Economics

EUR/USD – ECB may be convinced to hold in September after latest data

Eurozone Services PMI falls to 48.3 in August (50.5 expected, 50.9 in July) Eurozone Manufacturing PMI rises to 43.7 in August (42.6 expected, 42.7 in…

- Eurozone Services PMI falls to 48.3 in August (50.5 expected, 50.9 in July)

- Eurozone Manufacturing PMI rises to 43.7 in August (42.6 expected, 42.7 in July)

- Euro testing key support against the US dollar

The data from the eurozone was no more promising, particularly Germany – the bloc’s largest economy – which has had a harder year than most and looks likely to continue to do so going into next year.

There was a slight and unexpected improvement in the manufacturing number, albeit from a very low base and it still remains deep in contraction territory. But services contracted against expectations and the number was some way below forecasts and the July reading.

Interest rate probabilities were pared back in the eurozone this morning too, with traders viewing the meeting in a few weeks as a coin toss between standing pat and another 25 basis point hike. Another hike is far from guaranteed in the cycle and today’s data certainly supports the case for pausing to see what impact past tightening has had.

Is EURUSD heading into bearish territory?

The euro has been falling against the greenback for a month or so now, as have many other currencies as the dollar has performed well on the expectation of US rates remaining higher for longer.

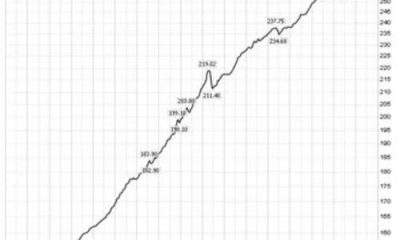

EURUSD Daily

Source – OANDA on Trading View

It’s now fallen back to a level that could tell us whether traders are viewing this as a corrective pattern or a broader reversal. While that is to a large extent a subjective view, there is a train of thought that when it’s trading above the 200-day simple moving average it’s in bullish territory, and below it’s in bearish territory. It’s worth noting there are many other ways to define it too.

The pair is now testing the 200-day SMA from above and this also coincides with the lows from late June and early July. A break of this could be a bearish signal, with the next test coming around the 1.0650-1.07 where the next support level from May coincides with the bottom of the 200/233-day SMA band.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…