fell by 7.1%, less than experts had predicted — 7.3%. Personal spending decreased by 1.0%, more than was forecast — 0.8%. The previous month’s gains got positive revisions from 10.0% to 10.1% for income and from 2.4% to 3.4%. Core PCE inflation was at 0.1%, matching expectations. The previous month’s value got a negative revision from 0.3% to 0.2%.

Michigan Sentiment Index climbed to 84.9 in March from 76.8 in February according to the revised estimate. That is compared with the median forecast of 83.6 and the preliminary figure of 83.0.

If you have any comments on the recent EUR/USD action, please reply using the form below.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…