Economics

EUR/USD – Bearish developments ahead of the European Central Bank meeting

The ECB meeting on Thursday is not likely to be as straightforward as many have seemed over the last year. Even before we get to the new economic forecasts…

The ECB meeting on Thursday is not likely to be as straightforward as many have seemed over the last year.

Even before we get to the new economic forecasts and what that means for monetary policy over the remainder of the year, there isn’t much of a consensus in the markets around what the decision on interest rates will be tomorrow.

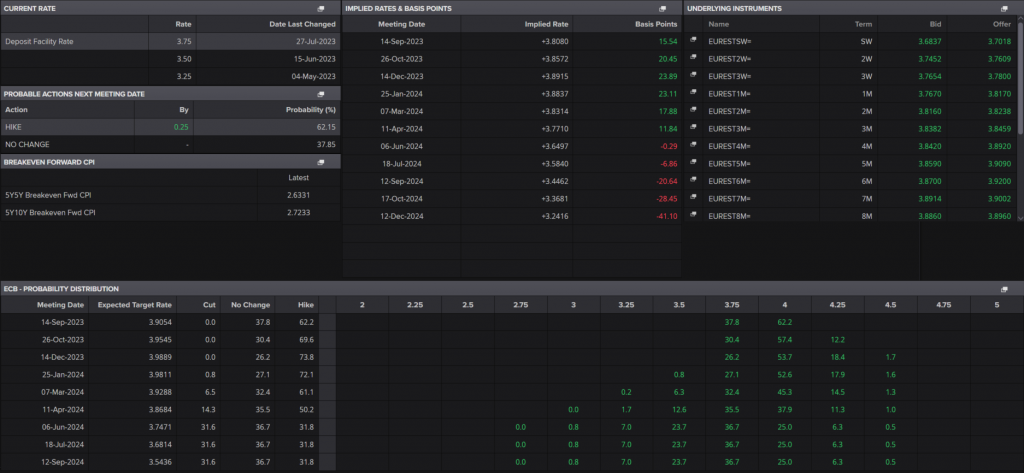

Markets are pricing in a little more than a 60% chance of another rate hike – probably the final one – and almost a 40% chance of a pause, with around a 70% chance that one will still follow at one of the upcoming meetings.

ECB Interest Rate Probability

Source – Refinitiv Eikon

How are markets positioned?

Obviously, with every currency pair, both components have to be taken into consideration but it’s interesting that EURUSD slipped below the 200/233-day simple moving average band a couple of weeks ago and has neither recovered or accelerated lower.

EURUSD Daily

Source – OANDA on Trading View

Perhaps this is a result of some apprehension ahead of the ECB meeting – and today’s US inflation report which triggered some initial volatility but didn’t ultimately swing the pair one way or another – or some slightly dovish positioning in case the ECB opts for its first pause?

That should become clearer tomorrow but with the pair already seeing some resistance around the prior lows – 1.0765 – a dovish outcome could see the pair accelerate lower. A significant move (initial volatility can produce big swings that don’t turn out to be significant) below 1.07 and the most recent lows would be very interesting and may suggest that dovish, and bearish, outcome has occurred.

inflation

monetary

markets

policy

interest rates

central bank

monetary policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…