Economics

EUR/USD: Dethroning King Dollar will be hard

The dollar was weaker and US stocks attempted to rally after the bond market selloff started to show some signs of exhaustion. Last night, the 10-year…

The dollar was weaker and US stocks attempted to rally after the bond market selloff started to show some signs of exhaustion. Last night, the 10-year Treasury yield rally stalled out after its second attempt failed at breaking above 4.56%. A little calm in the bond market gave risky assets a modest boost, but that should be short-lived.

A positive surprise with durable goods data was initially viewed as good news for the economy and possibly stocks, but good news is actually bad news for equities. Signs of economic resilience will move the needle in possibly making the Fed deliver more rate hikes. Also weighing on equities is the harsh reality that a tight oil market is not going away and that will be a major headache for the economy. The consumer is going to be in for a rough winter as energy prices are poised to rise even higher.

Costco’s strong earnings didn’t really tell us anything new about the consumer. It looks like Americans are still buying groceries at a strong pace but are buying less big-ticket items. The membership-based warehouse club is nicely positioned as one of the key retail stocks that will outperform its peers when the US consumer becomes more noticeably weaker next year.

Economic Data & Corporate news

– Eurozone’s record money supply shrink is another blow to an already weak economy

– US mortgage demand tumbles as Average 30-year fixed rate surges to 7.41%, highest since 2000

– US durable goods rise on military spending and business spending improved

– Costco results show consumer strength with grocery sales and softness with discretionary items

FX – King dollar will be hard to dethrone

The US dollar is rallying as Treasury yields continue to gain and on expectations the US growth exceptionalism story is not ready to go away.

Earlier the eurozone posted abysmal money supply data that showed the amount of money circulating fell the most on record as banks refrain from lending and as depositors keep their money in savings.

The US economy is poised to weaken here but Wall Street keeps getting upside surprises with too many US economic data points. Today’s upside surprise with durable goods reminded Wall Street that the economy is still holding up. Given the current interest rate environment it is clear that capital spending intentions are going to soften going forward. Until the economic data shows clear weakening labor market trends alongside earnings fears, US rates will stay high and are going to continue to support a stronger dollar.

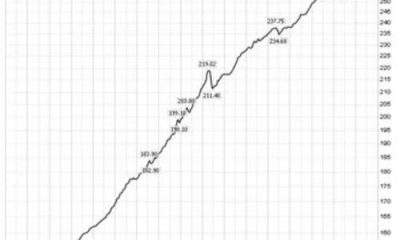

EUR/USD daily chart

Euro weakness has resumed and is currently testing the 1.05 handle. If downward momentum continues, price action might target the 1.04 10 level, which is the 50% retracement of the September 2022 low to the July high. To the upside, the 1.0720 level is key resistance.

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…