Economics

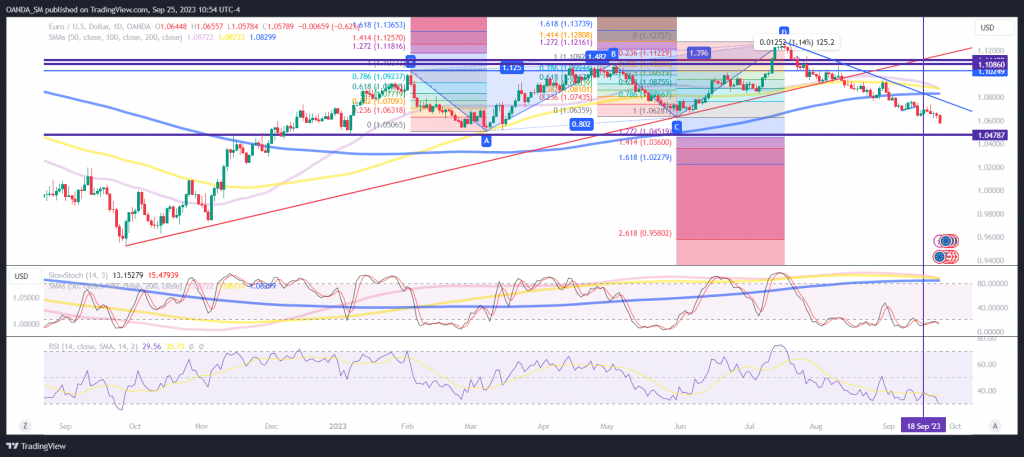

EUR/USD: Dollar rallies alongside surging yields

Fed rate hike expectations for November 1st stand at 18.6% vs 30% from a week ago Germany IFO Business climate declines for a fifth straight month 10-year…

- Fed rate hike expectations for November 1st stand at 18.6% vs 30% from a week ago

- Germany IFO Business climate declines for a fifth straight month

- 10-year Treasury yield surges 7.7bps to 4.511%

The euro softened earlier after an uninspiring German business outlook suggests the eurozone’s largest economy still has a rough road ahead. This was the fifth straight month of declines for Germany’s business confidence. Investors focused on the expectations survey’s slight miss. The IFO economists believe that a third quarter contraction is likely. As long as the ECB is done raising rates, the outlook should gradually improve for Germany.

US dollar strength remains as global bond yields shift higher on fears that central banks will follow the Fed’s lead and keep rates higher over the long-term. It is a slow start to Monday, with one economic release and one Fed speaker, but right now it seems a weaker consumer is steadily getting priced in.

The Chicago Fed National Activity index showed slower growth in August, which didn’t surprise anyone.

Fed’s Goolsbee, one of the more dovish members, noted that the risk of inflation staying too high is the bigger risk. He is still holding onto hopes that a soft landing is possible, but he will likely be data dependent. Inflation flare up risks are growing and that still suggests the Fed might have to do more tightening despite the trajectory of the economy.

Retail/US consumer

Retail stocks, Foot Locker and Urban Outfitters both got downgraded to hold by Jefferies as the consumer is faced with headwinds. Softer spending with apparel and footwear will be driven on the resumption of student loan repayments.

Last week, Bankrate’s survey noted that 40% of Americans feel financially burdened by holiday shopping. Two weeks ago, Deloitte forecasted soft holiday sales.

It is no surprise that the consumer won’t be spending as much this holiday season given excess savings will have disappeared, credit card balances will become crippling with higher rates, and the labor market will be seeing some type of a slowdown.

Sticky inflation which comes with renewed dollar strength risks remain a risk on the table as oil prices appear poised to remain elevated all the way through the winter. Also on the minds of traders is the rising risk of a government shutdown next week.

EUR/USD Daily Chart

The dollar remains king but that could show some signs of exhaustion once the euro falls towards the 1.05 handle. As long the global outlook doesn’t fall apart, the dollar should be nearing a peak.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…