Economics

Don’t Be Fooled, US Stocks Are Still Far From Cheap

Don’t Be Fooled, US Stocks Are Still Far From Cheap

Authored by Simon White, Bloomberg macro strategist,

The US stock market continues to…

Don’t Be Fooled, US Stocks Are Still Far From Cheap

Authored by Simon White, Bloomberg macro strategist,

The US stock market continues to be overvalued on several measures, exposing equities to further downside.

Stock pickers love bear markets. Suddenly many companies on their watch lists begin to look attractive. But despite the protracted equity market downturn, valuations – almost no matter how you slice or dice them – continue to look rich.

It’s true the S&P’s P/E ratio has fallen precipitously over the last two years, but that was from nosebleed levels, and it is now only back to its long-term mean. Valuations cannot be said to be unambiguously cheap at an index level. The Nasdaq’s P/E fell sharply too, but it is only just below its long-term average.

Long-term returns are what that matters to most investors, and on that basis disappointment is likely to await anyone buying stocks. The most popular measure of long-term valuation is the cyclically-adjusted P/E (CAPE). Buying the index when this is historically cheap typically leads to well above-average 10-year returns, and vice-versa.

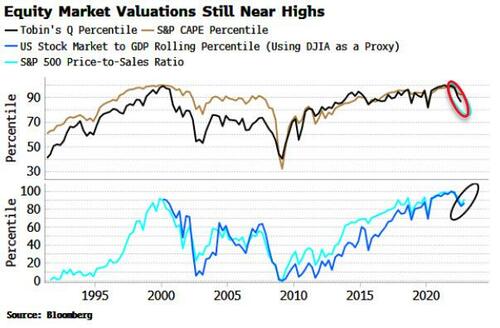

The CAPE has fallen, but still remains in the top 90% of all its readings. This is the same for other measures of long-term value, such as Tobin’s Q (the ratio between a firm’s market cap and the replacement cost of its assets), and the price-to-sales ratio. Buffet’s famed, favorite measure – the market cap of US equities versus GDP – also remains elevated.

Even with the equity market down over 17% from its highs, these measures remain in the top 85-90% of all their readings. This is a market far from screaming “buying opportunity of a lifetime”.

As a stock picker, you are less interested in the index averages, which can be overly influenced by the valuations of a few mega-cap stocks. As long as there are plenty of lower-valued stocks to choose from you should be happy. But that has distinctly failed to transpire so far in this bear market.

If it had, we would have seen a pronounced shift in the distribution of the P/Es of S&P500 stocks. But it is little changed to that seen at the 2022 peak. This stands in stark contrast to the 2009 bottom, when there was an unequivocal and significant shift lower in companies’ valuations, leading to a bonanza for stock pickers.

It’s hard to make the case that the stock market has bottomed until we see a broad-based and noteworthy decline in P/E ratios. And stocks are unlikely to cheapen significantly until they adequately price two major risks: inflation (and therefore rates), and earnings.

We can think about how these relate to equity prices by looking at the “Rule of 20”, which states that over the long term, the P/E ratio and the inflation rate should sum to 20. When that sum is over 20, the market is said to be overvalued, and undervalued when it is below 20.

When inflation is high, as it was in the 1970s, nominal earnings rise, so P/Es should adjust lower to take account of this. Today the Rule of 20 implies an S&P 25% lower than its current price.

That implied value is destined to fall further as inflation begins to rise again, as it looks set to do, and also as earnings fall. It bears repeating that earnings are a lagging indicator, and they will only begin to decline after the recession – which continues to look odds on, even as early as the summer – has begun.

This is not supposed to be a hard forecast for the S&P, but when the gap between the rule-implied and the actual index level is as large as it is today, it gives a strong indication of the market’s direction of travel.

Despite risks from inflation and recession, investors are being offered scant margin to hold stocks, with the equity risk premium near the lows it reached in the aftermath of the GFC.

Still, the value sector has had one its best runs for fifteen years, outperforming the hitherto go-go growth sector for most of the last two-and-a-half years.

It should continue to do well, especially due to the generally low duration of value stocks, a sine qua non in an inflationary world. But until there is a re-rating lower in stocks across the board, it will be tougher to build portfolios of cheap, quality companies that have the potential to post strong, long-term returns. Stock pickers should bide their time for cheaper valuations ahead.

Tyler Durden

Tue, 02/28/2023 – 08:30

inflation

markets

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…