Economics

ECB Preview: “None Of The Available Options Come Without A Cost”

ECB Preview: "None Of The Available Options Come Without A Cost"

In the aftermath of the Credit Suisse near failure and (insufficient) bailout,…

ECB Preview: “None Of The Available Options Come Without A Cost”

In the aftermath of the Credit Suisse near failure and (insufficient) bailout, today’s ECB decision carries added weight. Here, courtesy of Newsquawk, is a summary of what to expect

- ECB policy announcement due Thursday 16th March; rate decision at 13:15GMT/09:15EDT, press

- conference from 13:45GMT/09:45EDT

- Consensus and market pricing look for a 50bps hike, taking the deposit rate to 3.00%

- Focus will fall on clues over the ECB’s tightening ambitions beyond March

OVERVIEW: Given the comms at the February meeting and the subsequent lack of a walk-back from officials at the Bank, the ECB is unanimously expected to hike the deposit rate by 50bps to 3.0%. As such, greater focus will be on what lies beyond the March meeting for the ECB, with the Bank likely to stress its “meeting-by-meeting” and “datadependent” approach. Since the prior meeting, Eurozone inflation slowed to 8.5% in February from 8.6%, whilst the super-core metric rose to 5.6% from 5.3%; something which is of great concern to policymakers on the Governing Council. This, allied with increasingly hawkish bets surrounding the Fed, had prompted many desks to project the ECB’s terminal rate at 4% (would see 50bps March, 50bps May and then either another 50bps in June or 25bps in June and July). However, the fallout from the the collapse of Silicon Valley Bank, which has prompted a global repricing of monetary policy expectations and subsequently swept up ECB pricing in the process. As such, market pricing (at the time of writing and in relatively volatile trade) looks for a terminal rate of around 3.5% by December vs. a circa 4% rate in the summer previously. The statement is unlikely to be explicit in stating what markets should expect for the coming months, and as such the accompanying macro projections will be of greater interest to the market. On which, ING suggests that lower energy prices, higher 3M Euribor rates and a stronger EUR should lead to lower inflation projections for 2024 and 2025. ING cautions that if this does not materialise, it will underscore the level of concern over core inflation on the Governing Council. From a dovish perspective, a more subdued growth outlook within the projections, could see markets move closer to a lower terminal rate. On the balance sheet, no changes are expected with the current monthly decline of EUR 15bln/month in APP reinvestments set to run until June.

PRIOR MEETING: As expected, the ECB delivered another 50bps hike to the deposit rate and reaffirmed its tightening intentions by stating that it expects to unveil another 50bps adjustment in March. Lagarde stated that this is warranted on account of underlying inflationary pressures, fiscal measures and wage growth. At the March meeting, the ECB stated it will evaluate the subsequent path of its monetary policy. On the balance sheet, the ECB announced that reinvestments will be allocated proportionally to the share of redemptions across each constituent programme of the APP. At the follow-up press conference, Lagarde stated that the Bank’s economic assessment sees risks to the economic outlook and inflation as “more balanced”. In terms of the decision itself, Lagarde says there was a “large consensus”, adding there was a discussion on communication, but not full agreement. For the policy path going forward, Lagarde noted that the ECB will not be at peak rates in March and there will most likely be ground left to cover. Furthermore, Lagarde attempted to stress the longevity of reaching terminal by stating that when the level is reached, rates will need to stay there.

RECENT ECONOMIC DEVELOPMENTS: Headline Eurozone inflation fell to 8.5% in February from 8.6%, whilst the super-core metric rose to 5.6% from 5.3%. In terms of the breakdown, ING highlighted the jump in food inflation which rose from 14.1 to 15%, whilst services inflation jumped to 4.8% from 4.4%. The March ECB Consumer Expectations Survey saw the 12-month ahead inflation expectation fall to 4.9% vs. the Dec reading of 5.0% whilst the 3-year reading fell to 2.5% from 3.0%. In terms of market gauges, the 5y5y inflation forward stands at 2.37% vs. around 2.31% at the time of the last meeting. On the growth front, Q4 2022 GDP printed at just 0.1% on a Q/Q basis and 1.9% Y/Y. More timely survey data from S&P Global saw the February EZ-wide Composite PMI rise to 52.0 from 50.3, driven by a jump in the services print to 52.7 from 50.8, whilst manufacturing ticked higher to 48.5 from 48.8. The accompanying report noted “a resounding expansion of business activity in February helps allay worries of a eurozone recession, for now.” The February Eurozone Consumer Confidence metric remained below pre-pandemic levels at -19. In the labour market, the EZ unemployment rate stands at just 6.7%.

RECENT COMMUNICATIONS: Since the prior meeting, Lagarde (2nd Mar) has reaffirmed that a 50bps hike remains on the table for the March meeting, whilst noting that inflation is still too high and the future rate path will be datadependent. Lagarde (21st Feb) also stated that she is not seeing signs of a wage-price spiral within the Eurozone. The influential Schnabel of Germany (17th Feb) stated that the broad disinflation process has not even started yet, weaker transmission may require more forceful action and QT could be sped up after June. Schnabel also remarked that it was not easy to say if policy is already restrictive. Chief Economist Lane (6th Mar) stated that current information on underlying inflation pressures suggests that it will be appropriate to raise rates further beyond our March meeting. Lane also cautioned that it is important to measure the ECB’s cumulative tightening so far and that policy should not be on auto-pilot. At the hawkish end of the spectrum, Austria’s Holzmann (6th Mar) has called for rates to be raised by 50bp at each of the next four meetings, whilst stating that the Bank needs to be a bit more aggressive in reducing its balance sheet to a “reasonable level”. These views were followed up by an interjection from Italy’s Visco (1st Mar) who stated he did not appreciate colleagues’ statements on future and prolonged increases in interest rates, adding that policy needs to remain prudent and should be guided by data as it comes available.

RATES: Given the comms at the February meeting and the subsequent lack of a walk-back from officials at the Bank, the ECB is unanimously expected to hike its three key rates by 50bps a piece, taking the Deposit rate to 3.0%, Main Refi to 3.5% and Marginal Lending to 3.75%. As such, greater focus will fall on what lies beyond March with the Bank likely to stress its “meeting-by-meeting” and “data-dependent” approach. In the wake of the February meeting, Reuters sources suggested that policymakers saw at least two more rate hikes with the May increase expected to either be 25bps or 50bps. Since then, the developments in core inflation, allied with increasingly hawkish bets surrounding the Fed, prompted many desks to project the ECB’s terminal rate at 4% (would see 50bps March, 50bps May and then either another 50bps in June or 25bps in June and July). The statement is unlikely to be explicit in stating what markets should expect for the coming months, and as such the accompanying macro projections will be of greater interest to the market (see below for further details). ING notes that if the 2024 and 2025 inflation profiles are not revised lower, it will underscore the level of concern over core inflation on the Governing Council. This could prompt a further hawkish repricing in the market and give further ammo to the hawks on the Governing Council with Austria’s Holzmann (March 6th) outlining the case for 50bps hikes at the next four meetings. From a dovish perspective, a more subdued growth outlook within the projections, could see markets move closer to a lower terminal rate. One note of caution stems from the fallout of the collapse of Silicon Valley Collapse which has prompted a global repricing of monetary policy expectations and has subsequently swayed ECB pricing in the process. As such, market pricing (at the time of writing and in relatively volatile trade) looks for a terminal rate of around 3.5% by December vs. a circa 4% rate in summer previously. By way of a comparison, surveyed analysts by Reuters (March 7-9th) expect three 25bps hikes at the May, June and July meetings to give a terminal rate of 3.75%.

BALANCE SHEET: On the balance sheet, no changes are expected with the current monthly decline of EUR 15bln /month in APP reinvestments set to run until June. That said, moving forward, ING notes that more aggressive policy rate hikes against a very slow reduction of the ECB’s bond portfolio or less aggressive rate hikes but a faster reduction of the bond portfolio could be the trade-off between hawks and doves.

ECONOMIC PROJECTIONS: The underlying assumptions underpinning the projections will likely be based around softer energy prices, higher market rates and a firmer EUR. From a growth perspective, Nordea expects that the 2023 GDP forecast will be upgraded from 0.5% to 1.0% on account of the better-than-expected start to the year for the Eurozone economy; no material changes are expected for 2024 and 2025. On inflation, Nordea suggests that the better growth outturn should prompt upward revisions to the core readings with 2023 to be upgraded to 4.5% from 4.2% with 2024 and 2025 to remain above target at 2.8% and 2.4% respectively. With regards to headline inflation, Nordea expects 2023 inflation to be lowered with 2024 to be held at 3.4% and 2.3% respectively. As always, the medium-term forecasts and their distance above the 2% target will be interpreted as a measure of how much work the ECB still has to do with regards to rate hikes.

- ECB Euro Area Real GDP Forecasts (Dec 2022):

- 2023: 0.5% (prev. 0.9%) 2024: 1.9% (prev. 1.3%) 2025: 1.8%

- ECB Euro Area HICP Forecasts (Dec 2022):

- 2023: 6.3% (prev. 5.5%) 2024: 3.4% (prev. 2.3%) 2025: 2.3%

- ECB Euro Area HICP ex-food and energy Forecasts (Dec 2022):

- 2023: 4.2% (prev. 3.4%) 2024: 2.8% (prev. 2.3%) 2025: 2.4%

* * *

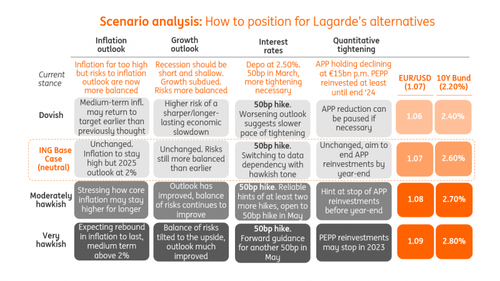

As usual, here is the handy ECB scenario analysis cheat sheet courtesy of ING Economics

* * *

Finally, here is a take by Bloomberg strategist Ven Ram, summarizing what traders expect today

The European Central Bank finds itself in an unenviable position, having to review its monetary policy even as Credit Suisse seeks to stem a crisis of confidence. The rub is that none of the available options that it has come without a trade-off or cost.

The ECB painted itself into a corner at the previous meeting, having explicitly telegraphed an intent to raise rates by 50 basis points today. It didn’t even lace the sentence with any riders such as “unless exceptional circumstances dictate otherwise”:

“In view of the underlying inflation pressures, the Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March…”

The million-dollar question — nah, make that a multi-billion-dollar question, considering that we are discussing Credit Suisse — is whether the ECB will follow through on that pledge or find itself a way out of the morass. To its credit, few last month would have imagined a backdrop such as today, but such is life in the markets.

Raising rates by as much it promised can work both ways:

- a) It can tell the world how seriously consumed it still is by inflation — and we will get new inflation projections today;

- b) It shows it has confidence that measures taken by Credit Suisse, including availing of the central bank backstop will stem the tide. However,

- c) It can also have the effect of tightening financial conditions at a time when the market is thirsting for more liquidity.

Halfway House Option:

- This entails the ECB raising rates by 25 basis points, which is roughly what the markets were pricing at the end of Wednesday. This has the advantage of signaling to investors that it is still intent on fighting inflation, while the less-than-pledged margin of increase would acknowledge the quickly souring macroeconomic backdrop.

The Stay-Put Option:

- This involves the ECB deciding to pause altogether today, but signaling to the markets that the time-out is to assess the evolving macroeconomic landscape rather than a termination of its tightening cycle. The downside of such a decision would be that investors may conclude the problem confronting the European banking industry is indeed a problem that can’t be easily solved and that perpetuates a negative feedback loop.

Whatever the decision, clearly, the markets will be waiting for the appointed hour with bated breath.

Tyler Durden

Thu, 03/16/2023 – 07:27

dollar

inflation

monetary

markets

policy

interest rates

fed

central bank

monetary policy

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…